USDJPY rises towards the 155.00 area

The USDJPY rate is climbing towards the 155.00 area amid the end of the US government shutdown and the Bank of Japan’s reluctance to raise interest rates. Discover more in our analysis for 13 November 2025.

USDJPY forecast: key trading points

- Market focus: the US government shutdown has ended, while the yen has fallen to its lowest level in nine months

- Current trend: upward momentum persists

- USDJPY forecast for 13 November 2025: 156.00 or 154.00

Fundamental analysis

On Thursday, the USDJPY pair rose towards 155.00, hovering near a nine-month low after Japan’s Prime Minister Sanae Takaichi urged the Bank of Japan to continue maintaining low interest rates.

US President Donald Trump signed a bill ending the longest government shutdown in US history. Optimism over a potential Federal Reserve rate cut also lifted investor sentiment.

Meanwhile, Bank of Japan Governor Kazuo Ueda told parliament that the central bank remains focused on achieving moderate inflation supported by wage growth and sustained economic expansion. Markets are currently pricing in a 24% likelihood of a 25-basis-point rate hike in December and a 46% chance in January.

USDJPY technical analysis

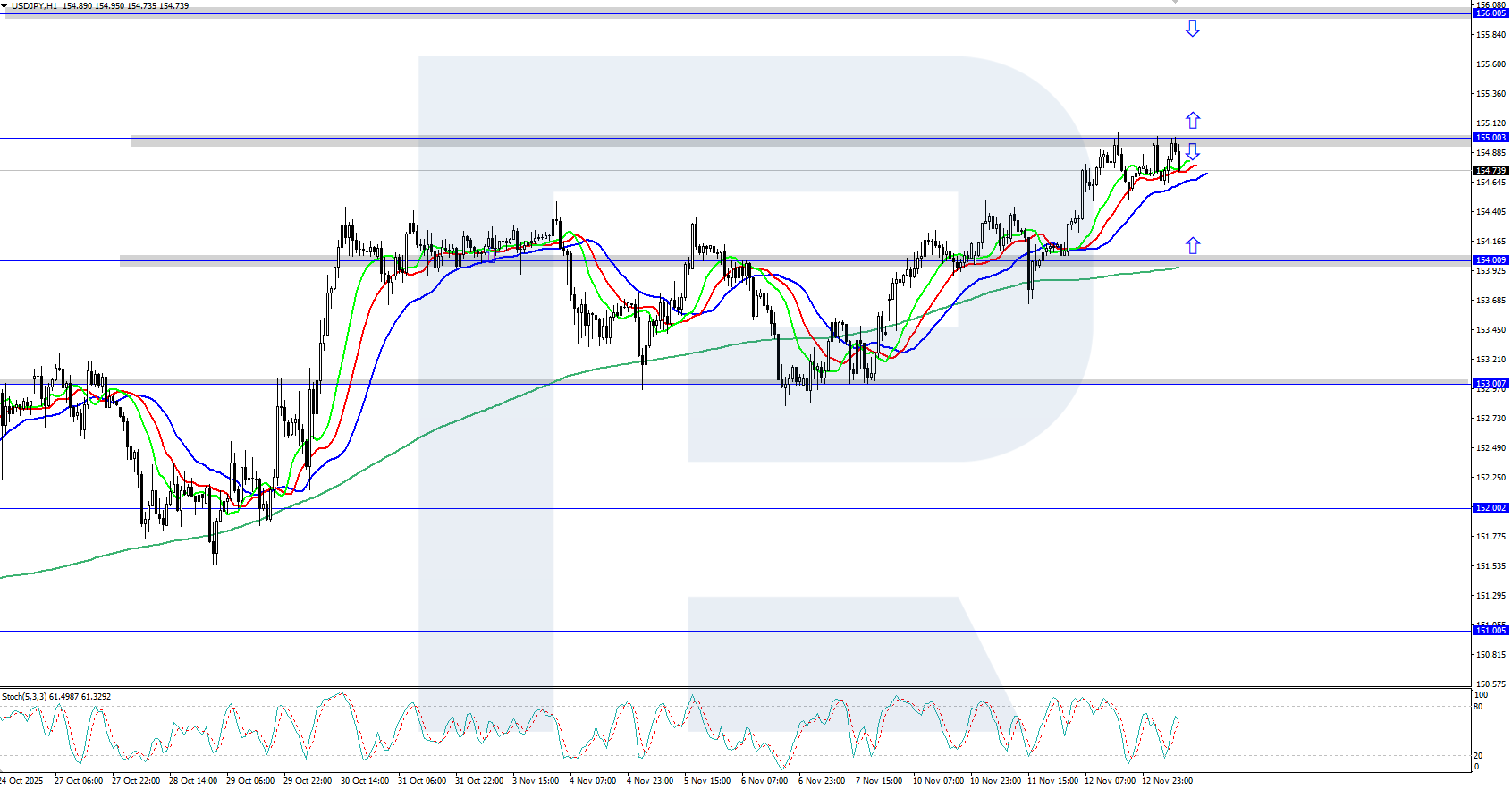

On the H4 chart, the USDJPY pair is steadily rising, reaching the 155.00 level. The Alligator indicator is moving upwards, confirming the ongoing bullish momentum. Further growth towards the local resistance level at 156.00 remains possible.

Today’s USDJPY forecast suggests further gains if the bulls hold above 155.00. However, if the bears regain control and reverse the movement, a correction towards the 154.00 support level could follow.

Summary

The USDJPY pair continues to rise, trading near 155.00. The market now awaits the release of US inflation data – the Consumer Price Index (CPI).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.