CHF continues to lose ground

Switzerland’s KOF leading indicators data may push the USDCHF pair up.

The Swiss franc continues to lose ground against the US dollar

A set of US data is due on Friday:

- The core Personal Consumption Expenditures price index (y/y) for May

- The core Personal Consumption Expenditures price index (m/m) for May

- The Chicago Purchasing Managers’ Index (PMI) for June 2024

- The Federal Reserve’s Monetary Policy Report

This news data may bring positive and negative changes to the USDCHF rate.

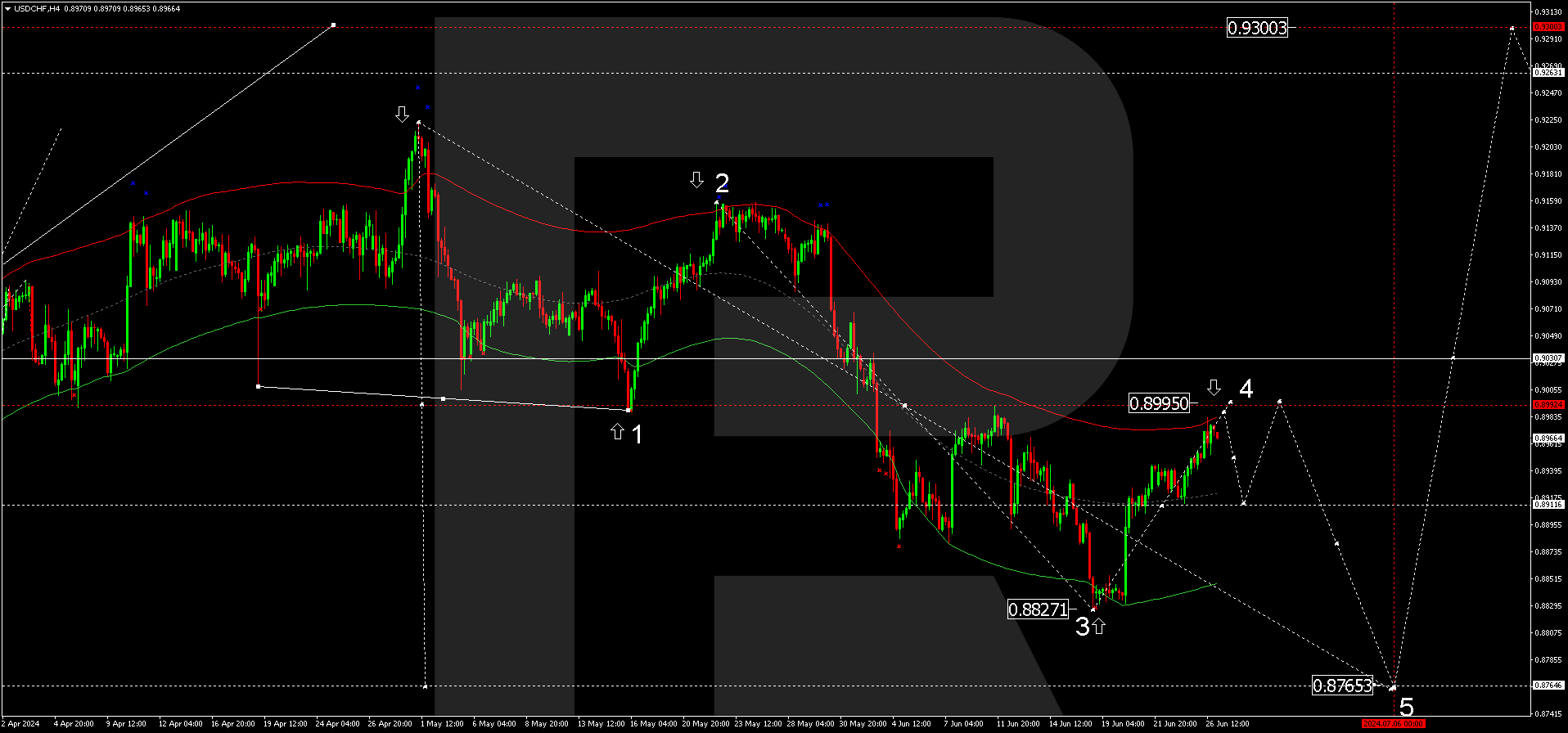

USDCHF technical analysis

On the Н4 chart, USDCHF has completed an upward impulse towards 0.8995, and a consolidation range has formed around 0.8911. Breaking above it, the price continues its upward trajectory, aiming for 0.8988 as the local target, expected to be reached on 28 June 2024. Subsequently, a decline to 0.8911 (testing from above) is possible, followed by a rise to 0.8995. Once this wave is complete, the price is expected to fall to 0.8766.

USDCHF technical analysis 28.06.2024

The Elliott Wave structure and a wave matrix with a pivot point at 0.8995 technically confirm this scenario. This level is considered crucial for a corrective wave in the USDCHF pair. The market has rebounded upward from the Envelope’s lower boundary at 0.8830. Today, the quotes are hovering above its centre. A growth structure is expected to develop, aiming for the Envelope’s upper boundary. Subsequently, the USDCHF pair could decline to its lower boundary at 0.8766.

Summary

The news landscape confirms the USDCHF technical analysis forecast, which points to a potential corrective wave towards 0.8787, followed by a rise to the 0.9030 and 0.9300 targets.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.