Brent prices stuck in a sideways range

Brent quotes show moderate growth, rising to the 63.00 USD area despite an increase in US crude oil inventories according to EIA data. Discover more in our analysis for 4 December 2025.

Brent forecast: key trading points

- Market focus: US crude oil inventories rose by 0.57 million barrels last week

- Current trend: moving within a sideways range

- Brent forecast for 4 December 2025: 65.00 or 61.00

Fundamental analysis

Brent prices climbed to 63.00 USD per barrel on Thursday, extending gains from the previous session. The move was supported by Ukrainian attacks on Russian oil infrastructure and stalled peace negotiations, which reduced expectations of a recovery in Russian supply.

The US has also increased threats against Venezuela’s oil sector, adding to the geopolitical risk premium. However, crude prices remain capped by weak demand and potential oversupply. This is confirmed by EIA data showing a 0.57 million barrel increase in US crude inventories last week, along with rising gasoline and distillate stocks.

Brent technical analysis

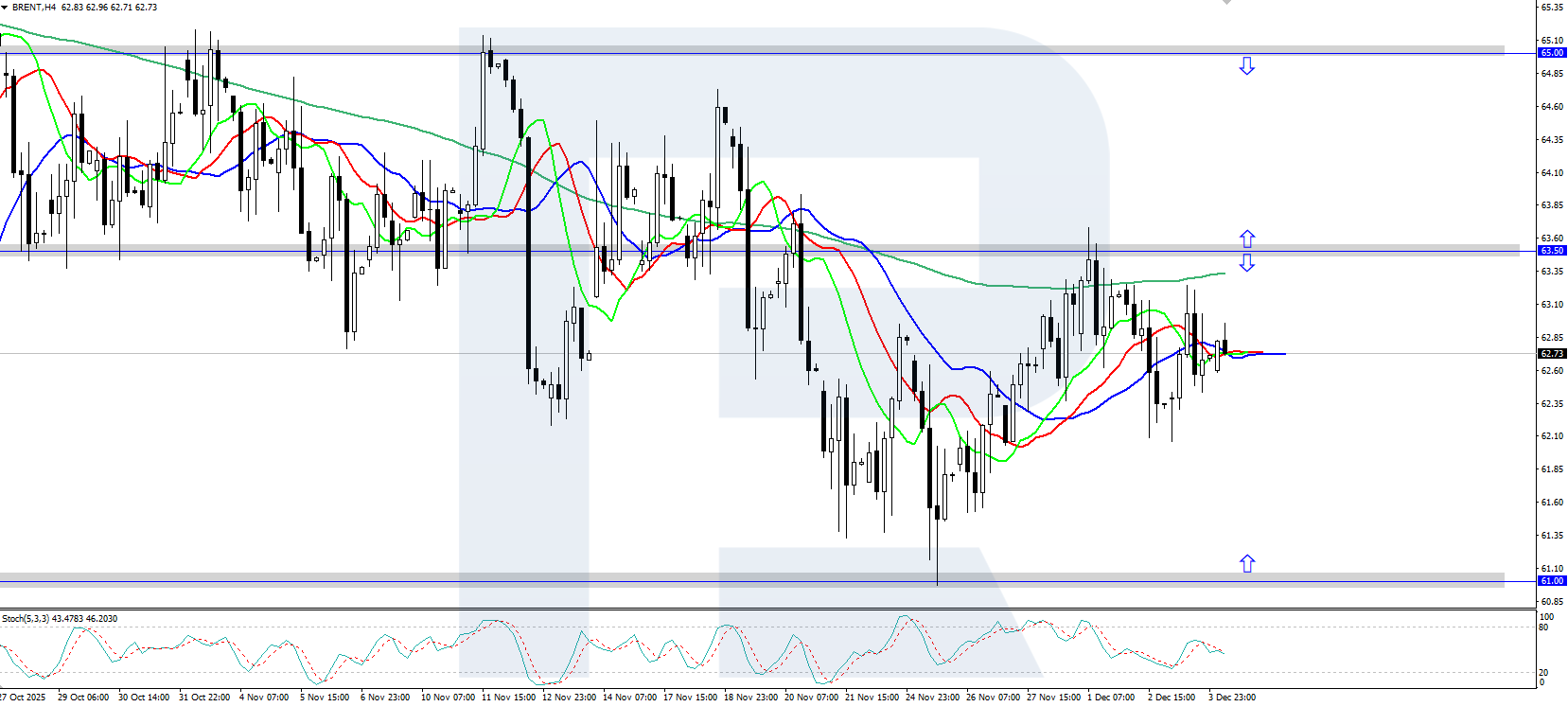

On the H4 chart, Brent is trending upwards within a broad sideways range of 61.00–65.00 USD. The Alligator indicator has turned upwards, signalling that the bullish movement may continue.

The short-term Brent forecast suggests a rise towards 65.00 USD if buyers gain a foothold above 63.50 USD. Conversely, if sellers reverse prices downwards, a correction towards the 61.00 USD support level is possible.

Summary

Brent prices show moderate growth, rising to the 63.00 USD area. According to the latest EIA report, US crude oil inventories increased by 0.57 million barrels last week.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.