Johnson & Johnson: Record revenue in Q4 2025 and optimistic expectations for 2026

Johnson & Johnson delivered strong results for Q4 2025, with revenue rising by 9% and net income reaching 2.42 billion USD. The 2026 forecast anticipates steady growth, which should help drive the company’s stock price higher.

Johnson & Johnson (NYSE: JNJ) reported Q4 2025 revenue of 24.6 billion USD, up 9.1% from the same period last year, exceeding analyst expectations, forecasted at approximately 24.1 billion USD. Net income totalled 2.42 billion USD, with earnings per share (EPS) of 2.46 USD, in line with market expectations. Key drivers of growth included strong sales in the pharmaceutical and medical devices segments, particularly in oncology drugs and medical technologies.

The company forecasts 2026 revenue of approximately 100.5 billion USD, representing a 5.7–6.7% increase from 2025, with adjusted EPS expected to be around 11.53 USD.

Overall, J&J continues its growth strategy through innovation and operational efficiency, as evidenced by its strong financial results and confidence in the future. Following the report, JNJ shares continued to rise, hitting a new all-time high.

This article provides an analysis of Johnson & Johnson's quarterly reports, a technical and fundamental analysis of JNJ shares, and a stock forecast for the company in 2026. It also explores Johnson & Johnson’s business model, revenue sources, and expert predictions for Johnson & Johnson’s stock in 2026.

About Johnson & Johnson

Founded in 1886 in the US, Johnson & Johnson manufactures medical products, pharmaceuticals, and health-related items, including personal care products and medical devices. J&J is renowned for its popular brands, such as Band-Aid, Neutrogena, Tylenol, and others. The company went public in 1944 and is now one of the largest healthcare corporations in the world.

Image of the Johnson & Johnson company nameJohnson & Johnson’s business model

Johnson & Johnson is one of the world’s largest companies, engaged in the healthcare and consumer goods sectors. It has a diversified business model and sells its products in three main segments:

- Pharmaceutical Segment: revenue primarily comes from the sale of prescription medicines. Key therapeutic areas include oncology, immunology, neurology, infectious diseases, cardiology, metabolism, and vaccines.

- Medical Devices Segment: this division generates revenue primarily from sales of medical equipment and devices. Its core areas include surgery, orthopaedics, interventional solutions, and eye surgery.

- Consumer Health Segment: the main revenue stream is derived from sales of health and personal care products. The key areas include skin care, baby care, oral care, dietary supplements, and over-the-counter medicines.

Johnson & Johnson’s business model is based on diversifying revenues across three segments, enabling the company to earn not only from pharmaceuticals but also from the production and sale of medical equipment.

The consumer segment is also a significant area for revenue diversification as it covers products sold outside medical centres that do not require prescriptions.

Johnson & Johnson Q2 2024 earnings results

Johnson & Johnson released its Q2 2024 results on 17 July 2024. In addition to the key financial metrics, the company disclosed segmental data for Innovative Medicine (pharmaceuticals, health and personal care products) and MedTech (medical devices and equipment). Below are the figures compared with the same period last year:

- Revenue: 22.45 billion USD (+4.3%)

- Net profit: 4.68 billion USD (−12.8%)

- Earnings per share: 2.82 USD (+10.2%)

- Innovative Medicine revenue: 14.49 billion USD (+5.5%)

- US: 8.51 billion USD (+8.9%)

- Rest of the world: 5.98 billion USD (+1.1%)

- MedTech revenue: 7.96 billion USD (+2.2%)

- US: 4.05 billion USD (+5.7%)

- Rest of the world: 3.89 billion USD (−1.3%)

Johnson & Johnson’s management described its Q2 2024 performance as strong. In particular, Chairman and CEO Joaquin Duato highlighted that the results reflect the company’s ongoing commitment to advancing the next wave of medical innovations, which has driven significant sales growth and improvement in operating earnings per share (EPS). With a robust product portfolio, the integration of Shockwave, and the continued expansion of its pharmaceutical range, the company maintains a solid foundation for both near- and long-term growth.

Johnson & Johnson issued an upbeat outlook for 2024, expecting continued expansion across its core segments – Innovative Medicine and MedTech.

The company forecast full-year revenue of 89.30–90.30 billion USD, representing a 4.0–5.0% year-on-year increase. Earnings per share (EPS) were projected in the 10.70–10.80 USD range, marking a 2.5–3.5% rise from 2023.

