World indices overview: news from US 30, US 500, US Tech, JP 225, and DE 40 for 17 June 2025

The outbreak of an armed conflict between Iran and Israel has led to a decline in global stock indices. Find out more in our analysis and forecast for 17 June 2025.

US indices forecast: US 30, US 500, US Tech

- Recent data: US Producer Price Index (PPI) for May came in at 2.6%

- Market impact: moderate PPI growth is seen as a signal for more cautious expectations regarding the Federal Reserve’s monetary policy

Fundamental analysis

An increase in the PPI means rising production costs, which may lead to higher consumer prices (inflation). If inflation rises too quickly, the Federal Reserve may tighten policy (by raising interest rates), which negatively impacts stocks, particularly in rate-sensitive hi-tech and growth sectors.

The annual PPI increase of 2.6% (up from 2.4% earlier) points to growing inflationary pressure over the long term. In this case, the data shows a slight overall acceleration, but the core index declined slightly, which may be interpreted as a sign of stabilising inflation, supporting softer expectations for rate policy.

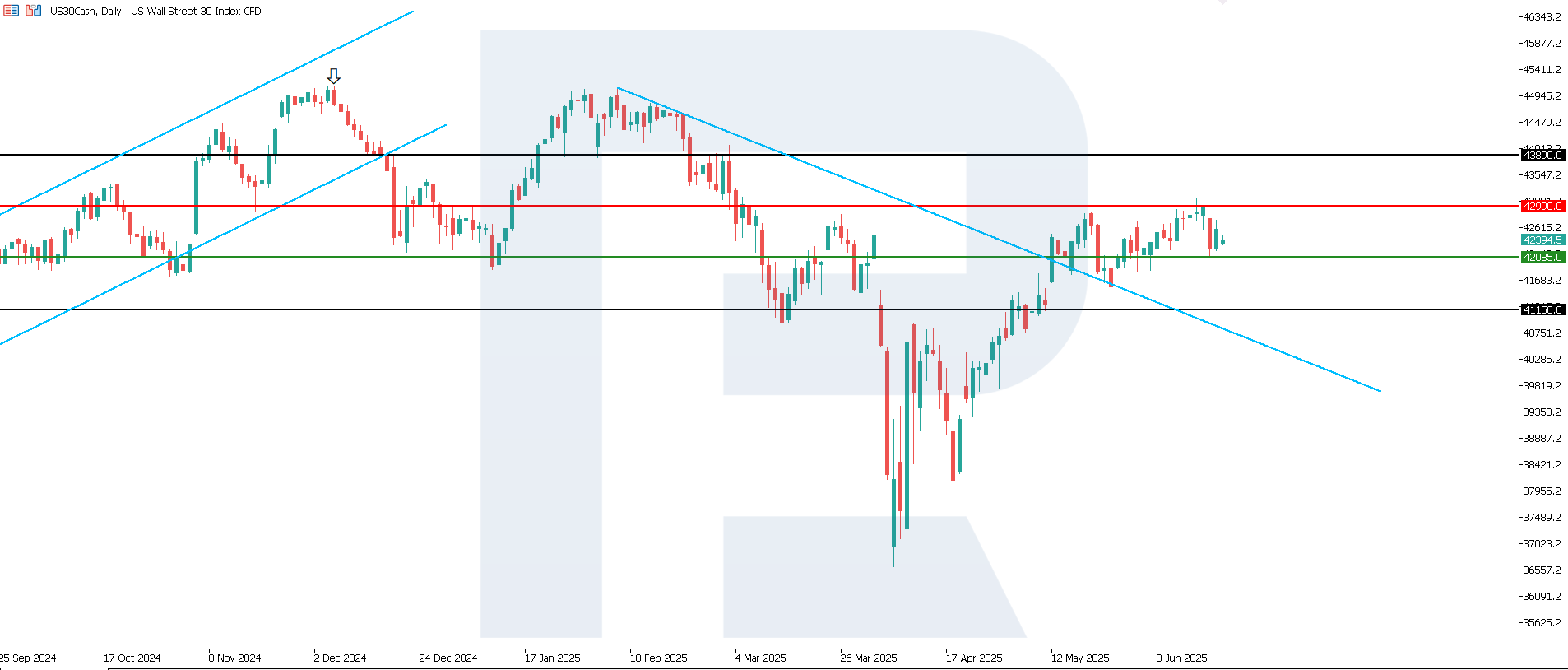

US 30 technical analysis

The US 30 index broke below the 42,570.0 support level, with a new one forming at 42,085.0. The resistance level shifted to 42,990.0. The US 30 outlook remains unstable. The momentum of the current downtrend is relatively weak and may shift into a sideways pattern.

