Top 3 trade ideas for 10 February 2026

Trade ideas for EURUSD, XAUUSD, and USDJPY are available today. The ideas expire on 11 February 2026 at 9:00 AM (GMT +3).

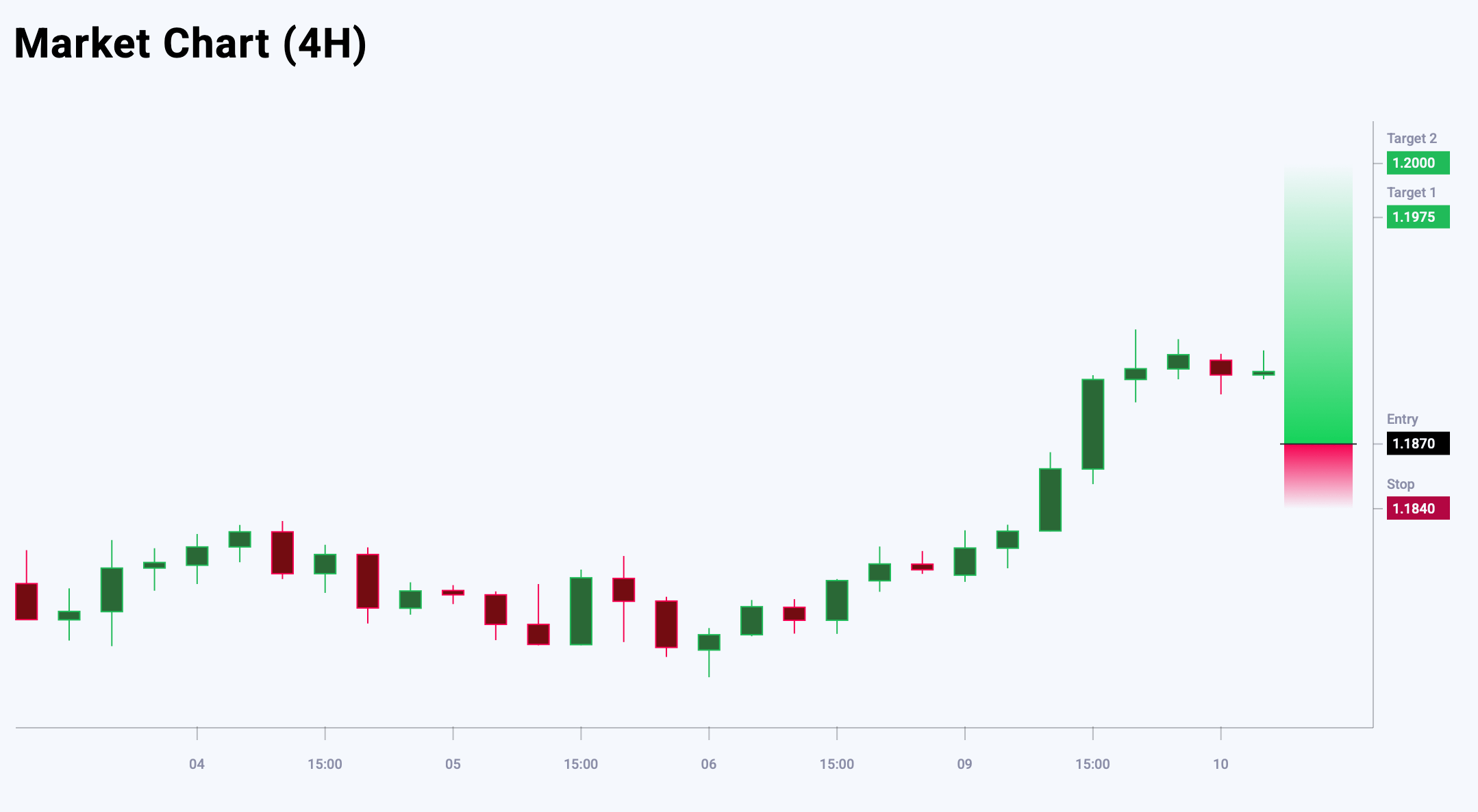

EURUSD trade idea

The primary trend for the EURUSD pair remains bullish, while the price is forming a potential bottom, creating conditions for buying interest. The key support level is located at 1.1870; however, the risk-to-reward ratio is unfavourable for opening long positions at current levels, making it preferable to wait for a corrective move. The preferred strategy is to buy on price declines. The EURUSD trade idea for today suggests placing a pending Buy Limit order.

Market sentiment for EURUSD shows a bullish bias – 53% versus 47%. The risk-to-reward ratio exceeds 1:4. The potential profit is 105 pips at the first take-profit level and 130 pips at the second, while possible losses are limited to 30 pips.

