The euro is in positive territory while the US dollar rests: US sentiment shifts before the long weekend

The EURUSD pair is on the rise. Investors are evaluating the US GDP and core PCE data. Find out more in our analysis for 28 November 2024.

EURUSD forecast: key trading points

- The EURUSD pair has risen and stabilised

- Investors are assessing statistics and the risks of new tariff complications

- EURUSD forecast for 28 November 2024: 1.0460

Fundamental analysis

The EURUSD rate remains steady at around 1.0550.

The US currency declined yesterday evening, reflecting the anticipation of the upcoming US holidays and the release of numerous macroeconomic reports. Additionally, investors continue to assess the risks of a new tariff war under President-elect Donald Trump. It is widely understood that such a conflict would have no winners but result in significant losses, further accelerating global inflation pressures.

Today marks Thanksgiving Day in the US, prompting the market to scale back positions ahead of the extended holiday period. The US markets are closed on Thursday, and Friday is a shortened trading day.

US Q3 2024 GDP increased by 2.8%, meeting expectations. This result aligns with the first estimate of the previous quarter and reinforces expectations of another Federal Reserve interest rate cut.

The baseline forecast now suggests a 67% likelihood of a December rate reduction.

The EURUSD forecast remains neutral.

EURUSD technical analysis

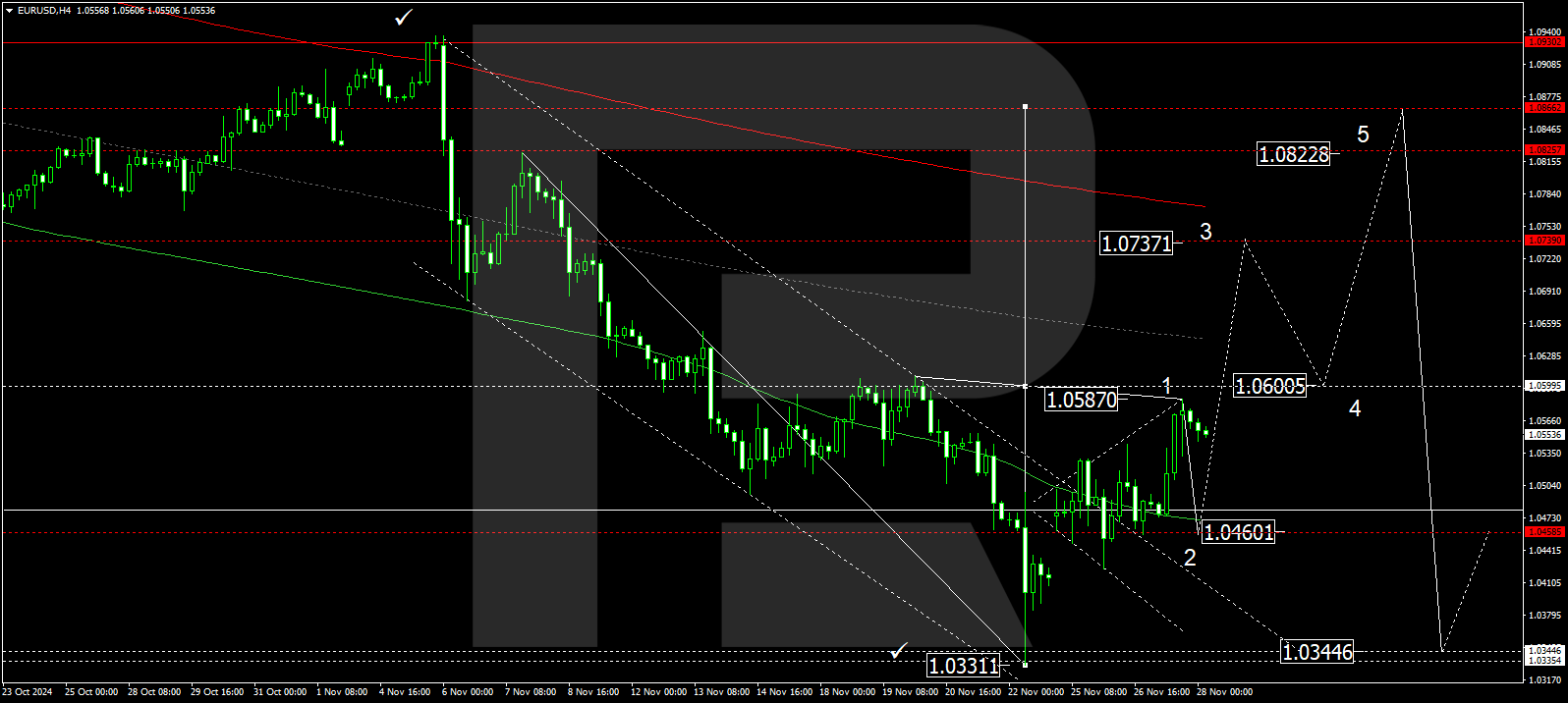

The EURUSD H4 chart shows that the market has completed a growth wave towards 1.0587, the first target. The structure is expected to shift downward today, 28 November 2024, targeting 1.0460 and marking the boundaries of a consolidation range. An upward breakout could extend the growth wave towards 1.0737. Conversely, a breakout below the range may lead to further declines towards 1.0344 and possibly 1.0300.

The Elliott Wave structure and growth wave matrix, with a pivot point at 1.0600, technically support this scenario. This level is considered crucial for the EURUSD rate. Another downward wave could target the lower boundary of the price envelope at 1.0460. Once this level is reached, a growth wave will likely develop, aiming for the envelope’s central line at 1.0600 and potentially continuing the trend to its upper boundary at 1.0822.

Summary

The EURUSD pair has recovered from a local low, but heightened volatility is expected due to the US Thanksgiving long weekend. Technical indicators for today’s EURUSD forecast suggest a potential downward wave towards the 1.0460 level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.