JP 225 analysis: the index is consolidating below 39,000.0

The JP 225 H4 chart shows a consolidation within a limited price range. The JP 225 forecast for next week is neutral.

JP 225 forecast: key trading points

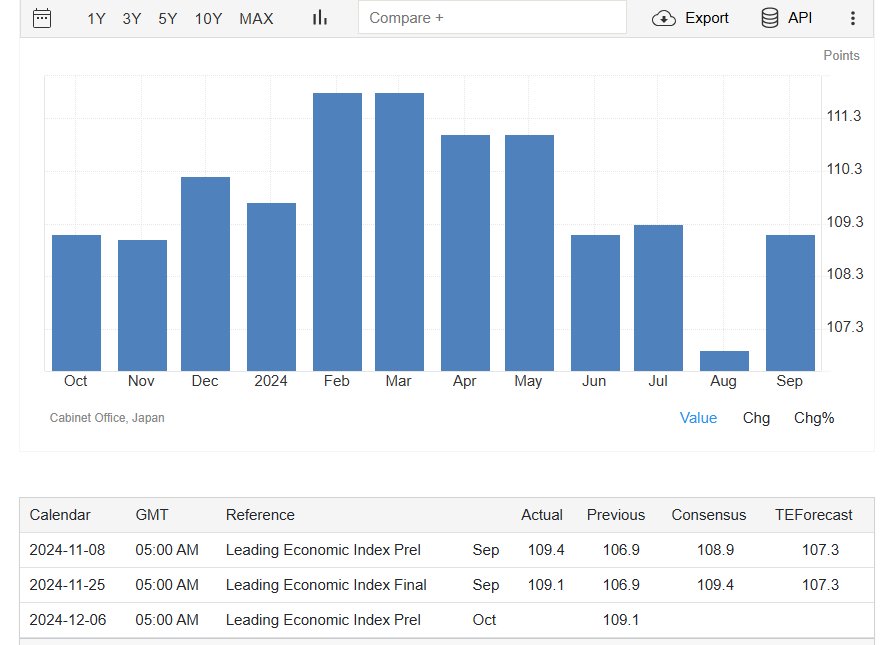

- Recent data: Japan’s Leading Economic Index for September was revised downward to 109.1 points from the preliminary 109.4

- Economic indicators: this index evaluates the economic outlook for the coming months

- Market impact: an increase in the index reflects a positive trend in the country’s economic development, while a decrease signals a negative trend

- Resistance: 39,000.0, Support: 37,700.0

- JP 225 price forecast: 38,000.0

Fundamental analysis

Japan’s Leading Economic Index for September, which evaluates the economic outlook for the coming months, was revised downward to 109.1 points from an initial estimate of 109.4.

Source: https://tradingeconomics.com/japan/leading-economic-index

The JP 225 index declined by approximately 1% on Tuesday following announcements by US President-elect Donald Trump of an additional 10% duty on all Chinese goods and a 25% duty on imports from Canada and Mexico. Investors are concerned about escalating global trade tensions.

With its significant dependence on exports to China, Japan remains vulnerable to fluctuations in China’s economic activity. Technology stocks suffered the most, with notable declines in Lasertec (-5.5%), Advantest (-4.3%), Disco (-3.1%), Hitachi (-2.7%), and Tokyo Electron (-2.1%).

JP 225 technical analysis

The JP 225 stock index declined on Tuesday but remained within the sideways price range of the last days between 37,700.0 and 39,000.0. A breakout from this range will define the index’s future price trajectory.

The following scenarios are considered for the JP 225 price forecast:

- Pessimistic JP 225 forecast: if the price secures below the 37,700.0 support level, the index could plunge to 37,000.0

- Optimistic JP 225 forecast: a breakout above the 39,000.0 resistance level could drive the price up to 40,000.0

Summary

The JP 225 stock index declined on Tuesday amid concerns about mounting global trade tensions. The forecast for next week is neutral; further prospects will become clearer after the price breaks out of the 37,700.0-39,000.0 sideways range.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.