Brent reacts to Donald Trump’s statements on Venezuelan tankers

Brent crude oil prices are declining after testing resistance and amid ongoing geopolitical uncertainty. The current price is 61.35 USD. Details — in our analysis for 23 December 2025.

Brent forecast: key takeaways

- Donald Trump stated that efforts are underway to seize a third Venezuelan oil tanker

- The number of active U.S. oil rigs fell by eight over the week to 406 units

- The U.S. rig count is at its lowest level since September 2021

- Brent forecast for 23 December 2025: 58.55

Fundamental analysis

Brent crude prices are declining after rising over the previous two trading sessions. Near the 61.55 USD level, buyers encountered notable resistance, which limited the further development of the upward move. At the same time, the market continues to factor in risks related to the stability of oil supplies from Venezuela.

Donald Trump stated that U.S. authorities are seeking to seize a third oil tanker off the coast of Venezuela and intend to retain both the transported oil and previously confiscated vessels. These remarks have increased the level of uncertainty in the market.

Additional support for prices comes from developments in the U.S. oil production sector. According to Baker Hughes data, the number of active oil rigs fell by eight last week to 406 units. This is the lowest level since September 2021 and signals a potential reduction in supply over the medium term.

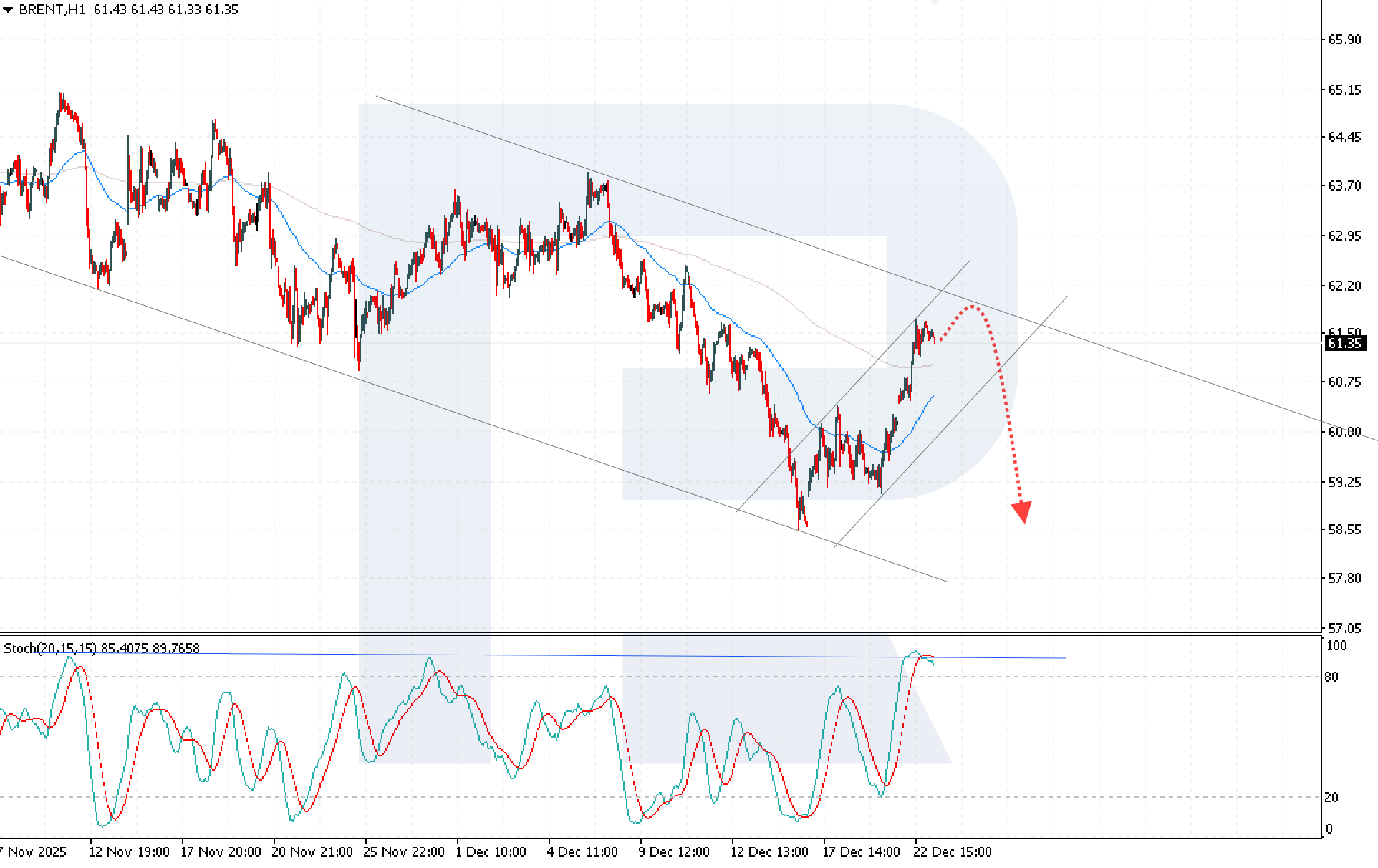

Brent technical analysis

Brent crude prices remain within a descending channel. After a local rebound, buyers faced resistance at 61.55 USD, which resulted in the formation of a corrective move. The price is once again approaching the upper boundary of the descending channel, where selling activity may intensify.

Today’s Brent forecast suggests a resumption of the decline toward the 58.55 USD level. An additional signal in favor of the bearish scenario would be a rebound from the upper boundary of the descending channel, which continues to act as key resistance. The Stochastic Oscillator also points to the likelihood of a correction, with its signal lines turning down from the overbought area.

A sustained move below the 60.00 USD level would confirm buyer weakness and the continuation of the downtrend.

Summary

Brent is facing resistance near the 61.55 USD level amid geopolitical risks and a decline in the number of U.S. oil rigs. Today’s Brent forecast suggests a test of the upper boundary of the descending channel followed by a decline toward 58.55 USD.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.