Management emphasised that Johnson & Johnson remains well-positioned for long-term growth, supported by its diversified product portfolio and sustained investment in innovation.

Johnson & Johnson Q3 2024 earnings results

On 15 October 2024, Johnson & Johnson released its Q3 2024 results, showing that revenue once again exceeded the figure recorded in the same period of 2023. Below are the key figures compared with Q3 2023:

- Revenue: 22.47 billion USD (+5.2%)

- Net profit: 2.69 billion USD (−37.5%)

- Earnings per share (EPS): 2.42 USD (−9.0%)

- Innovative Medicine revenue: 14.58 billion USD (+4.9%)

- US: 8.87 billion USD (+7.5%)

- Rest of the world: 5.70 billion USD (+1.2%)

- MedTech revenue: 7.89 billion USD (+7.1%)

- US: 4.03 billion USD (+5.7%)

- Rest of the world: 3.85 billion USD (+3.9%)

Joaquin Duato stated that J&J’s Q3 2024 results demonstrate the strength and diversity of the company’s business model and reflect its commitment to innovation in healthcare. He highlighted continued progress in developing treatments for diseases with high unmet needs, positioning J&J for sustainable long-term growth.

The earnings commentary noted significant progress in expanding the product portfolio, including regulatory approval for TREMFYA in ulcerative colitis and the combination of RYBREVANT with LAZCLUZE for treating non-small cell lung cancer. It also mentioned applying for exclusive rights related to the development of the OTTAVA general-purpose robotic surgery system.

The company attributed the decline in net profit to one-off research and development expenses associated with the acquisition of M-Wave’s research outcomes.

Johnson & Johnson Q4 2024 earnings results

On 22 January 2025, Johnson & Johnson released its Q4 2024 results, which exceeded expectations, although the key indicator dynamics were mixed:

- Revenue: 22.52 billion USD (+5.3%)

- Net profit: 3.43 billion USD (−17.5%)

- Earnings per share (EPS): 2.04 USD (−10.9%)

- Revenue from Innovative Medicine: 14.33 billion USD (+4.4%)

- US: 8.97 billion USD (+11.1%)

- Rest of the world: 5.35 billion USD (−5.1%)

- Revenue from MedTech: 8.18 billion USD (+6.7%)

- US: 4.22 billion USD (+7.6%)

- Rest of the world: 3.96 billion USD (+5.8%)

Joaquin Duato described 2024 as a "year of transformation" for Johnson & Johnson, highlighting robust growth and accelerated progress in the company’s product portfolio. J&J achieved annual sales of 88.80 billion USD and an EPS of 9.98 USD, representing growth compared to 2023, but was slightly below the forecast it provided in its Q2 2024 earnings commentary.

The decline in net profit was attributed to increased costs related to acquisitions, operational activities, adverse foreign exchange movements, and legal settlement expenses.

For 2025, the company provided a cautious outlook, expecting sales to range between 89.20 billion USD and 90.00 billion USD, below analysts’ expectations of 91.04 billion USD. The adjusted EPS forecast was set at 10.50-10.70 USD per market expectations.

Following the earnings release, J&J’s stock price declined, likely due to the conservative 2025 sales forecast.

Johnson & Johnson Q1 2025 earnings results

On 15 April 2025, Johnson & Johnson released its Q1 2025 results, which exceeded expectations. The key figures are presented below, compared to Q1 2024:

- Revenue: 21.89 billion USD (+2.4%)

- Net profit: 6.71 billion USD (+1.9%)

- Earnings per share (EPS): 2.77 USD (+2.2%)

- Innovative Medicine revenue: 13.87 billion USD (+2.3%)

- US: 8.09 billion USD (+6.3%)

- Rest of the world: 5.78 billion USD (–2.9%)

- MedTech revenue: 8.02 billion USD (+2.5%)

- US: 4.21 billion USD (+5.1%)

- Rest of the world: 3.81 billion USD (–0.2%)

The company delivered strong results, beating Wall Street estimates for both earnings per share and revenue. This performance was supported by steady growth in the Innovative Medicine and MedTech segments. Johnson & Johnson’s ability to maintain robust performance despite challenges, such as biosimilar competition for Stelara and macroeconomic pressures in key markets, underscores its strategic resilience and operational effectiveness.