The following scenarios are considered for the US 30 price forecast:

- Pessimistic US 30 forecast: a breakout below the 42,085.0 support level could push the index to 41,150.0

- Optimistic US 30 forecast: a breakout above the 42,990.0 resistance level could boost the index to 43,890.0

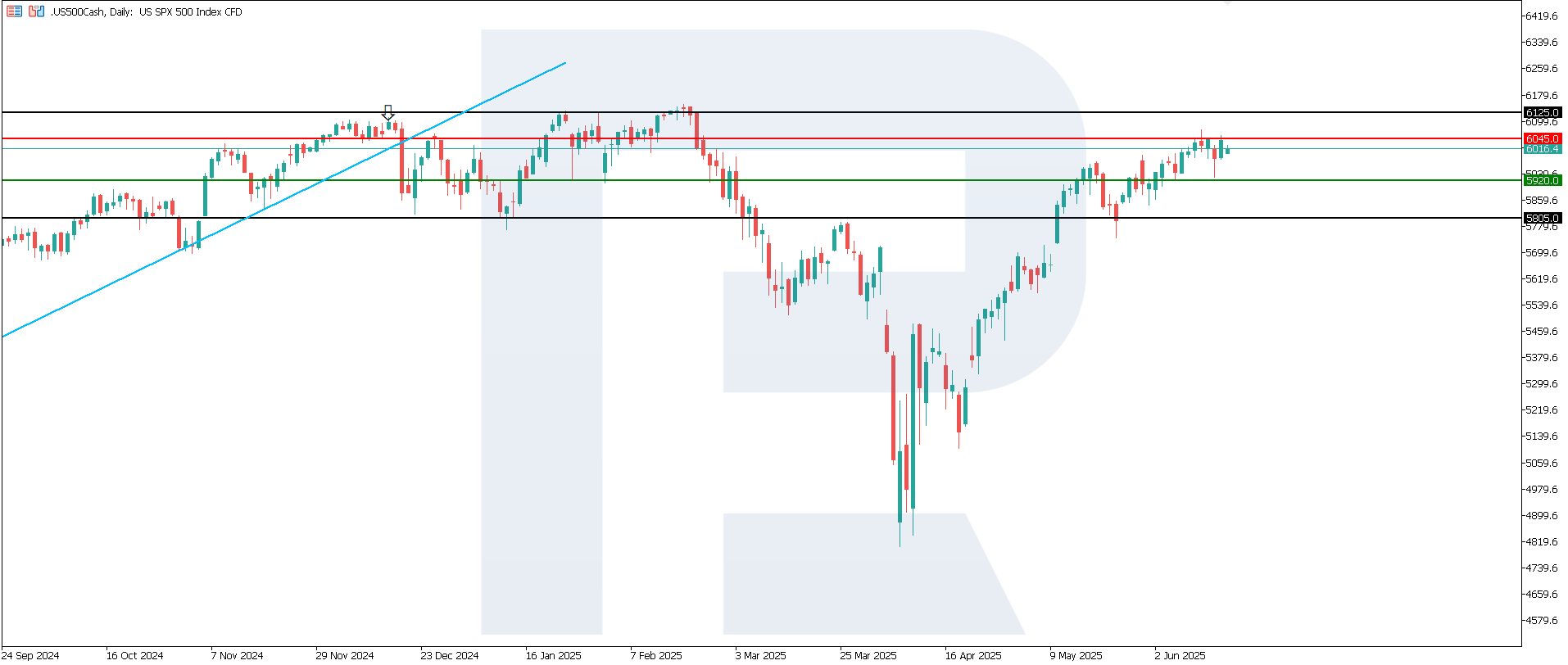

US 500 technical analysis

The US 500 index remained in an uptrend, with the support level shifting to 5,920.0 and resistance forming at 6,045.0. The index is attempting to break above this level and reach a new all-time high.

