US 30 analysis: breaking the downtrend

US 30 resumed growth amid the decline of other US stock indices

Fundamental analysis of the US 30 index

The US 30 stock index rose, unlike the declining US 500 and USTECH indices. This divergent movement among US stock indices was noted for the first time since 6 June 2024. The current quotation is 39137.5.

The technology sector slumped mainly due to a drop in NVIDIA Corp.'s share price. Since this company is not part of the US 30, the index grew due to the increased capitalisation of Salesforce Inc, Chevron Corp, and International Business Machines.

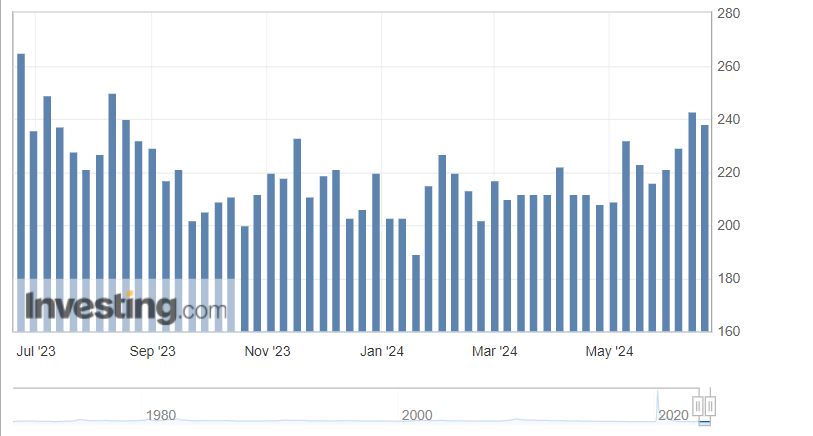

US initial jobless claims 21.06.2024Source: https://investing.com/economic-calendar/initial-jobless-claims-294

Investors assessed the latest batch of economic data. Weekly jobless claims decreased but were higher than expected, and housing construction volumes sharply fell. For this reason, investors are reluctant to buy shares of companies associated with the real economy. However, the growth potential is not yet exhausted. The market's focus is now on monetary policy. Since the US Federal Reserve has softened its rhetoric after two months of declining inflation, the likelihood of a key rate cut in the autumn remains. The market may continue to rise on these expectations.

US 30 stock index technical analysis

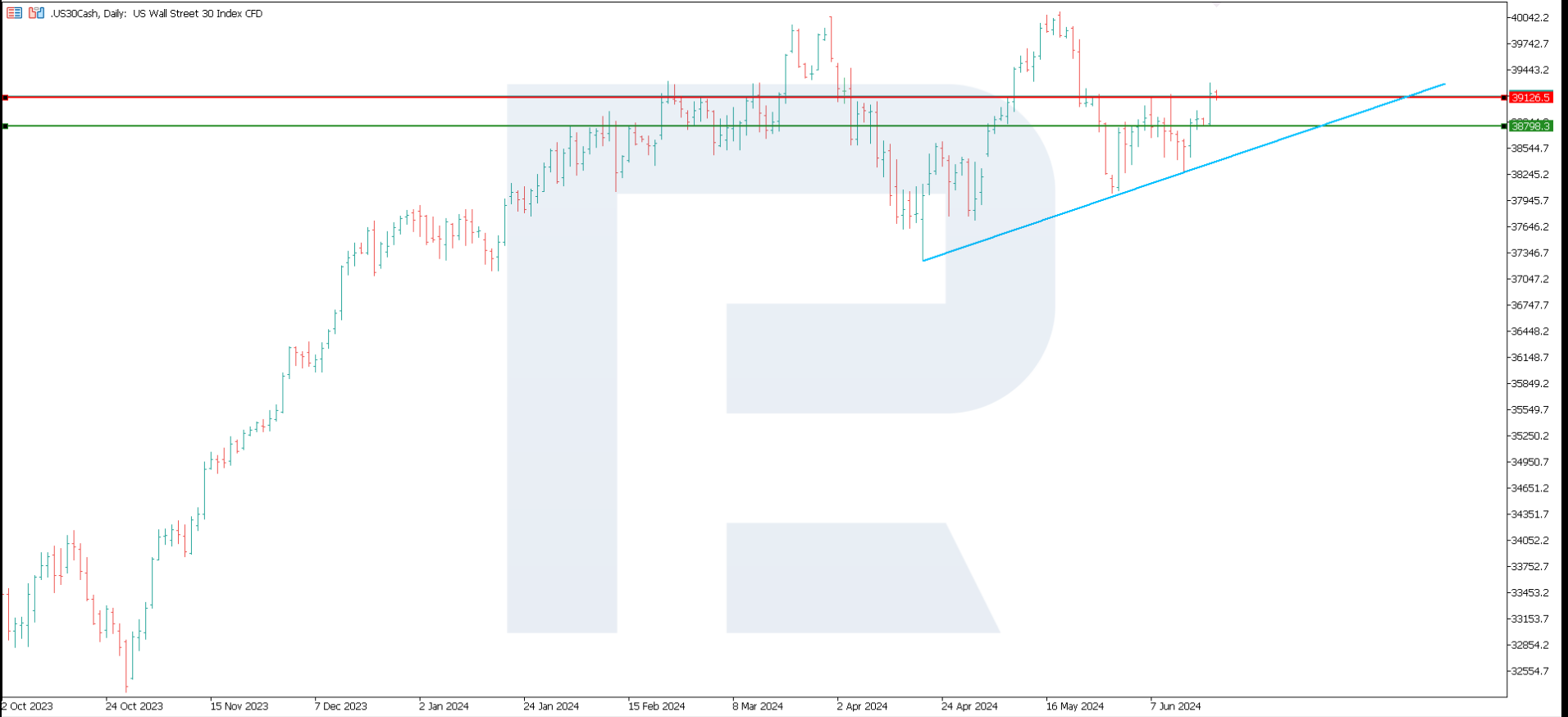

The US 30 stock index was in a downtrend before the end of Thursday's trading session. After hitting a high on 20 May 2024, the asset faced a deep correction.

The US 30 stock index (D1) 21.06.2024

After a rebound from a low on 19 April 2024, an uptrend started, which was confirmed by surpassing the 39126.5 resistance level. A new resistance level has yet to form, while the 38789.3 mark serves as support.

The index will likely decline as part of a correction at the beginning of next week and mark the current resistance level. However, despite this, the US 30 index might continue its growth to new all-time highs. A global trend reversal could be considered only if the price breaches the current support level, with a potential decline target at 37665.0.

Summary

The US 30 stock index has resumed growth and will likely decline as part of a correction at the beginning of next week, forming a new resistance level. From a technical analysis perspective, the US 30 stock index price has the potential for growth to new all-time highs. A global trend reversal is only possible after the price breaches the current 38789.3 support level.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.