Gold (XAUUSD) holds above 2,500 USD but may enter a correction

The XAUUSD price has been trading above 2,500 USD since the beginning of the week but has yet to hit a new all-time high of 2,532 USD. Tomorrow, the market will focus on US GDP data. Find out more in our XAUUSD analysis for today, 28 August 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await Q2 US GDP data, due on Thursday

- Current trend: although gold is trading within an uptrend, there are risks of a downward correction

- XAUUSD forecast for 28 August 2024: 2,532 and 2,483

XAUUSD fundamental analysis

XAUUSD quotes have traded above 2,500 USD this week, supported by expectations of a September Federal Reserve interest rate cut. However, gold has yet to reach the all-time high of 2,532 USD, as it encounters active selling pressure near this level. The US GDP statistics due on Thursday could influence further gold price movements.

US GDP is expected to rise by 2.8% in Q2. A more significant uptick would support the US dollar and contribute to a decline in the XAUUSD pair. Conversely, if the data turns out worse than forecasted, gold may gain another driver for further growth, possibly reaching a new high of 2,532 USD.

XAUUSD technical analysis

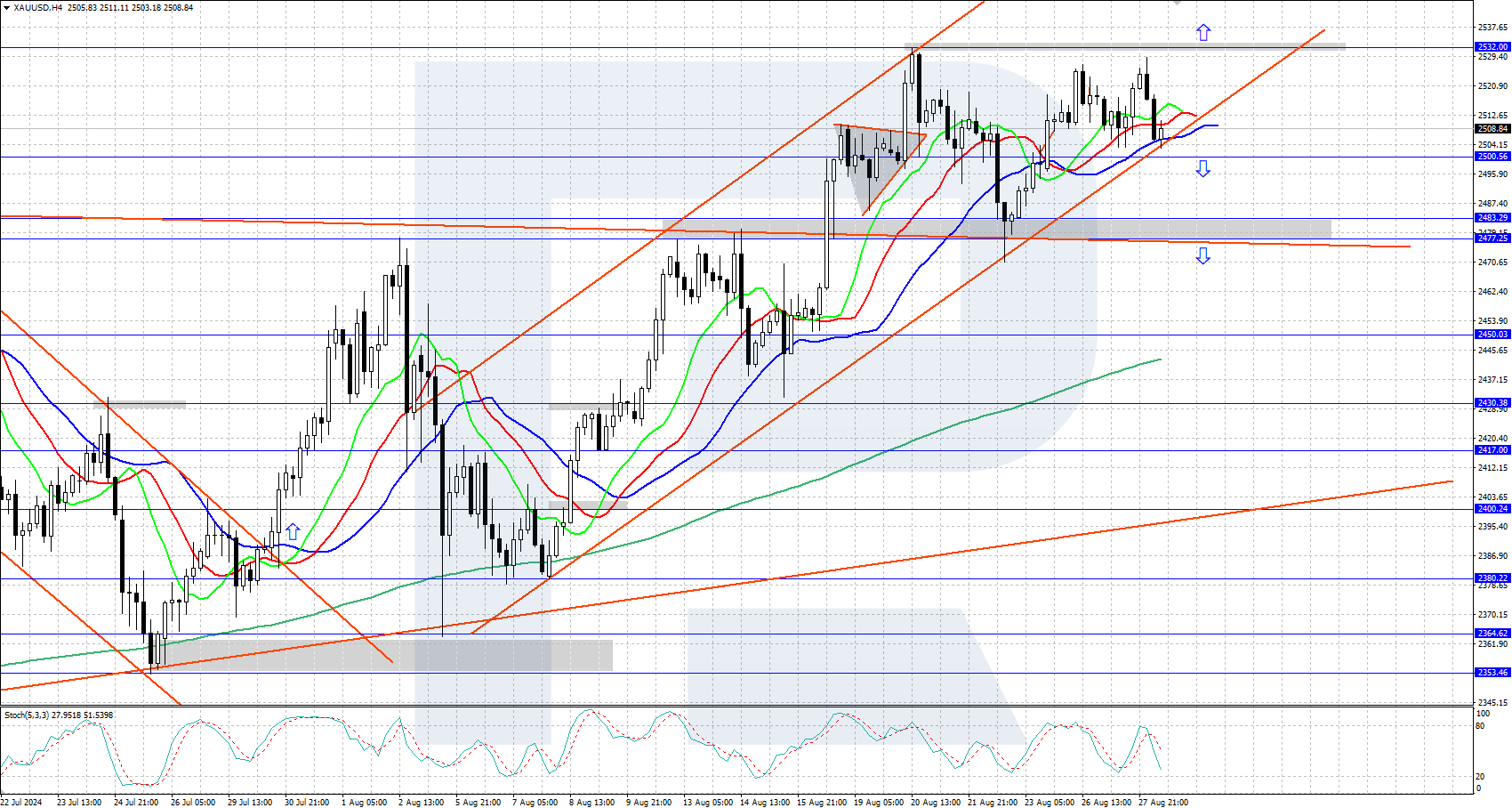

On the H4 chart, XAUUSD quotes are experiencing a steady bullish trend, trading within an ascending price channel where a triangle pattern has formed. This formation could signal further upward movement, but gold has yet to surpass an all-time high of 2,532 USD, with XAUUSD quotes encountering active selling in this area.

The short-term XAUUSD price forecast suggests that the price could reach the 2,600 level soon if bulls maintain control within the ascending channel and break above 2,532. However, a decline below the 2,483-2,477 support area would signal a potential downward correction, invalidating the bullish scenario.

Summary

XAUUSD quotes are holding above 2,500 USD but have been unable to break through the 2,532 USD resistance level, raising concerns about a possible downward correction. The upcoming US GDP data on Thursday is expected to be a significant catalyst for the gold market, with the outlook depending on whether the economic data signals further support for gold prices or strengthens the US dollar, leading to potential downside pressure on XAUUSD.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.