Trading plan

- Entry point: 1.1870

- Target 1: 1.1975

- Target 2: 1.2000

- Stop-Loss: 1.1840

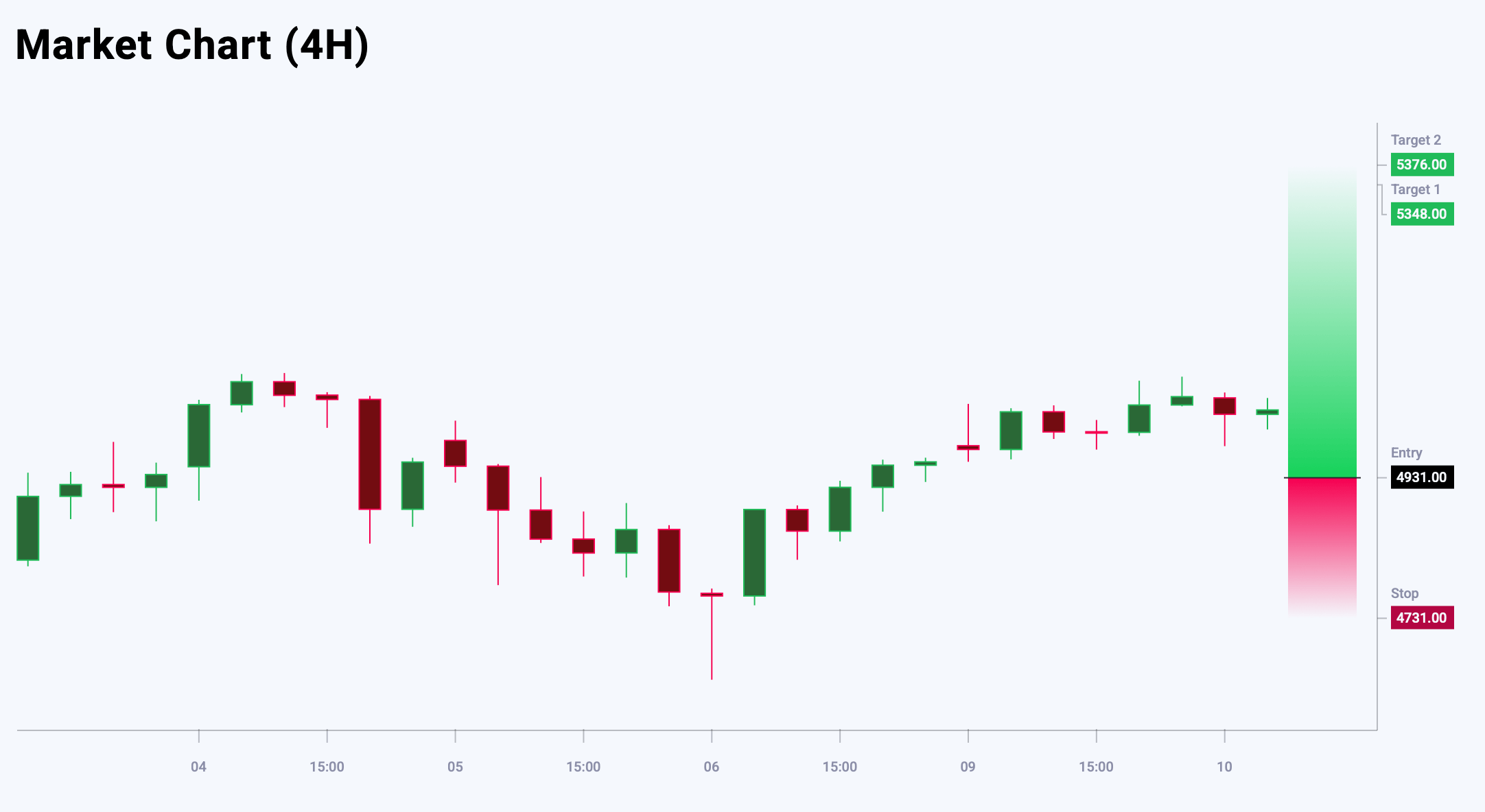

XAUUSD trade idea

XAUUSD is trading within a corrective channel, reflecting the current consolidation phase. The AB=CD pattern target is located at 5,376, while the 5,348 level represents a significant resistance zone. Moderate selling pressure may appear at the start of the session, although it is expected to remain limited. The key support level is located at 4,913. Overall, gold maintains upside potential with limited downside risk in the short term. The XAUUSD trade idea for today suggests placing a pending Buy Limit order.

For XAUUSD, bullish sentiment prevails at 51% versus 49%. The risk-to-reward ratio exceeds 1:2. The potential profit is 61,700 pips at the first take-profit level and 44,500 pips at the second, with possible losses capped at 20,000 pips.

