EURUSD remains weak as pressure from the US dollar persists

The EURUSD pair is trading near 1.0307 and appears weak. The Federal Reserve’s hawkish stance and Trump’s tariff wars keep the market tense. Find out more in our analysis for 9 January 2025.

EURUSD forecast: key trading points

- The EURUSD pair declines with no signs of reversal

- The Fed’s restrictive monetary policy and the tariff threats from the US continue to support the US dollar

- EURUSD forecast for 9 January 2025: 1.0282 and 1.0269

Fundamental analysis

The EURUSD rate has fallen to 1.0307. Pressure on the euro is increasing despite the pair’s downtrend since September last year.

The Federal Reserve’s stance on monetary policy remains tough. While the Fed is prepared to conclude its tightening cycle, it is not expected to lower interest rates swiftly. According to the latest Federal Reserve meeting minutes, released yesterday, progress in controlling inflation is still insufficient to justify easing policy in line with market expectations. The Fed’s target interest rate currently ranges between 4.25-4.50% per annum. Following the December meeting, investor expectations for near-term rate cuts have diminished.

As for US trade tariffs, these are bold yet unsubstantiated statements so far. US President-elect Donald Trump’s inauguration is scheduled for 20 January, after which his rhetoric may become more specific.

The EURUSD forecast remains negative.

EURUSD technical analysis

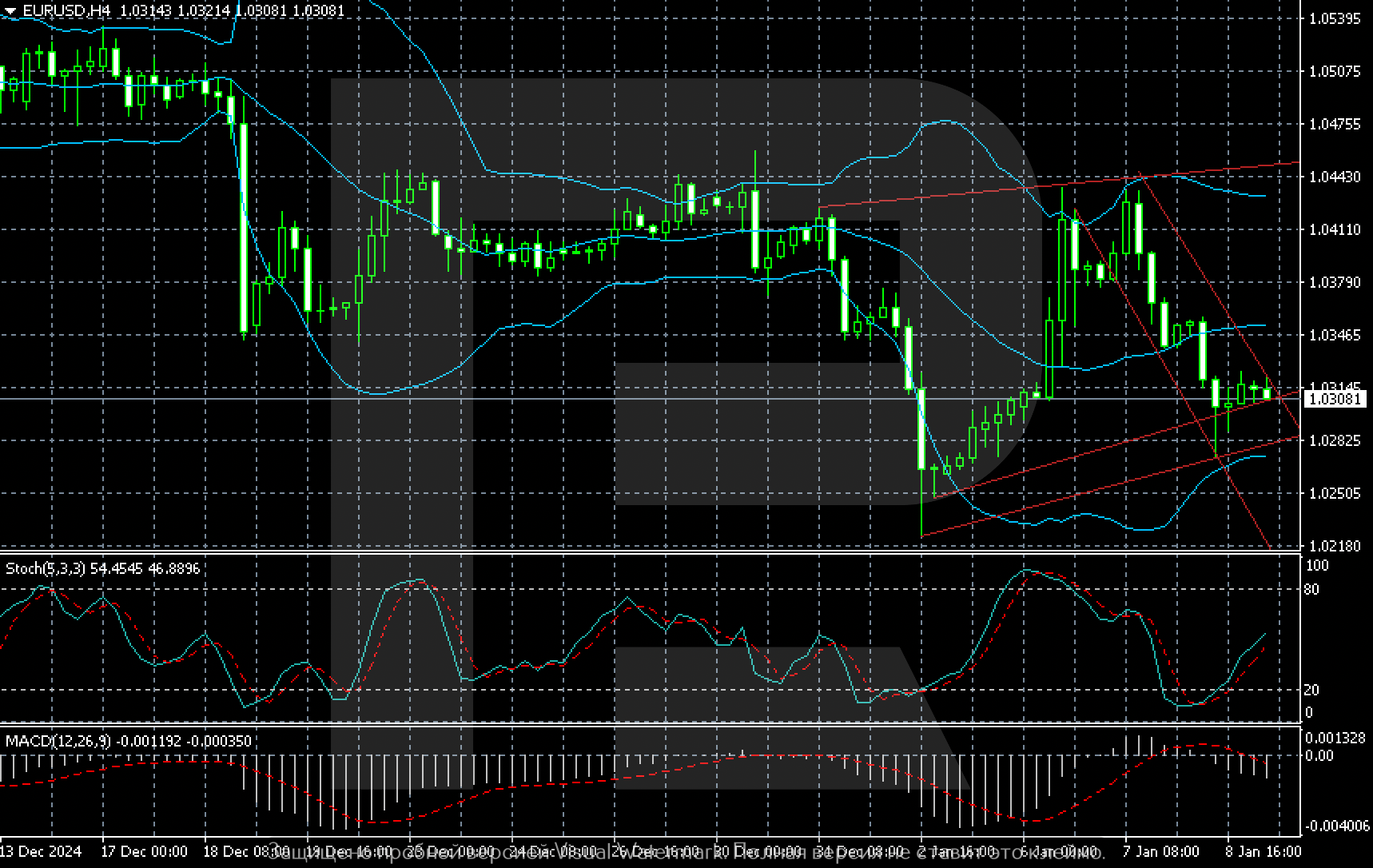

A negative scenario persists on the EURUSD H4 chart, suggesting a decline towards the trendline at 1.0269, following a break below an intermediate support level at 1.0282.

If the trend receives further confirmation, the new downside targets for the EURUSD pair on the H4 chart for today, 9 January 2025, could include retests of the 1.0245 and 1.0221 levels from 2 January 2025.

Summary

The EURUSD pair continues to tumble as the market struggles to resist pressure from the US dollar. Today’s EURUSD forecast suggests a decline to 1.0282, followed by a further drop to 1.0269.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.