Johnson & Johnson continues to enhance its portfolio through strategic acquisitions. The 14.6 billion USD deal to acquire Intra-Cellular Therapies is nearing completion, strengthening J&J’s position in neurology. Progress in product development – including the approval of TREMFYA for the treatment of Crohn’s disease and positive clinical results for RYBREVANT in lung cancer therapy – reaffirms the company’s commitment to innovation. Additionally, the launch of clinical trials for the OTTAVA surgical robotic system positions J&J as a potential competitor to leading players in the medical technology sector, such as Intuitive Surgical.

From a financial perspective, Johnson & Johnson remains highly resilient. The company increased its quarterly dividend to 1.30 USD per share,

marking the 63rd consecutive year of dividend growth. It also raised its full-year 2025 revenue forecast to 91.0–91.8 billion USD, reflecting anticipated tariffs of around 400 million USD and the expected impact of the pending Intra-Cellular Therapies acquisition.

Nevertheless, certain challenges remain. The company continues to face legal risks related to talc-based product litigation and declining Stelara sales due to intensifying competition from biosimilars.

Johnson & Johnson Q2 2025 earnings results

Johnson & Johnson released its Q2 2025 earnings report on 16 July 2025, once again beating market expectations. The key metrics are outlined below, compared to Q2 2024:

- Revenue: 23.74 billion USD (+5.8%)

- Net income: 5.54 billion USD (+18.2%)

- Earnings per share: 2.77 USD (−1.8%)

- Revenue – Innovative Medicine: 15.20 billion USD (+4.9%)

- US: 9.16 billion USD (+7.6%)

- Rest of the world: 6.04 billion USD (+1.0%)

- Revenue – MedTech: 8.54 billion USD (+7.3%)

- US: 4.38 billion USD (+8.0%)

- Rest of the world: 4.16 billion USD (+6.7%)

Johnson & Johnson delivered strong Q2 2025 results, surpassing market expectations. Revenue stood at 23.7 billion USD, marking a 5.8% year-on-year increase, while adjusted EPS reached 2.77 USD, significantly ahead of analyst forecasts. Management noted solid growth in both the Innovative Medicine and MedTech segments, with oncology and cardiovascular products performing particularly well. Darzalex once again exceeded expectations, delivering sales of 3.54 billion USD (+22%), and the MedTech division expanded further, driven by electrophysiology and cardiovascular surgery, achieving double-digit growth.

A major positive factor was the halving of projected tariff costs, from 400 million USD to 200 million USD, due to easing trade tensions. Johnson & Johnson directed these savings towards R&D and the expansion of its product portfolio, reflecting prudent capital allocation and a clear long-term strategy. Additional support for revenue came from favourable currency effects.

The company made an aggressive push into oncology, setting a goal of reaching 50 billion USD in revenue from this area by 2030, and is actively advancing new developments in oncology, immunology, cardiology, and surgical robotics. These positive trends enabled management to raise its guidance for 2025: revenue is now expected in the range of 93.2–93.6 billion USD, and EPS between 10.80 and 10.90 USD (previously 10.50–10.70 USD).

The company did not provide guidance for Q3 2025, but management’s generally optimistic tone and the upgraded annual outlook indicated sustained growth momentum. Analysts expected Q3 2025 EPS of about 2.75 USD and revenue of roughly 23.17 billion USD. High expectations were placed on new product lines and on the continued expansion of the MedTech and Innovative Medicine segments.

Johnson & Johnson Q3 2025 earnings results

On 14 October 2025, Johnson & Johnson released its Q3 2025 results. The key figures compared to Q3 2024 are as follows:

- Revenue: 23.99 billion USD (+6.8%)

- Net profit: 6.80 billion USD (+15.7%)

- Earnings per share: 2.80 USD (+15.7%)

- Innovative Medicine revenue: 15.56 billion USD (+6.8%)

- US: 9.40 billion USD (+6.0%)

- Rest of world: 6.16 billion USD (+7.9%)

- MedTech revenue: 8.43 billion USD (+6.8%)

- US: 4.31 billion USD (+6.6%)

- Rest of world: 4.12 billion USD (+7.0%)

Johnson & Johnson’s Q3 2025 results beat analyst expectations. Revenue totalled 23.99 billion USD, slightly above the market forecast of 23.79 billion USD. Adjusted earnings per share were 2.80 USD, also beating estimates of 2.75 USD.

