Year-end rally or another decline: what lies ahead for Brent?

After another decline, Brent prices are recovering and trading near 59.80 USD per barrel. Details — in our analysis for 18 December 2025.

Brent forecast: key trading points

- U.S. Consumer Price Index (CPI): previous value – 3.0%, forecast – 3.1%

- U.S. Initial Jobless Claims: previous value – 236K, forecast – 224K

- Brent forecast for 18 December 2025: 58.60 and 61.30

Fundamental analysis

The fundamental analysis of Brent for today, 20 November 2025, takes into account that Brent prices are forming a corrective wave and are trading near the 59.80 USD per barrel level.

Potential triggers for changes in Brent prices under current conditions include:

- The U.S. is strengthening sanctions and the blockade of oil tankers from Venezuela. Against this backdrop, concerns over reduced oil supplies are emerging, which supports Brent prices.

- Positive prospects regarding a possible peace agreement between Russia and Ukraine may ease price pressure, as expectations of lifting restrictions on Russian oil exports increase potential supply.

- Weak economic data, including from the U.S., China, and other major energy consumers, may reduce demand, keeping prices under pressure.

- Weekly global oil inventory reports reflect actual changes in available supply, which may increase volatility in Brent prices.

- A weaker USD increases oil affordability for other countries.

The Brent forecast for 18 December 2025 considers that, following the systematic decline since 25 October 2025, prices may form a year-end rally and recover part of the losses.

Brent technical analysis

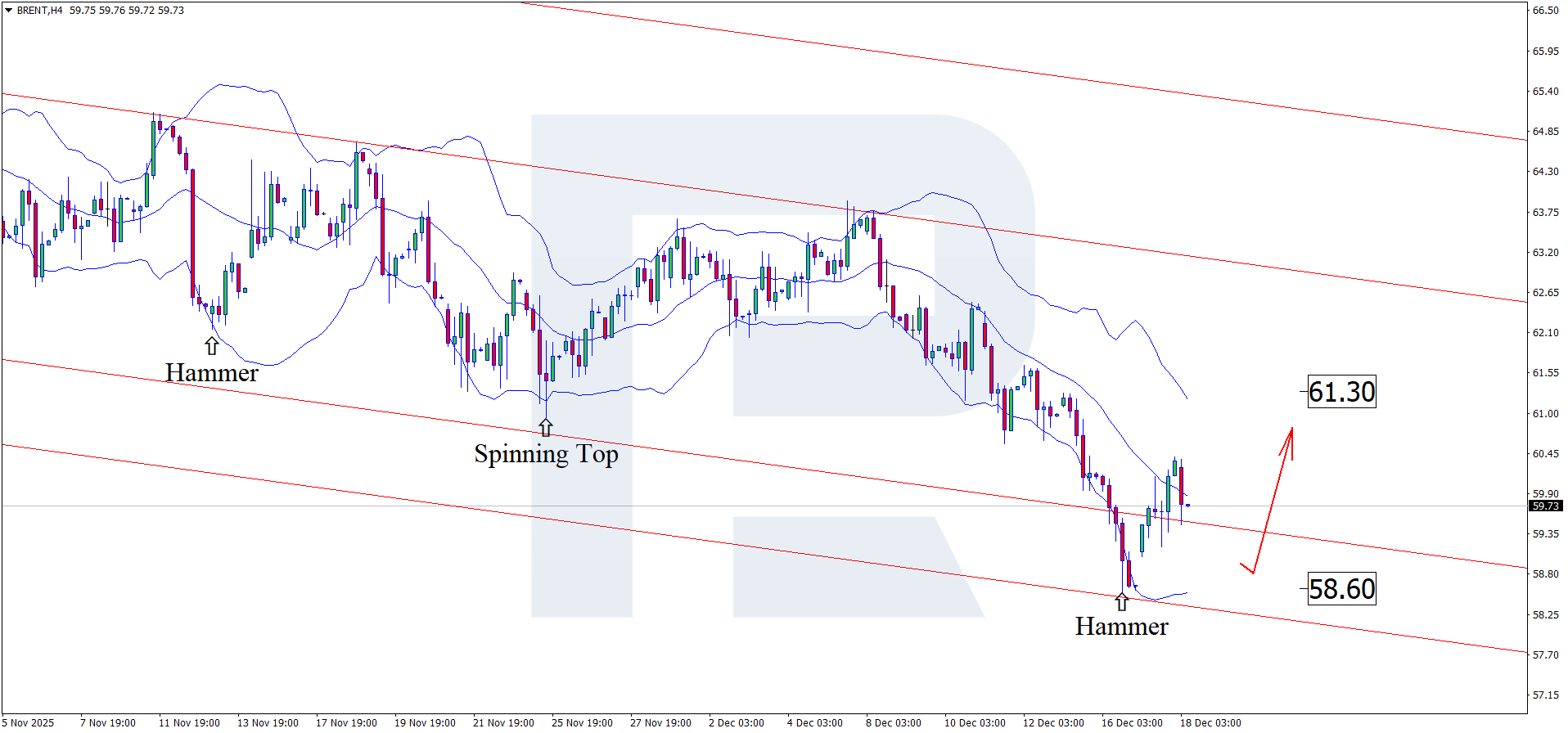

On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. At this stage, the market is working off this signal through a recovery wave.

The Brent price forecast for 18 December 2025 identifies the 61.30 USD level as the primary upside target. A breakout above this resistance would open the way for a stronger upward wave.

At the same time, an alternative scenario should not be ruled out, in which Brent prices may resume the downward trend, with the downside target at 58.60 USD.

Summary

A weaker USD amid recent economic data may create conditions for a rebound in Brent prices. Today’s Brent technical analysis suggests considering a potential move toward the 61.30 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.