Profit taking vs weak USD: who will win the battle for Brent

Brent crude oil continues to strengthen. The current price is 61.30 USD. Details — in our analysis for 30 December 2025.

Brent forecast: key takeaways

- Year-end liquidity decline is providing support to Brent prices

- Markets are awaiting OPEC+ policy decisions in 2026

- Brent forecast for 30 December 2025: 62.40

Fundamental analysis

The fundamental outlook for Brent on 30 December 2025 suggests that prices are forming a corrective wave and are trading near 61.30 USD per barrel.

Potential triggers for changes in Brent prices under current conditions include:

- Low liquidity ahead of year-end. Most market participants have reduced trading activity, meaning even relatively small trading volumes or minor news can trigger disproportionately sharp price fluctuations in Brent.

- Profit taking after December price movements. Some participants are closing long positions ahead of reporting dates, creating risks of short-term price impulses without a change in the medium-term trend.

- Expectations regarding OPEC+ policy in 2026. The market is pricing in the possibility of an extension or adjustment of production limits, and any leaks or comments on this topic could be immediately reflected in prices.

- Weakness of the U.S. dollar. Pressure on the USD amid expectations of Fed policy easing increases the attractiveness of commodity assets, including oil, for holders of other currencies.

Toward year-end, Brent prices are once again forming a corrective wave amid a weaker USD and the broader global geopolitical environment.

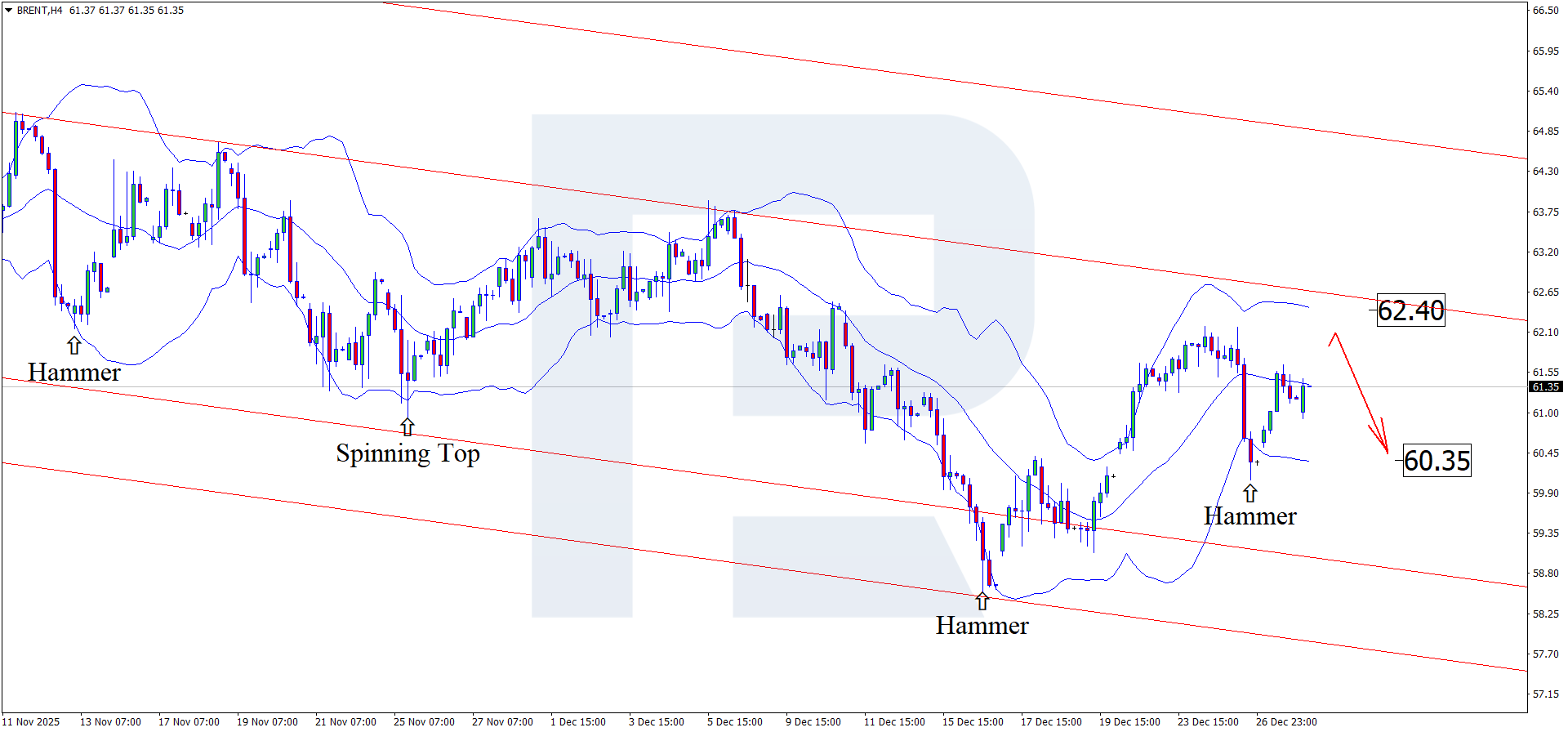

Brent technical analysis

On the H4 chart, Brent prices tested the lower Bollinger Band and formed a Hammer reversal pattern. At this stage, the market is working out the signal through an upward price wave.

The Brent price forecast for 30 December 2025 identifies 62.40 USD as the upside target. A breakout above this resistance level would open the way for a stronger upward move.

At the same time, an alternative scenario should not be ruled out, in which Brent prices resume a downward trend, with 60.35 USD acting as the downside target.

Summary

Oil prices continue to rise toward the end of 2025. Technical analysis of Brent for today suggests considering a continuation of the upward wave, with 62.40 USD as the target level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.