Sales increased across all major business areas. In the Innovative Medicine segment, growth was mainly driven by oncology and neuroscience therapies, with strong performance from Darzalex, Carvykti, Erleada, Rybrevant/Lazcluze, and Spravato (for depression treatment). Sales of Stelara and Imbruvica declined, partly due to competition from lower-cost biosimilars and changes in the Medicare program. According to the company, the loss of exclusivity for Stelara reduced total growth by approximately 10.7 percentage points. Darzalex alone generated sales of 3.67 billion USD during the quarter.

In the MedTech segment, growth was supported by devices for treating arrhythmias (Biosense Webster), cardiovascular technologies (Abiomed, Shockwave), surgical sutures, and ophthalmic instruments. The fastest growth was recorded in the Cardiovascular and Vision divisions.

The company raised its full-year revenue forecast to 93.5–93.9 billion USD (midpoint: 93.7 billion USD) and kept its earnings per share (EPS) forecast unchanged at 10.80–10.90 USD. A favourable currency translation also provided a tailwind, adding roughly 1.4% to revenue in the quarter.

Johnson & Johnson also announced that it planned to spin off its orthopaedics division, DePuy Synthes, into a separate company within 18–24 months. This move will allow the company to focus on higher-growth areas, including oncology, immunology, neuroscience, cardiovascular care, surgery, and ophthalmology.

Johnson & Johnson Q4 2025 results

Johnson & Johnson reported its Q4 2025 results on 21 January 2026. Below are the key figures compared to Q4 2024:

- Revenue: 24.56 billion USD (+9.1%)

- Net income: 6.01 billion USD (+21.5%)

- Earnings per share (EPS): 2.46 USD (+20.6%)

- Innovative Medicine Revenue: 15.76 billion USD (+10.0%)

- US: 9.68 billion USD (+7.9%)

- Rest of the World: 6.07 billion USD (+13.4%)

- MedTech Revenue: 8.80 billion USD (+7.5%)

- US: 4.51 billion USD (+6.6%)

- Rest of the World: 4.30 billion USD (+8.5%)

For Q4 2025, Johnson & Johnson exceeded the revenue forecast, though earnings per share (EPS) came in line with expectations. Quarterly revenue totalled 24.6 billion USD, up 9% year-on-year, surpassing analysts’ consensus estimate by 400 million USD. The primary source of revenue growth came from the pharmaceutical and MedTech segments. Adjusted EPS was 2.46 USD, matching market expectations.

The company’s operational results show solid momentum. Pharmaceutical sales continued to grow, driven by strong demand for new cancer and autoimmune drugs (e.g., Darzalex and Tremfya). Meanwhile, older brands facing patent expirations experienced pressure from biosimilar competition. Stelara, a long-time top seller, experienced a significant decline in revenue, but the overall impact was offset by growth in other therapeutic areas. MedTech also contributed significantly to revenue, with moderate growth.

Management provided an optimistic forecast for 2026, which surpassed the average analyst consensus: Johnson & Johnson expects revenue in the range of 100.0–100.5 billion USD, with adjusted EPS projected to be between 11.4 and 11.6 USD. This reflects a growth target of 6–7% for both revenue and profit compared to 2025, exceeding average analyst estimates. The company attributes this optimism to the expansion of its portfolio of innovative drugs, particularly in oncology, immunology, and other key therapeutic areas, as well as ongoing investments in R&D and manufacturing.

The report indicates that Johnson & Johnson’s operational model remains resilient, with steady revenue growth and a confident outlook for the future. However, the absence of significant EPS outperformance could suggest that rising costs (e.g., from acquisitions or investment activities) are offsetting the net impact of increased sales.

Fundamental analysis of Johnson & Johnson

Below is the fundamental analysis of J&J based on Q3 2026 financial results:

- Liquidity and cash flow: the company demonstrates an excellent ability to generate cash. In 2025, free cash flow reached 19.7 billion USD, and by year-end, cash and liquid securities totalled 20 billion USD. The current ratio stands at 1.07, indicating sufficient assets to cover short-term obligations.

- Debt and interest coverage: J&J maintains a stable debt load. Total debt at the end of 2025 was approximately 48 billion USD, with net debt at around 28 billion USD. The debt-to-equity ratio is 0.58, considered moderate for a pharmaceutical giant. The interest coverage ratio stands at 27.01, indicating that the company comfortably covers its debt service obligations.

