No rescue mission needed: falling PMI will not stop GBPUSD's climb

Positive UK data may trigger a GBPUSD rally towards 1.3420. Discover more in our analysis for 23 April 2025.

GBPUSD forecast: key trading points

- UK services PMI: previously at 52.2, projected at 51.5

- US services PMI: previously at 54.4, projected at 52.8

- GBPUSD forecast for 23 April 2025: 1.3420 and 1.3240

Fundamental analysis

The services Purchasing Managers’ Index (PMI) is a vital economic barometer, reflecting the health of the largest sector in the economy. Based on surveys of purchasing managers, it captures trends in new orders, employment, business confidence, and overall activity.

A reading above 50.0 indicates expansion, while a value below 50.0 signals contraction. Given the dominant role services play in the UK GDP, the indicator is considered crucial for assessing the country’s economic health. Its release often causes strong fluctuations in the national currency exchange rate.

The forecast for 23 April 2025 anticipates a slight dip in UK services PMI to 51.5 points. The decrease is not critical, with the reading remaining above the key 50.0 threshold, which may be potentially positive for the pound.

Fundamental analysis for 23 April 2025 also takes into account the release of the US services PMI, which is expected to decline from 54.4 to 52.8.

Today’s GBPUSD forecast considers all US and UK data, which could support the GBP and spur further gains in the GBPUSD rate once the correction is complete.

GBPUSD technical analysis

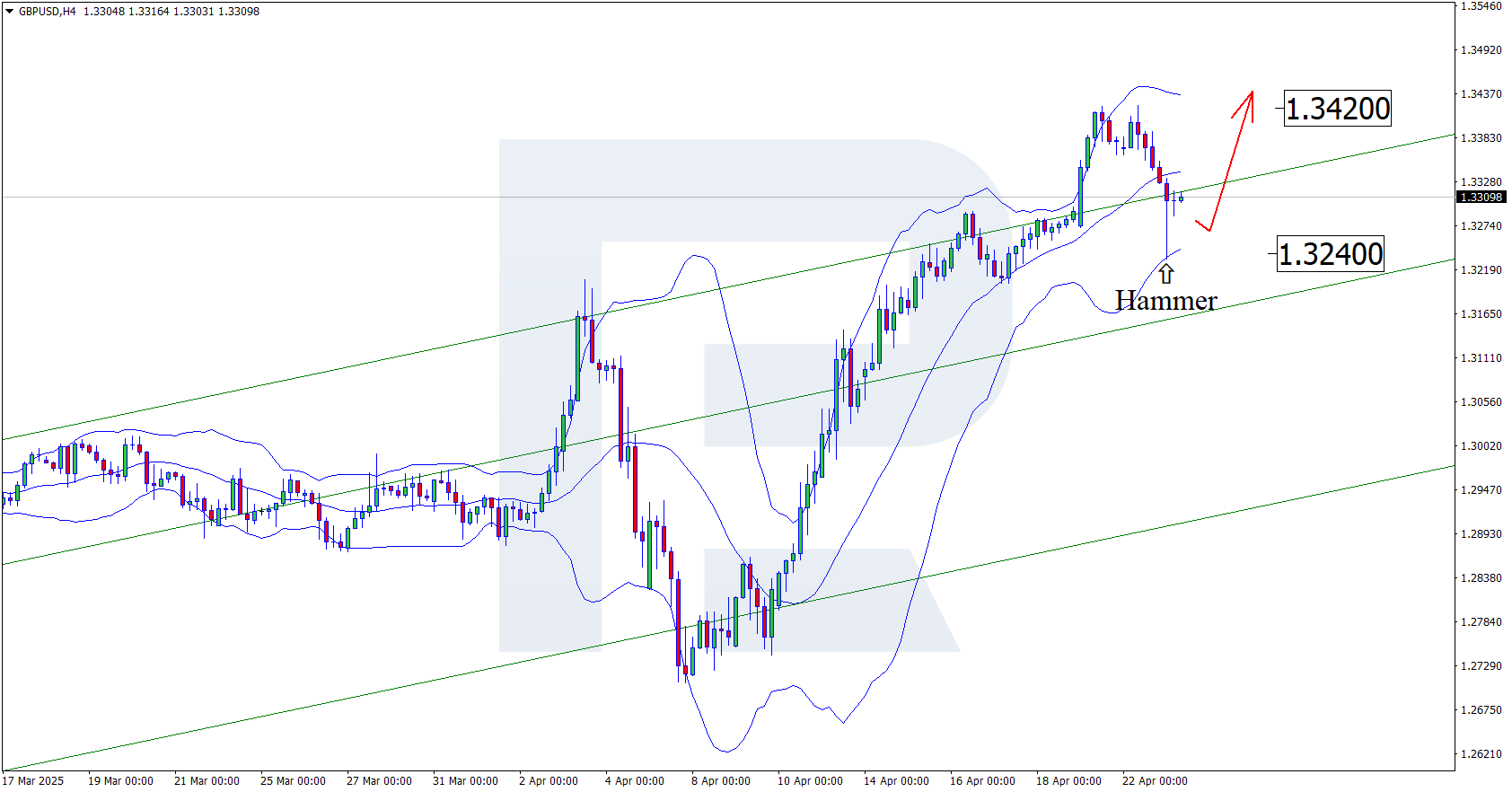

Having tested the lower Bollinger band, the GBPUSD price has formed a Hammer reversal pattern on the H4 chart. This may signal a rebound and the start of a corrective wave. With prices returning to the ascending channel and given the US and UK fundamentals, a bullish move towards the resistance level appears likely.

The current upside target is 1.3420. A breakout above the resistance level would pave the way for further bullish momentum.

The GBPUSD forecast also takes into account an alternative scenario, with the price correcting towards 1.3240 before resuming its upward trajectory.

Summary

Today’s economic data from the UK and US, combined with the GBPUSD technical analysis, suggests continued upward momentum after a corrective wave is complete.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.