Daily technical analysis and forecast for 13 November 2025

Here is a detailed daily technical analysis and forecast for EURUSD, USDJPY, GBPUSD, AUDUSD, USDCAD, XAUUSD and Brent for 13 November 2025.

EURUSD forecast

On the H4 chart of EURUSD, the market continues to develop a narrow consolidation range around 1.1586. On 13 November 2025, the likely scenario is a downward breakout towards 1.1505, with the potential continuation of the trend towards 1.1405. If the price breaks above the range, a further correction towards 1.1660 (testing from below) is possible. After the correction ends, a new downward wave towards 1.1405 may begin.

This scenario is confirmed by the Elliott wave structure and the downward wave matrix with a pivot point at 1.1660, which acts as the key element in the EURUSD wave structure. At the moment, the market completed a corrective wave towards the upper boundary of the Price Envelope at 1.1605. Today, a downward move towards the lower boundary of the Price Envelope at 1.1450 is expected, with the potential continuation of the trend towards 1.1405.

Technical indicators for today’s EURUSD forecast suggest a decline towards 1.1450.

USDJPY forecast

On the H4 chart of USDJPY, the market continues to form a consolidation range around 154.00. On 13 November 2025, the range could expand upwards to 155.15 and then decline to 153.90. A breakout upwards could lead to a continuation of the upward wave towards 155.70, with an extension potential to 157.57 as a local estimated target. A downward breakout may lead to a corrective move towards 152.22 at least, followed by growth towards 155.70.

The Elliott wave structure and the upward wave matrix with a pivot point at 152.22 confirm this scenario as the key structure of this wave. Currently, the market is forming a consolidation range around the central line of the Price Envelope at 154.00. A rise towards its upper boundary at 155.15 is possible, followed by a correction towards its lower boundary at 153.00 and then a new rise towards its upper boundary at 155.70.

Technical indicators for today’s USDJPY forecast suggest growth towards 155.15.

GBPUSD forecast

On the H4 chart of GBPUSD, the market completed a downward wave to 1.3083 and a correction to 1.3143. On 13 November 2025, the pair may continue to decline towards 1.3095. A breakout below this level would open the potential for an extension of the downward wave to 1.3052, with a further continuation of the trend towards 1.2965. The target is local, within the third wave along the downtrend.

The Elliott wave structure and the matrix of the downward wave with a pivot point at 1.3188 confirm this scenario as the key structure for this wave. Currently, a correction wave has reached the upper boundary of the Price Envelope at 1.3188 (testing from below). Today, the market may begin to develop a downward wave towards the lower boundary at 1.2915.

Technical indicators for today’s GBPUSD forecast suggest a possible start of a downward wave towards 1.2915.

AUDUSD forecast

On the H4 chart of AUDUSD, the market completed a correction to 0.6564. On 13 November 2025, a downward wave towards 0.6515 is expected, with the trend likely to continue towards 0.6422. This represents only half of the third downward wave towards 0.6226, a local estimated target. If the market holds above 0.6515 without breaking it, another rising structure towards the upper boundary of the corrective Flag at 0.6570 is possible.

The Elliott wave structure and the downward wave matrix in AUDUSD with a pivot point at 0.6570 confirm this scenario as the key structure of this wave. Currently, the market completed a correction towards the upper boundary of the Price Envelope at 0.6564. Today, a decline towards the central line at 0.6515 is expected, followed by a continuation of the third wave towards the lower boundary at 0.6422.

Technical indicators for today’s AUDUSD forecast suggest a downward wave towards 0.6484.

USDCAD forecast

On the H4 chart of USDCAD, the market completed a correction, reaching 1.3989. On 13 November 2025, a consolidation range is forming above this level. A breakout upwards may trigger an upward wave towards 1.4080. A breakout above 1.4080 will open the potential to extend the wave towards 1.4160. A downward breakout may lead to a continued correction towards 1.3939, followed by growth to 1.4080.

The Elliott wave structure and the matrix of the upward wave with a pivot point at 1.3939 confirm this scenario as the key structure for USDCAD. Currently, the market has completed a correction towards the lower boundary of the Price Envelope at 1.3989. Today, a rise towards its upper boundary at 1.4160 is relevant.

Technical indicators for today’s USDCAD forecast suggest a continued upward movement towards 1.4080.