- Profitability and operating expenses: J&J’s operating margin at the end of 2025 remains high at 25.66%, while the net margin is 27.26%. In 2025, the company invested more than 32 billion USD in research and development, and in mergers and acquisitions, underscoring its focus on long-term growth despite pressure from generics on key drugs.

- Dividends and coverage: Johnson & Johnson continues its status as a dividend king. In Q4 2025, the company announced quarterly dividends of 1.30 USD per share. With adjusted annual earnings of 10.79 USD, dividends are fully covered by earnings and stable cash flow. It is projected that free cash flow will increase to 21 billion USD in 2026, providing additional capacity for increased dividend payments.

- Key business segments: in the Innovative Medicine segment, revenue in Q4 increased by 8.2% to 15.76 billion USD. The main growth drivers were oncology and immunology drugs such as Darzalex and Tremfya. At the same time, the decline in Stelara sales was offset by growth in other segments.

In MedTech, sales grew by 7.5% to 8.80 billion USD. Success was achieved in the electrophysiology and cardiovascular solutions segments. The company also announced plans to spin off its orthopaedic business into a separate entity by mid-2027.

Fundamental analysis of JNJ – conclusion

The company ended 2025 with strong financial results, surpassing market expectations for both revenue and profit. Johnson & Johnson is confidently addressing challenges, such as the loss of the Stelara patent, through new product launches and active investments in research and development. Exceptional liquidity and moderate debt enable the company to maintain financial stability and continue expanding through mergers and acquisitions, making it a reliable asset for dividend-focused investors.

Johnson & Johnson key valuation multiples analysis

Below are the key valuation multiples for Johnson & Johnson based on the Q1 2026 financial results, calculated with a share price of 340 USD:

| Multiple | What it indicates | Value | Comment |

|---|---|---|---|

| P/E (TTM) | Price paid for 1 USD of earnings over the past 12 months | 19.8 | ⬤ Moderate valuation for such a stable company. |

| P/S (TTM) | Price paid for 1 USD of annual revenue | 5.6 | ⬤ For a company of this size and with these margins, this valuation is normal. However, any slowdown in revenue growth may impact the stock price. |

| EV/Sales (TTM) | Enterprise value to sales, accounting for debt | 5.9 | ⬤ Considering the debt, the company is valued slightly above its annual revenue, which is reasonable for a stable business. |

| P/FCF (TTM) | Price paid for 1 USD of free cash flow | 26.9 | ⬤ The valuation for free cash flow is relatively high. |

| FCF Yield (TTM) | Free cash flow yield to shareholders | 3.7% | ⬤ Normal yield for a stable company. |

| EV/EBITDA (TTM) | Enterprise value to operating profit before depreciation and amortisation | 16.7 | ⬤ A moderately high valuation for a mature business. |

| EV/EBIT (TTM) | Enterprise value to operating profit | 20.6 | ⬤ For the short term, any signal of growth slowdown or margin changes may impact the stock price. |

| P/B | Price to book value | 6.7 | ⬤ Growth expectations are built into the valuation, and weak results could exert pressure on the stock. |

| Net Debt/EBITDA | Debt burden relative to EBITDA | 0.83 | ⬤ The debt burden is moderate, providing the company with sufficient flexibility for financial manoeuvres. |

| Interest Coverage (TTM) | Ability to cover interest expenses with operating profit | 18 | ⬤ Excellent interest coverage. This provides the company with good protection against rising rates or adverse economic conditions. |

Johnson & Johnson’s valuation multiples analysis – conclusion

Johnson & Johnson continues to deliver excellent results, with strong revenue, profit, and free cash flow figures, while maintaining a low debt burden. For the medium-term investor, the company’s shares appear moderately expensive, implying minimal margin of safety. The main risk is a slowdown in growth, which could trigger a price correction. If the company continues to deliver stable growth and cash flow, the current price remains justified. However, if performance weakens, the high valuation could lead to a significant drop in share prices.

Ultimately, it is essential to closely monitor the company’s quarterly reports and new forecasts, as any setbacks in margin or revenue could have a significant impact on the stock price.

