Gold (XAUUSD) rises, reaching 2,700 USD

XAUUSD prices continue strengthening significantly after forming a local trough and reversing upwards. Further growth may follow a brief correction. Discover more in our XAUUSD analysis for today, 22 November 2024.

XAUUSD forecast: key trading points

- Market focus: US statistics on the Composite Purchasing Managers’ Index (PMI) and Michigan Consumer Sentiment Index are due today

- Current trend: strong upward movement

- XAUUSD forecast for 22 November 2024: 2,643 and 2,700

Fundamental analysis

XAUUSD quotes have completed a downward correction and reversed upwards, displaying significant growth towards the long-term trend. This growth is supported by demand from central banks, the Federal Reserve’s interest policy of cutting interest rates, and escalating global geopolitical tensions.

A crucial release of US statistics is expected today – the Composite Purchasing Managers’ Index (PMI) and Michigan Consumer Sentiment Index. Weaker-than-forecast statistics could exert pressure on the US dollar and support XAUUSD. Conversely, stronger figures may prompt a correction in the pair.

XAUUSD technical analysis

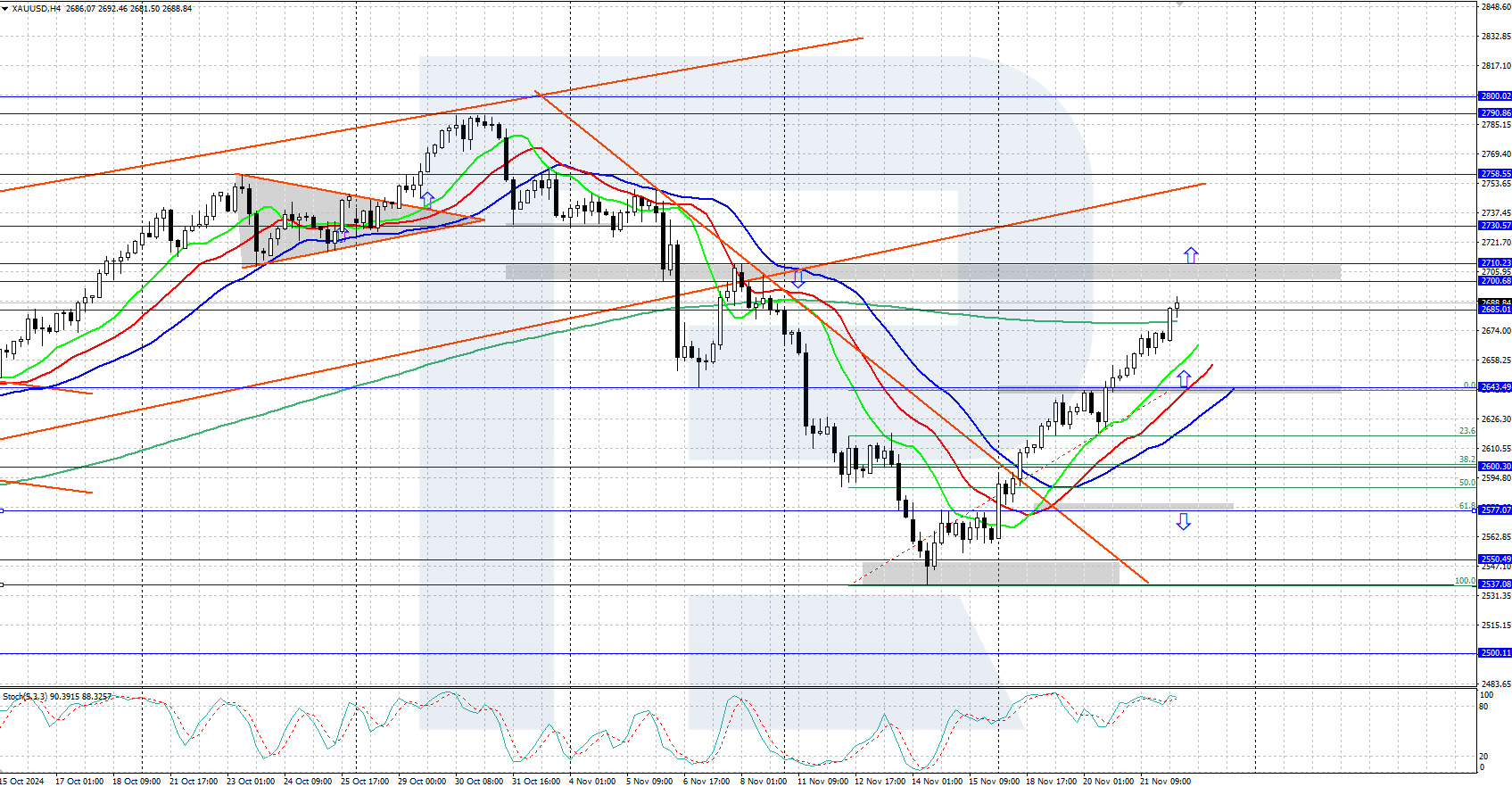

The XAUUSD H4 chart shows a steady upward movement. Last week, asset prices tumbled to 2,536 USD, where they faced strong demand from buyers, formed a local trough, and reversed upwards. The uptrend is continuing strongly.

The short-term XAUUSD price forecast suggests that after significant gains in recent days, the instrument may correct towards the 2,643 USD support level before resuming its ascent. If bears gain control and push the price below 2,577 USD, it could signal the end of the uptrend.

Summary

Gold (XAUUSD) quotes have climbed to the 2,700 USD area after completing a downward correction. Today, market participants await US statistics – the Composite Purchasing Managers’ Index (PMI) and Michigan Consumer Sentiment Index.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.