Brent: prices fall to support at 60.00 USD

Brent prices have dropped toward the 60.00 USD area amid peace talks on Ukraine and concerns over excess oil supply in global markets. Details — in our analysis for 16 December 2025.

Brent forecast: key trading points

- Market focus: today the market awaits US employment data for November

- Current trend: a downward move is observed

- Brent forecast for 16 December 2025: 58.50 or 64.00

Fundamental analysis

Brent prices are declining, falling toward the psychologically important 60.00 USD level, supported by renewed negotiations over a potential peace agreement between Russia and Ukraine.

On Monday, US officials signaled that an agreement between Russia and Ukraine is closer than ever, as Washington has agreed to provide security guarantees to Kyiv, although territorial issues remain unresolved.

A peace agreement could pave the way for the lifting of US sanctions on Russian oil, potentially injecting additional supply into the market.

It is forecast that the oil market will remain oversupplied this year and next, as OPEC+ producers have restored previously suspended output, while non-OPEC producers — particularly in North and South America — are also increasing production.

Brent technical analysis

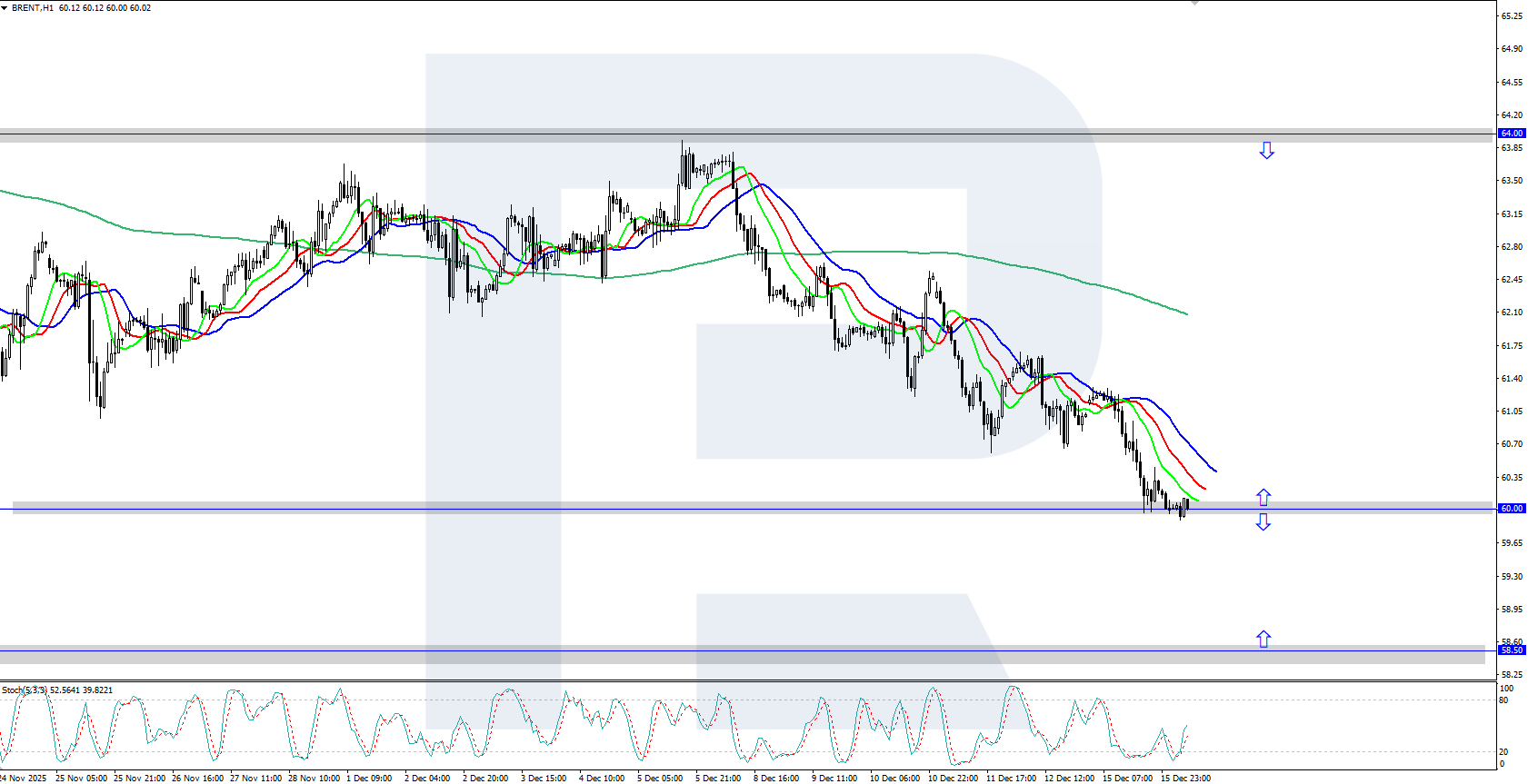

On the H4 chart, Brent shows a decline within a bearish impulse. The Alligator indicator is pointing downward, suggesting that the downward movement may continue. The key support level capable of halting the decline is currently located at 60.00 USD.

Within the short-term Brent price forecast, it can be assumed that if bulls manage to hold prices above 60.00 USD, a rebound toward the 64.00 USD level may follow. If bears manage to confidently push prices below 60.00 USD, further decline toward the 58.50 USD support becomes possible.

Summary

Brent crude oil continues to decline, falling toward the 60.00 USD support level. Today, market participants’ attention will be focused on US employment statistics.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.