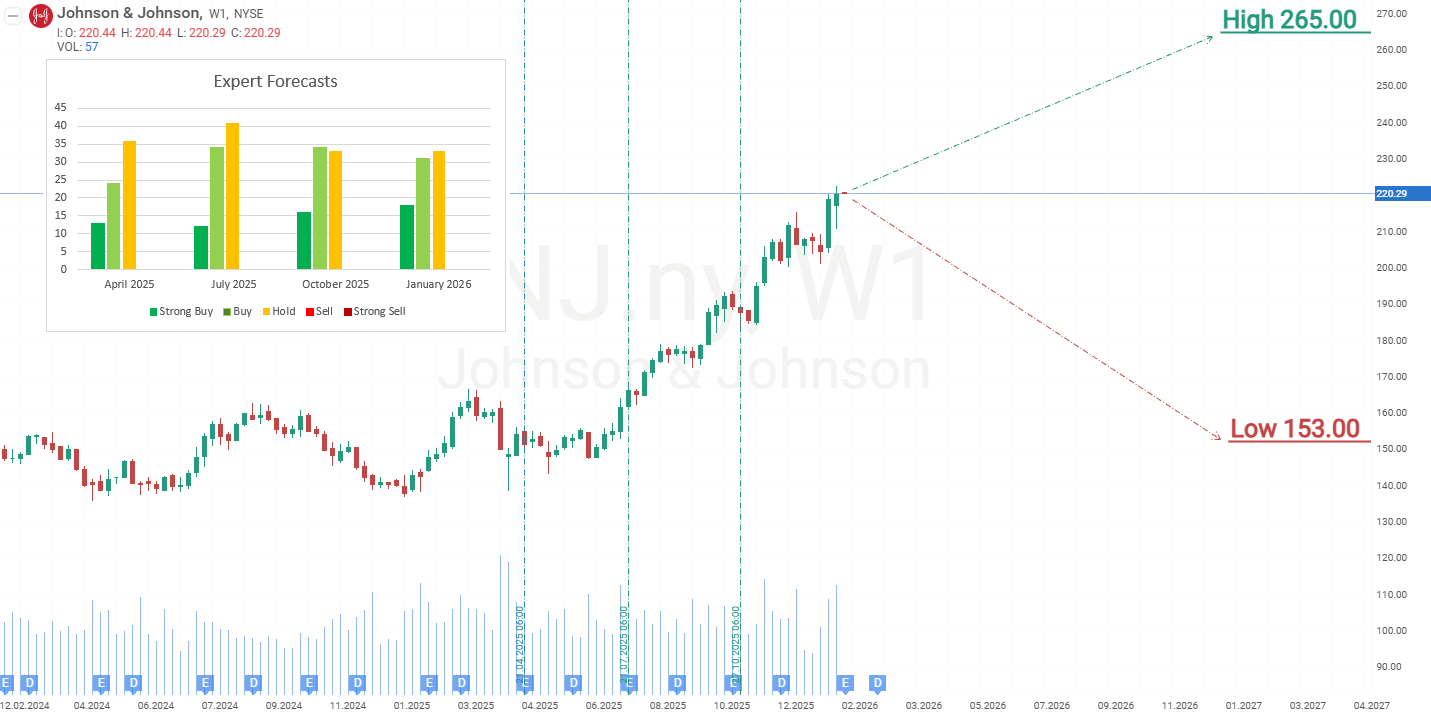

Expert forecasts for Johnson & Johnson stock for 2026

- Barchart: 13 out of 26 analysts rated Johnson & Johnson shares as Strong Buy, 2 as Buy, and 11 as Hold. The upper price target is 265 USD, and the lower bound is 165 USD.

- MarketBeat: 17 out of 26 analysts gave the shares a Buy rating, and 9 recommended Hold. The upper price target is 265 USD, and the lower bound is 190 USD.

- TipRanks: 8 out of 13 professionals recommended Buy, and 5 recommended Hold. The upper price target is 265 USD, and the lower bound is 200 USD.

- Stock Analysis: 5 out of 17 experts rated the shares as Strong Buy, 4 as Buy, and 8 as Hold. The upper price target is 265 USD, and the lower bound is 153 USD.

None of the analysts recommended selling Johnson & Johnson shares.

