Gold (XAUUSD) is undergoing a local correction; the market awaits nonfarm payrolls today

XAUUSD prices are correcting after reaching a new all-time high of 2,790 USD. Market participants focus on today’s US labour market statistics. Discover more in our XAUUSD analysis for today, 1 November 2024.

XAUUSD forecast: key trading points

- Market focus: market participants await today’s US labour market statistics, including nonfarm payrolls and the unemployment rate

- Current trend: a local correction is underway as part of the uptrend

- XAUUSD forecast for 1 November 2024: 2,758 and 2,710

Fundamental analysis

XAUUSD quotes continue to trade in an uptrend after recently reaching a new all-time high of 2,790 USD. A local correction is underway, after which the rally could continue. Gold’s growth is driven by demand from central banks and investors and the easing of the US Federal Reserve’s monetary policy.

Wednesday’s US employment data from Automatic Data Processing Inc. (ADP) came in above forecasts, showing gains of 233,000 jobs compared to the expected 115,000. As a result of the ADP report, the US dollar strengthened slightly against Gold.

US labour market statistics, including nonfarm payrolls and the unemployment rate, will be published today during the American session. If nonfarm payrolls exceed the forecast (+113,000 jobs), the US dollar will receive support, and the XAUUSD pair may continue a local correction. If data falls short of the estimates, this will drive further growth in the pair.

XAUUSD technical analysis

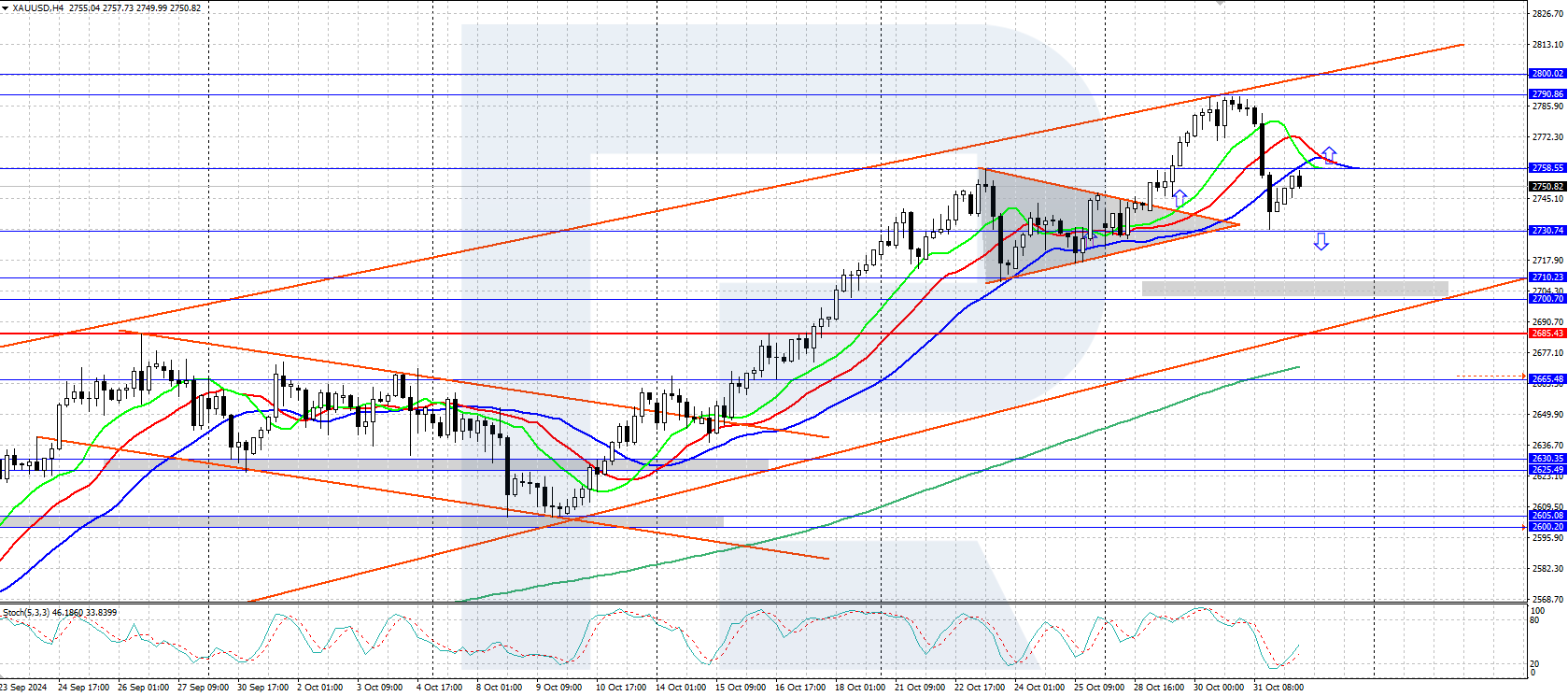

On the H4 chart, the XAUUSD pair is trading within a strong uptrend. A triangle price pattern has recently formed, with the quotes breaking above its upper boundary and reaching the pattern’s target – around 2,800 USD. The prices are currently undergoing a correction from the upper boundary of a price channel.

The short-term XAUUSD price forecast suggests that if bears push the quotes below the 2,730 USD support level, the prices could decline further to the 2,700-2,710 USD area. Conversely, if bulls seize the initiative and gain a foothold above 2,758 USD, the prices could return to a high of 2,790 USD in the short term.

The pair may see strong price movements during today’s American trading session following the release of nonfarm payrolls.

Summary

XAUUSD quotes are correcting downwards after reaching a new all-time high of 2,790 USD. The pair’s volatility may surge today following the release of US statistics, including nonfarm payrolls and the unemployment rate.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.