The following scenarios are considered for the US 500 price forecast:

- Pessimistic US 500 forecast: a breakout below the 5,920.0 support level could send the index down to 5,745.0

- Optimistic US 500 forecast: a breakout above the 6,045.0 resistance level could propel the index to 6,125.0

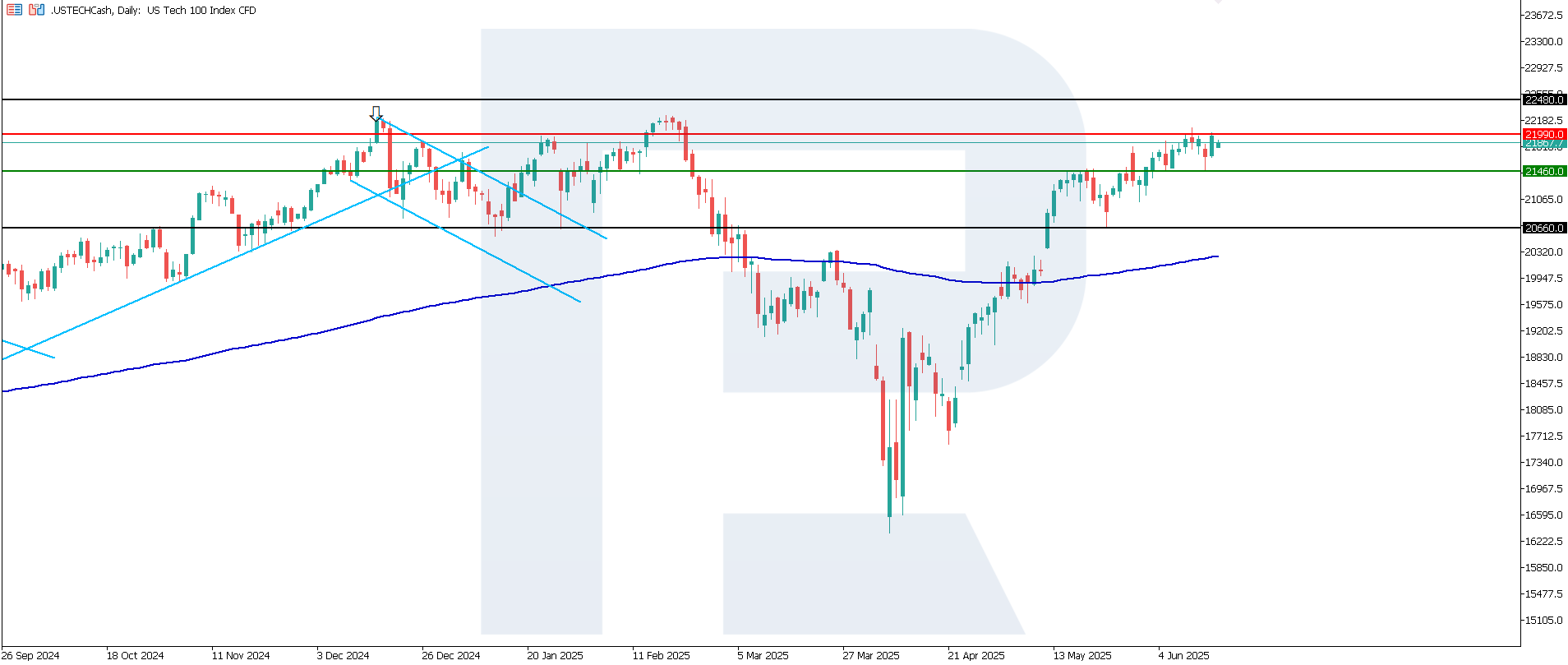

US Tech technical analysis

The US Tech index broke above the 21,780.0 resistance level, with a new one forming at 21,990.0. The support level has shifted to 21,460.0. The index has remained within an uptrend and shows potential for further growth.

The following scenarios are considered for the US Tech price forecast:

- Pessimistic US Tech forecast: a breakout below the 21,460.0 support level could push the index down to 20,660.0

- Optimistic US Tech forecast: a breakout above the 21,990.0 resistance level could drive the index to 22,480.0

Asian index forecast: JP 225

- Recent data: Bank of Japan’s policy rate remains at 0.50%

- Market impact: a stable 0.50% rate supports predictability and reduces market volatility

Fundamental analysis

The interest rate affects borrowing costs, consumer spending, investment, and ultimately corporate earnings. In this case, the rate remained unchanged at 0.50% in line with market expectations. This indicates stable monetary policy and no surprises.

The decision positively influences investor sentiment, as it rules out the risk of sharp changes in borrowing costs. The current monetary policy aligns with expectations and creates favourable conditions for most sectors of Japan’s equity market. This supports investment activity and reduces risks, especially for companies in the financial, technology, and industrial sectors.