Expert forecasts for Johnson & Johnson shares for 2026Johnson & Johnson stock price forecast for 2026

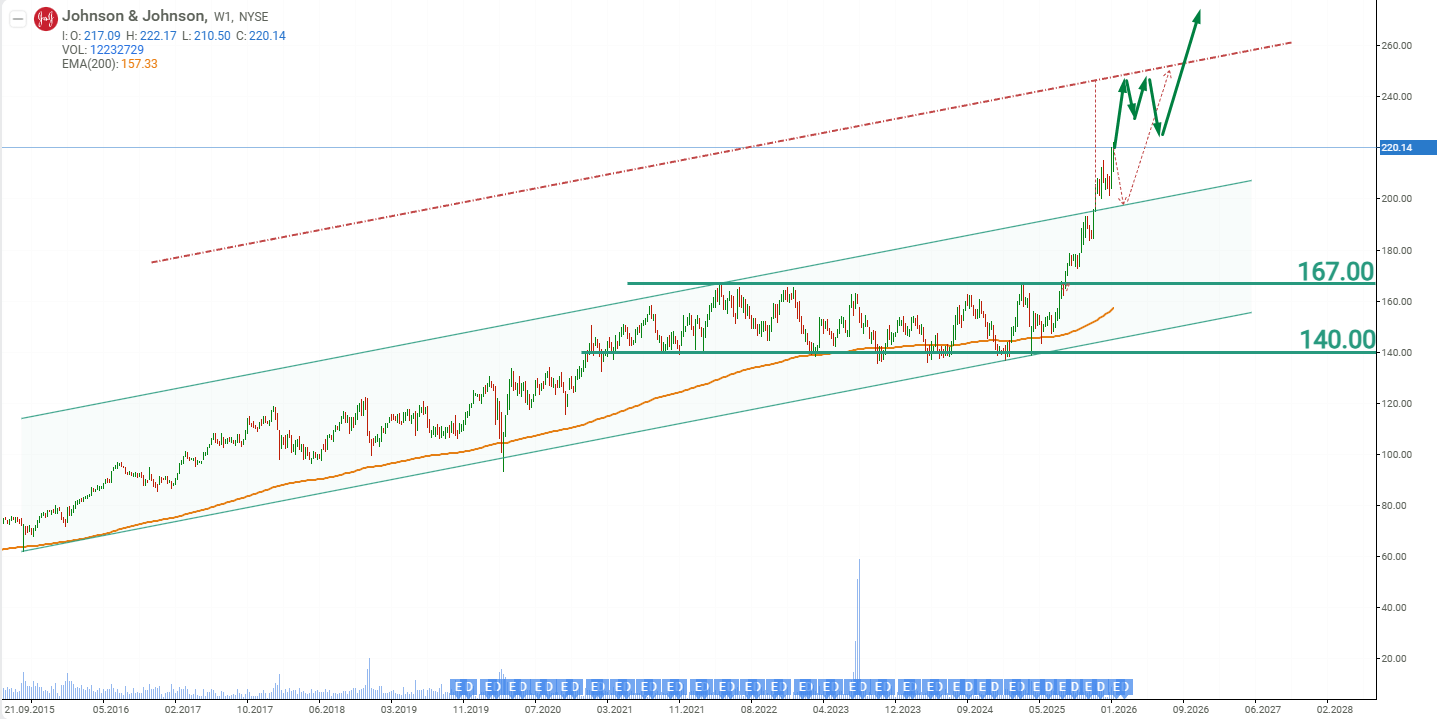

In August 2025, Johnson & Johnson shares broke through resistance at 167 USD, exiting the 140–167 USD trading range they had been in since 2021. This marked the start of a sustained upward trend, resulting in a 30% increase in JNJ’s share price by February 2026. The Q4 report showed that the company is maintaining its market position despite a decline in sales of the popular drug Stelara and the expiration of patents for others. This supports JNJ shares and contributes to their continued growth. Based on the current performance of Johnson & Johnson shares, the potential price scenarios for JNJ in 2026 are as follows:

The base-case forecast for Johnson & Johnson shares suggests further price growth to the 250 USD resistance level. After this, the shares may consolidate within a narrow range, as the price has been rising for five consecutive months without significant corrections. Following this consolidation, further price increases are anticipated.

The alternative forecast for Johnson & Johnson stock suggests a decline to support at 200 USD. At this level, a correction is expected to end, after which price growth would resume. The target level for growth would be the 250 USD resistance level.

Johnson & Johnson stock analysis and forecast for 2025Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.