Trading plan

- Entry point: 4,931.00

- Target 1: 5,548.00

- Target 2: 5,376.00

- Stop-Loss: 4,731.00

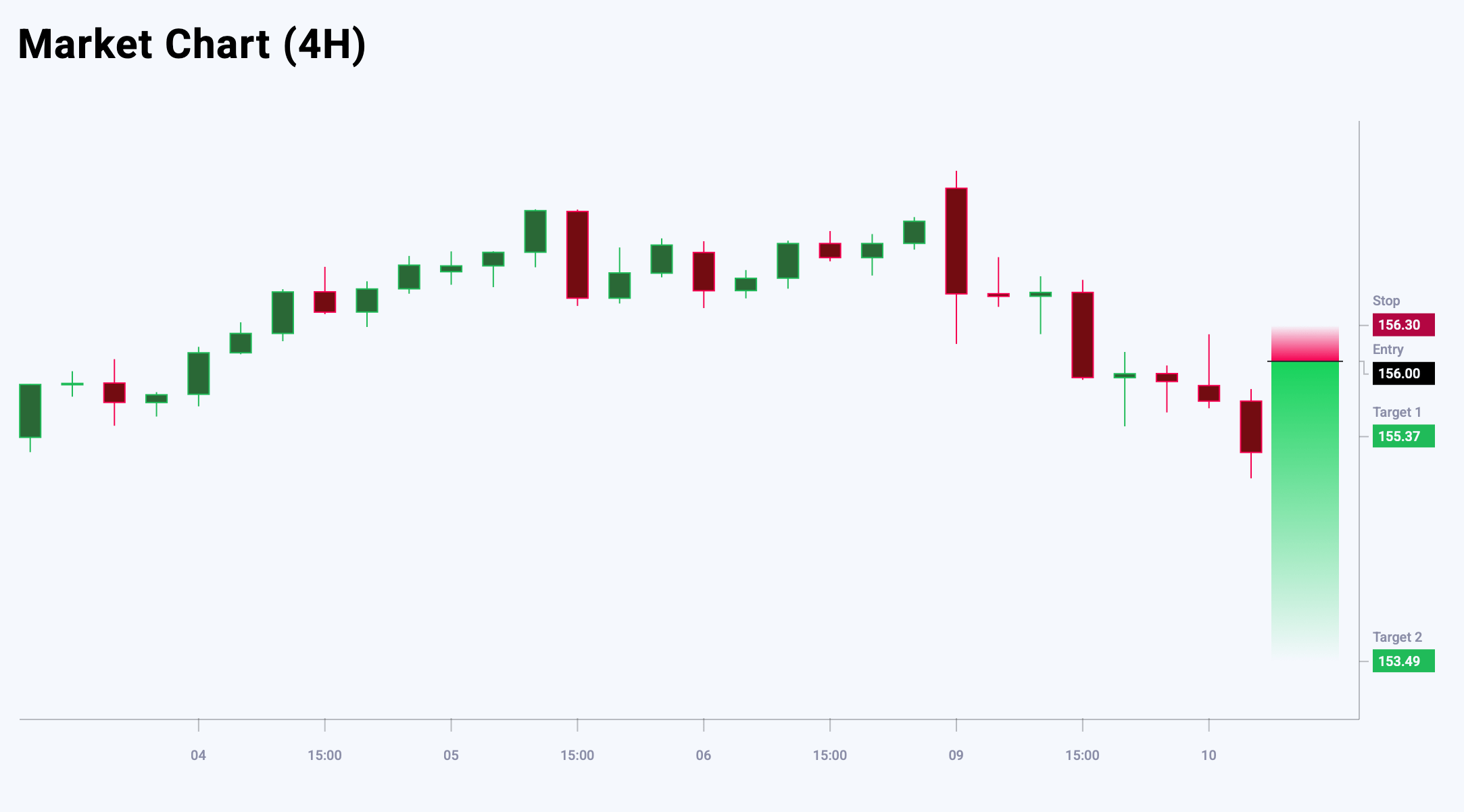

USDJPY trade idea

The USDJPY currency pair continued its downward movement from the 157.66 level, closing the previous session with losses. Selling activity intensified during the Asian session. The pair is currently trading within a range between the 155.37 support level and the 156.00 resistance level, with mixed and volatile price action expected to persist. The preferred strategy is to sell during a bullish correction. The USDJPY trade idea for today suggests placing a pending Sell Limit order.

Market sentiment for USDJPY indicates a bearish bias – 64% versus 36%. The risk-to-reward ratio exceeds 1:8. The potential profit is 63 pips at the first take-profit level and 251 pips at the second, with possible losses limited to 30 pips.

Trading plan

- Entry point: 156.00

- Target 1: 155.37

- Target 2: 153.49

- Stop-Loss: 156.30

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.