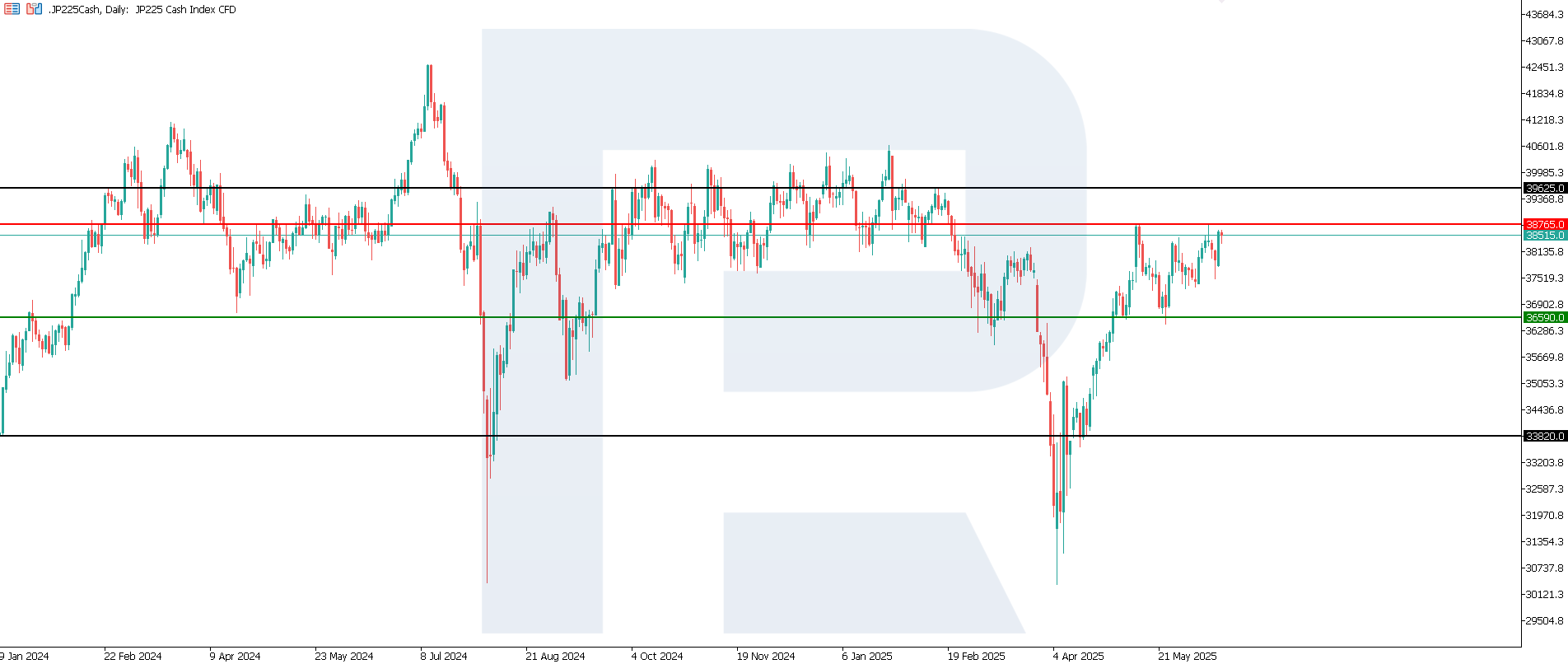

JP 225 technical analysis

After rebounding from the 36,590.0 support level, the JP 225 index continues to edge up and is approaching the 38,765.0 resistance level. An upward breakout would confirm continued medium-term upward momentum. At this point, there are no signs of a possible trend reversal.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: a breakout below the 36,590.0 support level could push the index down to 33,820.0

- Optimistic JP 225 forecast: a breakout above the 38,765.0 resistance level could propel the index to 39,625.0

European index forecast: DE 40

- Recent data: Germany’s CPI for May came in at 0.1%

- Market impact: easing inflation reduces the risk of ECB policy tightening, which is favourable for the German stock market

Fundamental analysis

Germany’s CPI for May 2025 stood at +0.1% m/m, matching the forecast and well below the previous +0.4%. This indicates slowing inflation at a low level, a positive sign for the economy as it eases pressure on consumer spending and allows for looser monetary policy.

Softer inflation conditions typically benefit tech companies, which rely on low borrowing costs. Low inflation and stable rates also support banks and insurers, as they reduce the risk of sudden rate fluctuations.

