Yen’s sharp strengthening: due to currency intervention or faith in the yen?

The USDJPY pair has declined, and investors continue to speculate whether this was driven by hidden financial intervention or unfavourable news from the US.

USDJPY trading key points

- Thomson Reuters/Ipsos primary consumer sentiment index (PCSI) in Japan: previously at 37.69%, currently at 37.63%

- Japan’s industrial production (m/m): previously at -0.9%, currently at 3.6%

- CFTC JPY speculative net positions: previously at -184.2 thousand

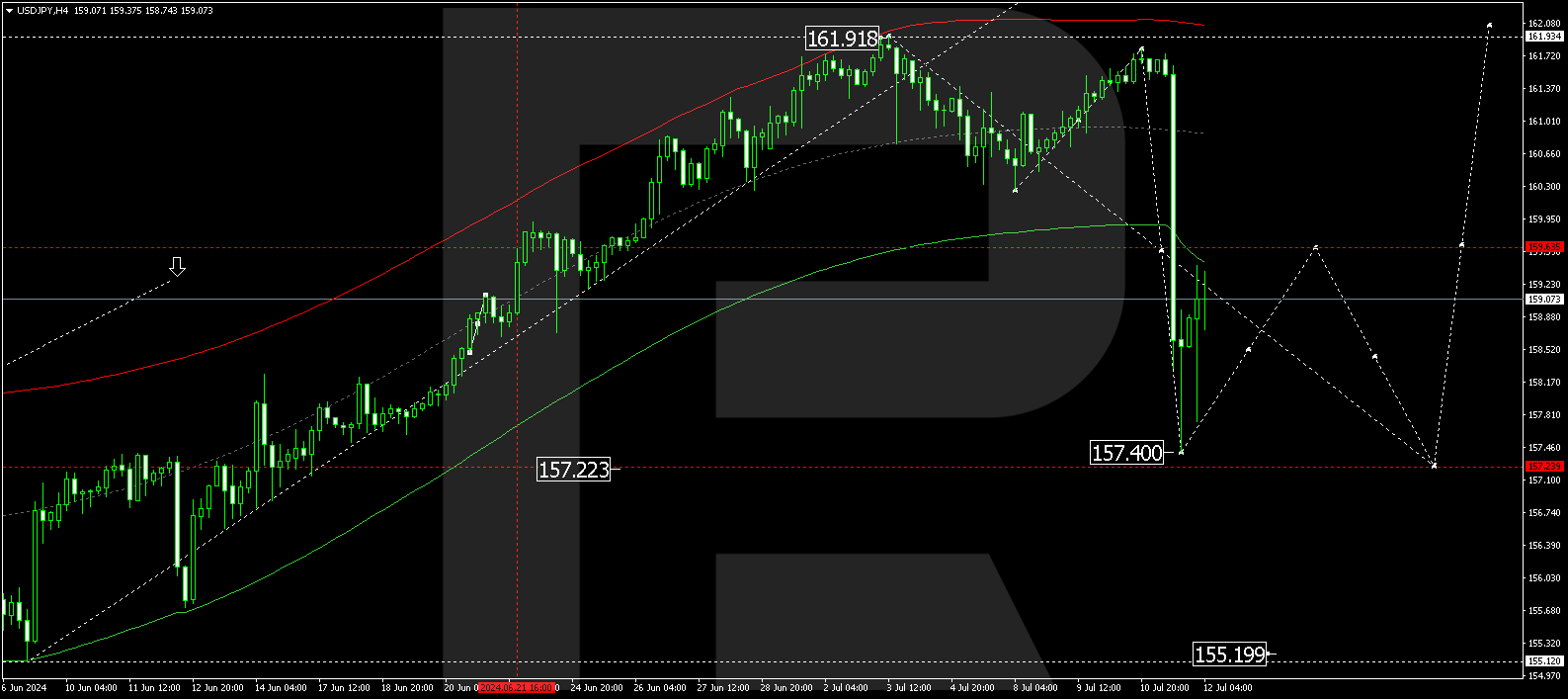

- USDJPY price targets: 159.70 and 157.22

Fundamental analysis

The USDJPY rate continues to decline today, 12 July 2024. The sharp strengthening of the yen has raised many questions with few answers. Some investors suggest the Bank of Japan has conducted hidden currency intervention, while others believe this was a reaction to US fundamental news. Either way, players who bet on a decline in the USDJPY pair generated profit. The primary consumer sentiment index (PCSI) data has already been released, showing that the index remained practically unchanged and probably had no impact on the quotes.

Despite a 0.9% fall in the previous month, industrial production in May increased by 3.6%, exceeding the expectations of a 2.8% rise and impacting the yen’s strengthening. By increasing industrial production, Japan may strengthen its currency without resorting to overt financial intervention.

A likely scenario for further yen strengthening could be the BoJ’s comprehensive approach, which would involve solving challenges with inflation and prices for consumer goods and services and covert currency intervention until it is officially announced.

Following Japan’s economic data release, the yen continues to correct amid an uptrend. The news was positive, helping the yen to strengthen further against the US dollar.

USDJPY technical analysis

On the H4 chart, the USDJPY pair has completed a corrective wave, reaching 157.40. Today, 12 July 2024, the price is expected to rise to 159.70 (testing from below) before declining to 157.22. This will mark the completion of the downward potential. Subsequently, another growth wave could start, aiming for 162.00.

Summary

Technical analysis for today’s USDJPY forecast aligns with the news landscape and investors’ actions, suggesting a rise to the 159.70 target followed by a decline to 157.22.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.