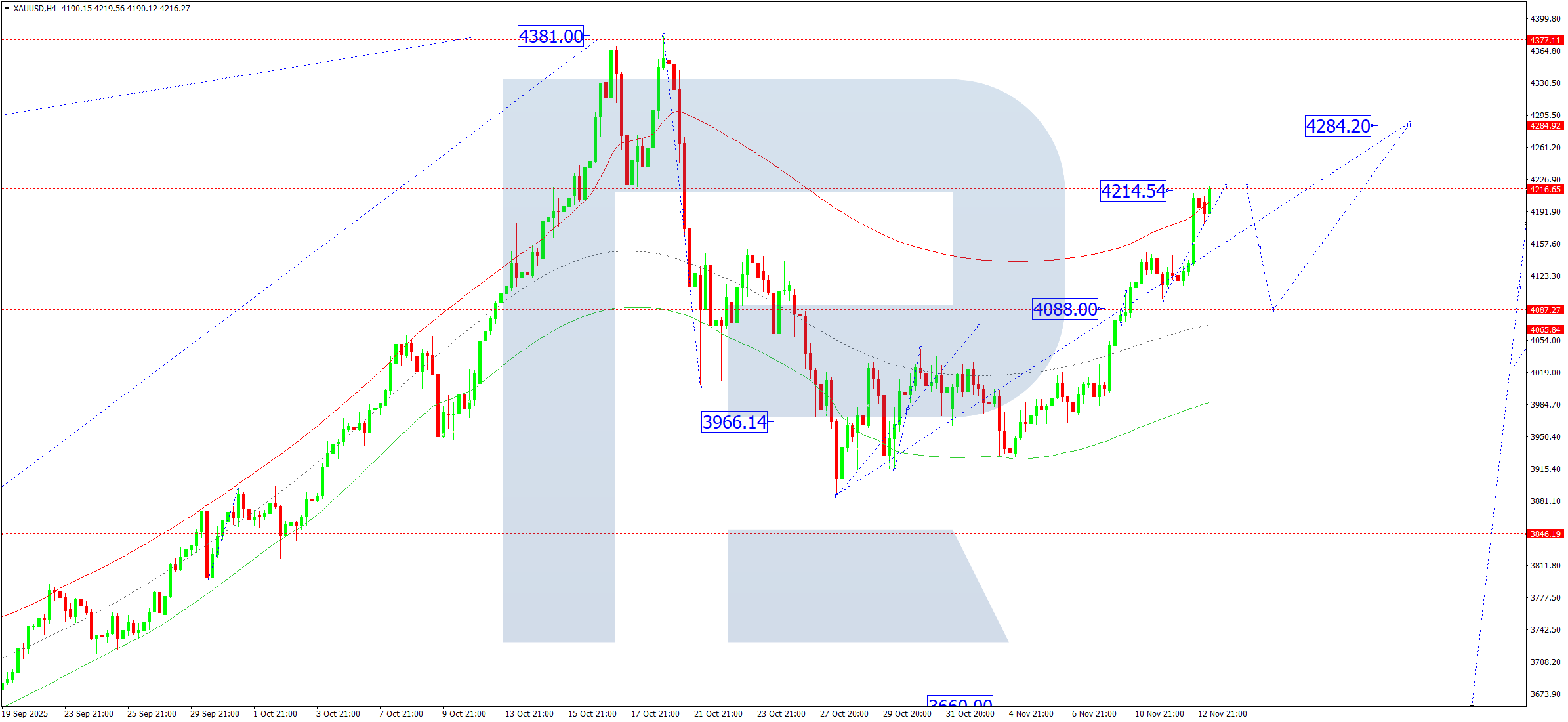

XAUUSD forecast

On the H4 chart of XAUUSD, the market formed a consolidation range around 4,088 and broke out upwards, completing an upward wave towards 4,214. On 13 November 2025, a decline towards 4,088 (testing from above) is possible. The market continues to develop a broader consolidation range around 4,088. A downward breakout may extend the correction to 3,850, while a breakout upwards opens potential for a trend continuation towards 4,284.

The Elliott wave structure and the upward wave matrix with a pivot point at 4,088 confirm this scenario as the key structure for XAUUSD in this wave. Currently, the market forms a consolidation range below the upper boundary of the Price Envelope at 4,214. Today, a decline towards the central line at 4,088 is possible, followed by growth towards the upper boundary at 4,284.

Technical indicators for today’s XAUUSD forecast suggest a correction towards 4,088 and the beginning of a rising wave towards 4,215 and 4,284.

Brent forecast

On the H4 chart of Brent crude oil, the market completed another corrective structure towards 62.15. On 13 November 2025, an upward move towards 65.00 is possible. Afterwards, a wide consolidation range may develop above this level. A further upward breakout could push the price to 66.10, with a continuation of the wave towards the local target of 70.00.

The Elliott wave structure and the upward wave matrix with a pivot point at 62.15 confirm this scenario as the key structure for Brent in this wave. Currently, the market has completed a correction towards the lower boundary of the Price Envelope at 62.15. Today, the scenario suggests the beginning of an upward impulse towards the upper boundary at 66.10.

Technical indicators for today’s Brent forecast suggest the start of a rise towards 66.10.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.