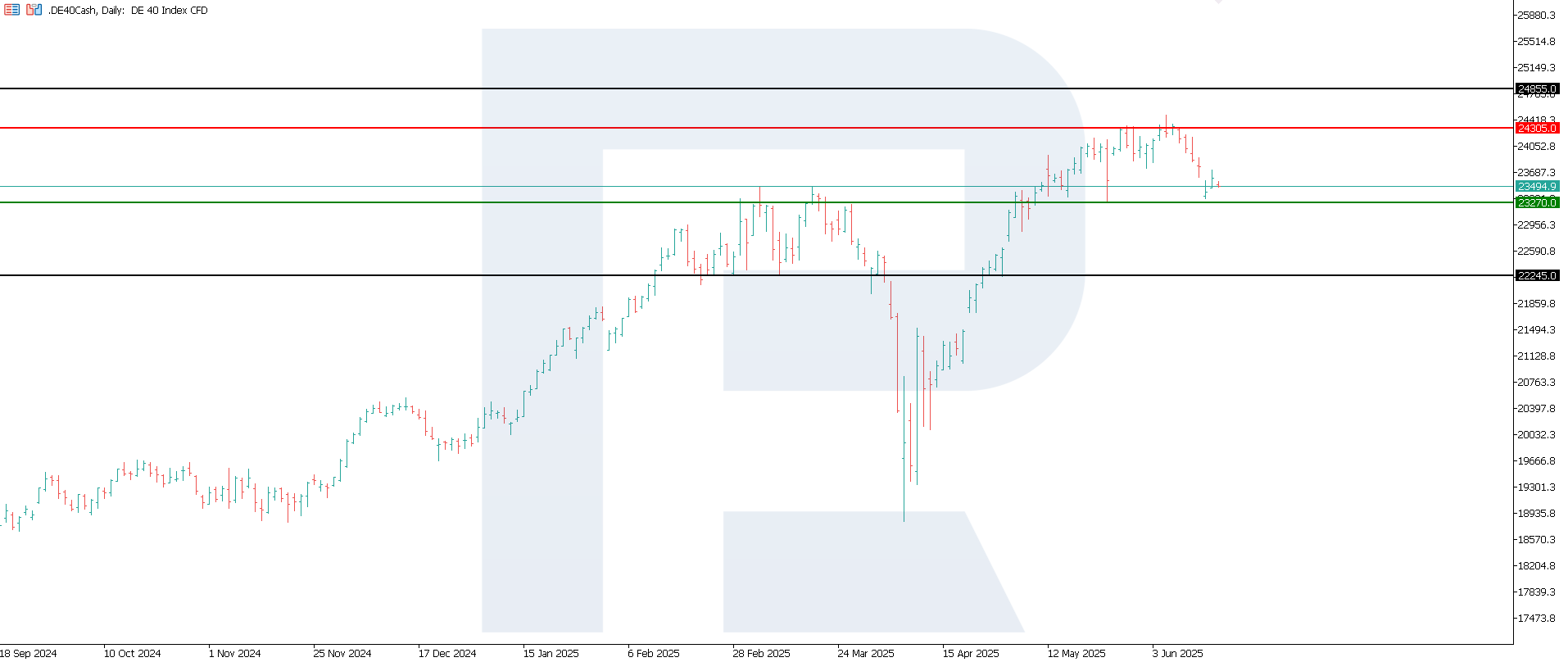

DE 40 technical analysis

The DE 40 index has formed key levels, with resistance at 24,305.0 and support around 23,270.0. The current price behaviour indicates a persistent uptrend, increasing the likelihood of new all-time highs in the near term. The support level remained intact following a correction.

The following scenarios are considered for the DE 40 price forecast:

- Pessimistic DE 40 forecast: a breakout below the 23,270.0 support level could send the index down to 22,245.0

- Optimistic DE 40 forecast: a breakout above the 24,305.0 resistance level could push the index higher to 24,855.0

Summary

Despite the sudden outbreak of hostilities between Iran and Israel, most global indices managed to retain their upward momentum after a brief correction. The US 30 was the only index to revert to a downtrend. Japan’s JP 225 is targeting a breakout above its current resistance level. The US 500 and US Tech continue to move within a steady uptrend, while Germany’s DE 40, following a deep correction, still has the potential to reach a new all-time high. Investor attention will remain on developments in the Middle East for a short time. If the situation does not escalate into a broader conflict threatening energy infrastructure, focus will likely shift back to US macroeconomic data.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.