Brent gained support around 72.00 USD

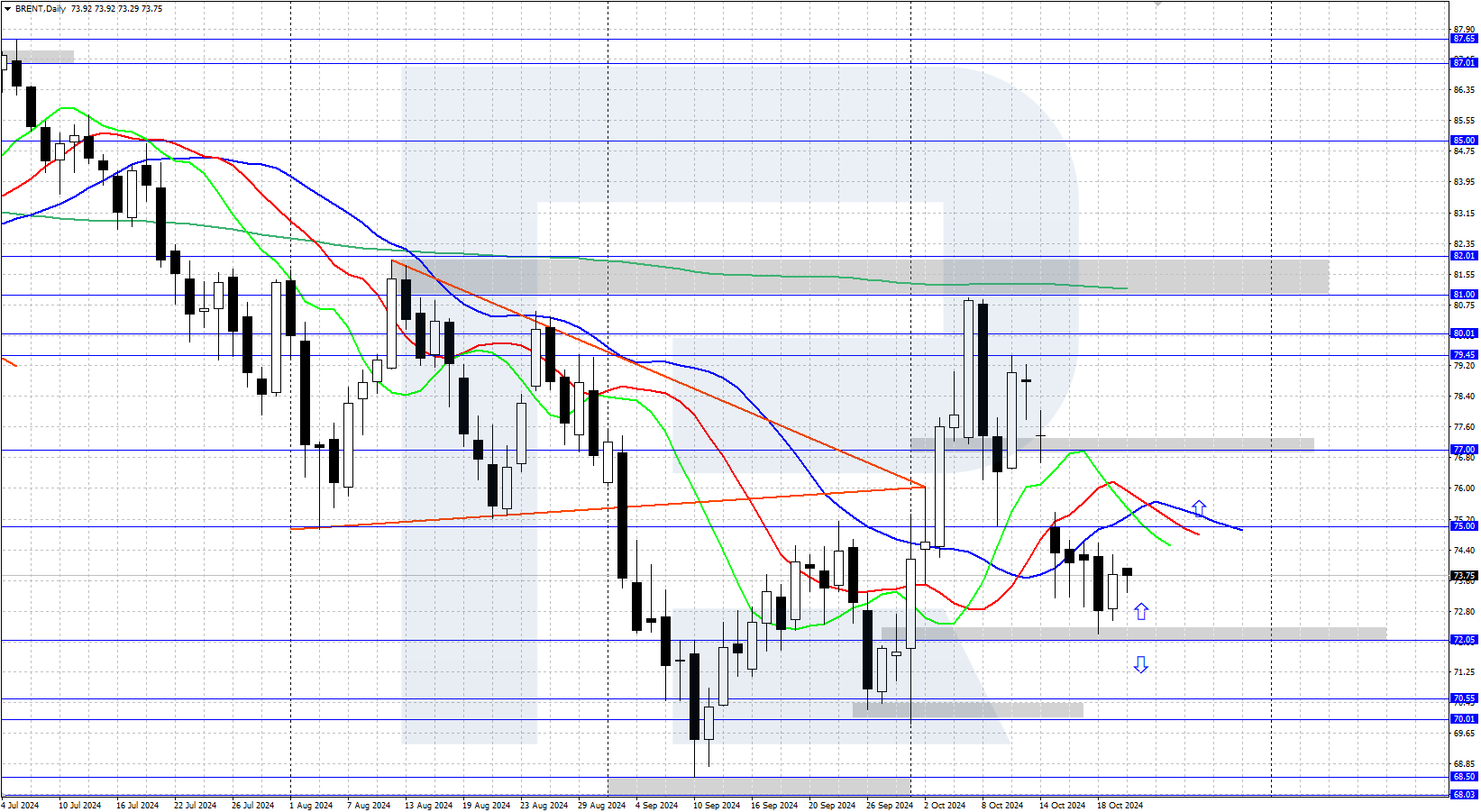

Brent prices fell by 7% last week amid the underwhelming OPEC report. The price found support at the 72.00 USD level and reversed upwards. More details in our Brent analysis for today, 22 October 2024.

Brent forecast: key trading points

- US data: the market awaits the API crude oil stock statistics

- Current trend: correcting as part of the uptrend

- Brent forecast for 22 October 2024: 72.00

Fundamental analysis

The OPEC report published last week showed a decrease in the forecast for global oil demand growth in 2024. Brent prices reacted negatively to the news, declining to the support area around 72.00 USD. Demand from buyers emerged there, and the prices are now attempting to reverse upwards.

Today, the American Petroleum Institute (API) will release US oil inventory statistics. A decrease in inventories may support Brent prices, while an increase will likely push the asset price down. The conflict in the Middle East remains an additional driver of oil price growth, with further escalation potentially providing upward momentum for the asset.

Brent technical analysis

Brent is currently trading around 74.00 USD; the asset price has halted its downward movement and reversed upwards from the support area around 72.00 USD. The situation remains uncertain, and further growth is only likely after the price holds above 75.00 USD.

The short-term Brent price forecast suggests that the decline could continue towards 70.00 USD if bears break through the 72.00 USD support level. If bulls take firm control and hold above 75.00 USD, prices could rise further to 77.00 USD.

Summary

Brent has halted its decline and reversed upwards after gaining support around 72.00 USD. Today’s US crude oil stock statistics from the American Petroleum Institute (API) may additionally impact oil price movements.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.