USDJPY set to extend rally: yen remains under pressure

The USDJPY pair climbed to 144.76, with the yen facing pressure from the lack of a trade deal with the US. Find more details in our analysis for 17 June 2025.

USDJPY forecast: key trading points

- The USDJPY pair continues to rise for the third consecutive day

- The Bank of Japan kept interest rates unchanged at 0.5%

- There is no progress in Japan-US trade talks so far

- USDJPY forecast for 17 June 2025: 145.13 and 145.47

Fundamental analysis

The USDJPY rate rose to 144.76, with a variety of key developments surrounding the Japanese yen.

Firstly, markets reacted to the Bank of Japan's neutral stance on interest rates. On Tuesday, the central bank held the rate steady at 0.5% per annum. In its statement, the BoJ confirmed it will gradually scale back government bond purchases, in line with prior guidance.

Second, Japanese Prime Minister Shigeru Ishiba and US President Donald Trump failed to reach a tariff agreement during the G7 summit in Canada.

Meanwhile, the US dollar continued to strengthen amid rising geopolitical tensions and inflation concerns, increasing demand for safe-haven assets.

The USDJPY forecast is positive.

USDJPY technical analysis

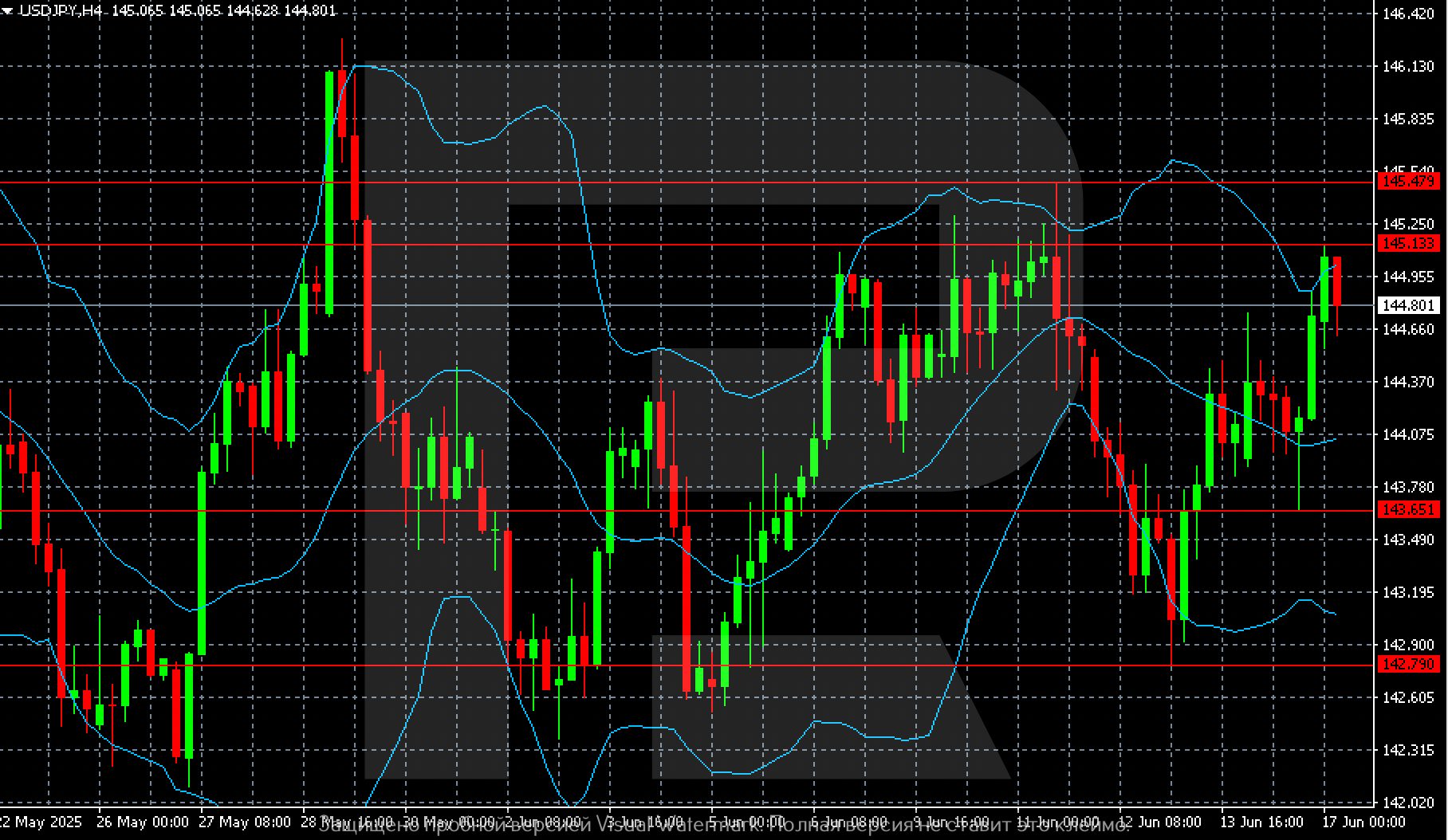

The USDJPY H4 chart suggests a likely return to 145.13 after a mild and brief correction. Subsequently, the market could push higher to 145.47.

The nearest significant support level stands at 143.65.

Summary

The USDJPY pair maintains a bullish stance as uncertainty around the yen prevails. The USDJPY forecast for 17 June 2025 expects continued upward movement with the next target at 145.47.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.