DE 40 analysis: workforce productivity in Germany remains a key challenge

The DE 40 stock index is hovering within a sideways channel with little chance of any trend origination.

Germany’s productivity rate is among the lowest in developed countries, slowing down economic growth rates

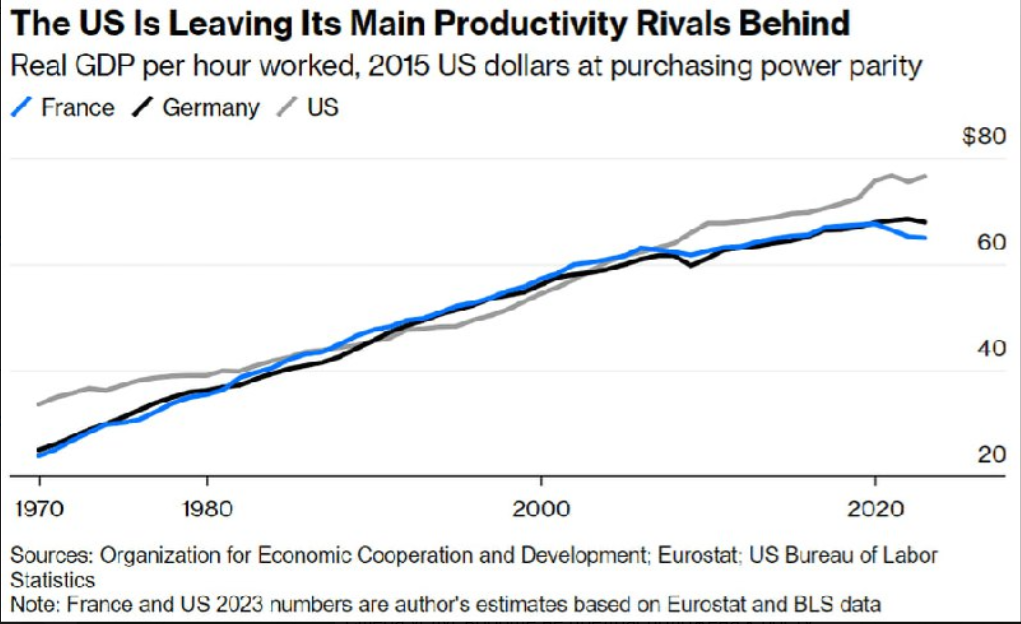

In 2022, GDP per hour in Germany was 11% lower than in the US. This discrepancy could be attributed to mass layoffs from low-paid jobs in the US services sector during the pandemic, with human resources redirected towards more efficient activities. The chart below shows that reindustrialisation, the hi-tech industry, and growth in workforce productivity in the US are increasing unlike in Germany, the EU’s driving force.

Real GDP per hour worked in the US, France, and Germany 27.06.2024

It is also worth noting that there are fewer working hours per year in Germany than in most countries. If the retail sector starts working on weekends, workforce productivity and GDP will increase overall. However, this is not in line with the current economic policy of the ruling coalition. Nevertheless, as the number of challenges increases, this issue will become critical in the near term. Due to this, it is unsurprising that the capitalisation of just one corporation in the US exceeds the capitalisation of Germany’s entire stock market.

DE 40 technical analysis

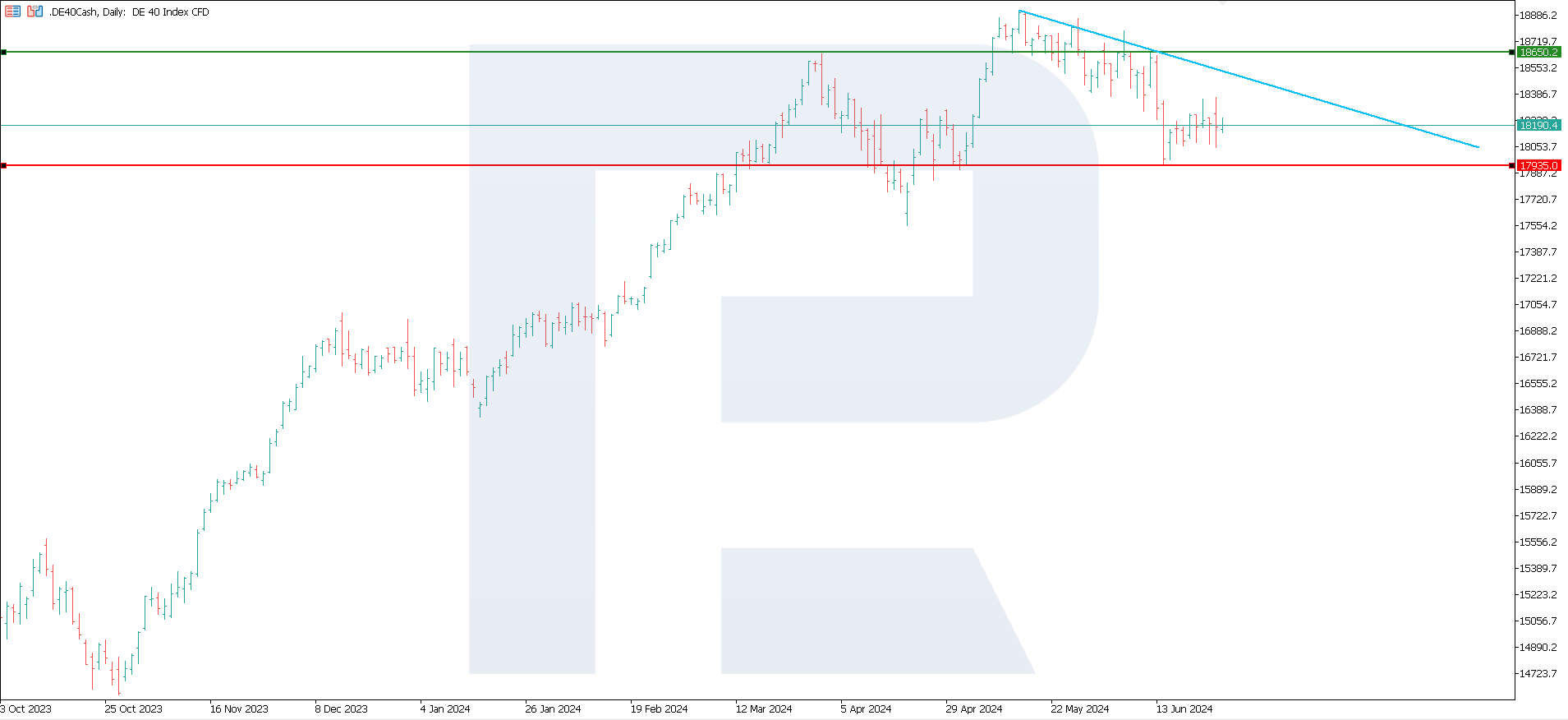

The DE 40 stock index is hovering within a sideways channel. Although a downtrend is expected after reaching a new high, this has little confirmation so far. Given fundamental factors, the quotes will remain within the channel until the end of this week and the beginning of next.

DE 40 index 27.06.2024

A resistance level formed at 18650.2, with support at 17935.0. Although the quotes may remain within this range for an extended period, there is a higher probability of a further decline. If the support level breaks, the target will be the 17550.0 level. Conversely, the growth target could be 18875.0.

Summary

In 2022, workforce productivity in Germany was 11% lower than in the US. This challenge impedes Germany’s economic development. After reaching a new high, the DE 40 stock index is in a downtrend, with the potential decline target at 17550.0.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.