Top 3 trade ideas for 2 September 2025

Trade ideas for EURGBP, USDCAD, and GBPUSD are available today. The ideas expire on 3 September 2025 at 8:00 AM (GMT +3).

EURGBP trade idea

The EURGBP rate remains in uncertainty, forming sideways consolidation on the intraday chart while actively testing resistance. Buying at current levels offers a poor risk-to-reward ratio. A breakout above the 0.8675 resistance level would confirm a bullish impulse, with an upside target at 0.8700. Today’s EURGBP trade idea suggests placing a pending Buy Limit order.

Market sentiment for EURGBP shows a bearish tilt – 62% vs 38%. The risk-to-reward ratio exceeds 1:3. Potential profit is 50 pips at the first take-profit target and 65 pips at the second, while possible losses are capped at 25 pips.

Trading plan

- Entry point: 0.8635

- Target 1: 0.8685

- Target 2: 0.8700

- Stop-Loss: 0.8610

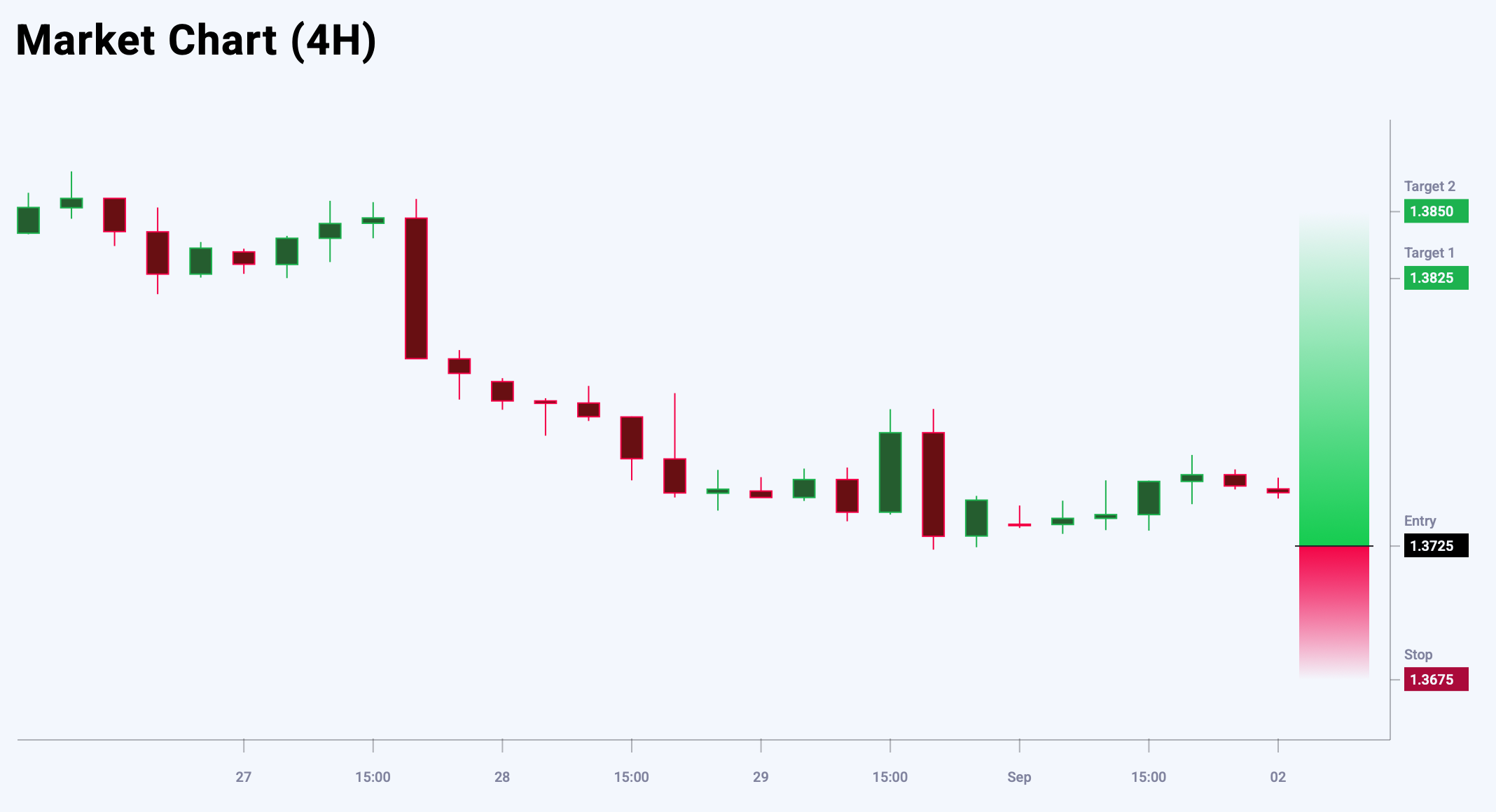

USDCAD trade idea

The USDCAD rate maintains its upward momentum with no clear signs of completion. A short-term correction may occur but will not break the overall bullish trend. A breakout above 1.3775 would confirm the strength of the bullish impulse, with an upside target at 1.3850. The short-term RSI shows a positive signal, supporting further gains. Today’s USDCAD trade idea suggests placing a pending Buy Limit order.

Market sentiment for USDCAD shows a bearish bias – 54% vs 46%. The risk-to-reward ratio exceeds 1:2. Potential profit is 100 pips at the first take-profit target and 125 pips at the second, with possible losses limited to 50 pips.

Trading plan

- Entry point: 1.3725

- Target 1: 1.3825

- Target 2: 1.3850

- Stop-Loss: 1.3675

GBPUSD trade idea

The GBPUSD rate shows signs of forming a top, with a potential minor bearish correction. The short-term outlook remains moderately bullish, so buying on pullbacks with a tight stop appears justified in expectation of further growth. The support level lies at 1.3484. Today’s GBPUSD trade idea suggests placing a pending Buy Limit order.

Market sentiment for GBPUSD shows a strong bearish tilt – 75% vs 25%. The risk-to-reward ratio exceeds 1:7. Potential profit is 113 pips at the first take-profit target and 306 pips at the second, with possible losses capped at 40 pips.

Trading plan

- Entry point: 1.3484

- Target 1: 1.3597

- Target 2: 1.3790

- Stop-Loss: 1.3444

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.