Brent benefits from overall market panic and rises

Brent crude oil prices are testing 64 USD per barrel. Buyers have found support in the Iranian factor. Discover more in our analysis for 13 January 2026.

Brent forecast: key takeaways

- Brent crude relies on new US measures against Iran

- Production problems in Kazakhstan and infrastructure damage in Russia act as bullish signals

- Brent forecast for 13 January 2026: 64.20

Fundamental analysis

Brent prices rose to 64 USD per barrel on Tuesday, reaching their highest level in more than a month. Price support came from new US trade measures against Iran.

On Monday, US President Donald Trump announced the introduction of 25% tariffs on goods from countries doing business with Iran. In this way, pressure on the country increased amid large-scale domestic protests. According to Trump, the measures take effect immediately, although details have not yet been disclosed.

Additional tension was created by Trump’s statements about the possibility of military action against Iran. This increased fears of oil supply disruptions – one of the key sources of global supply.

Supply risks have also intensified in other regions: production in Kazakhstan is suffering due to adverse weather conditions and scheduled maintenance, while damage to Russian infrastructure caused by drone attacks is adding further strain. This provides additional support to prices.

The Brent outlook is mixed.

Brent technical analysis

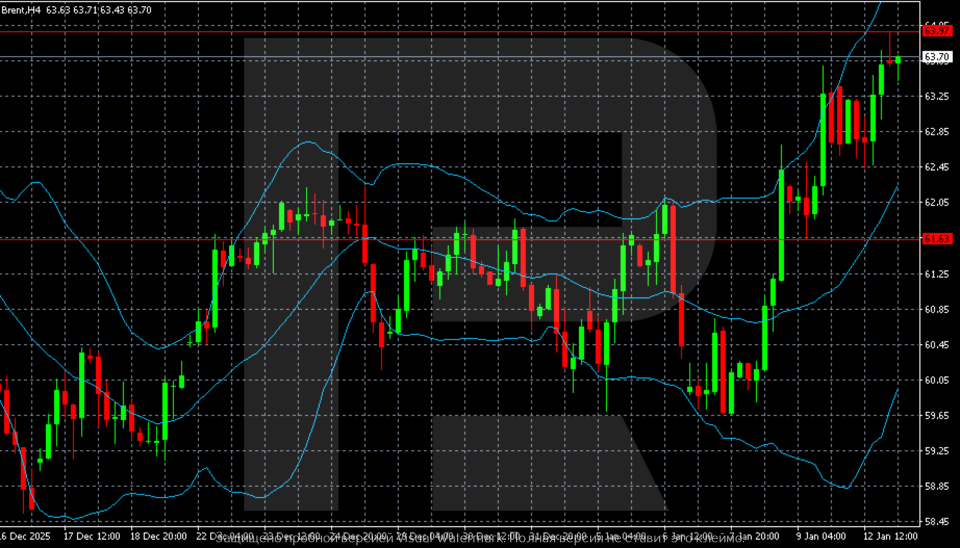

On the H4 chart, Brent is forming a stable upward movement. The price has confidently exited the late-December consolidation range and accelerated higher, hitting new local highs in the 63.70–64.00 area. The rally is accompanied by Bollinger Bands expansion, indicating rising volatility and an impulsive nature of the move.

The market structure changed in early January. After a series of lower lows, oil formed a reversal and shifted to a sequence of higher lows and higher highs. Recent candlesticks remain predominantly bullish, with prices holding in the upper part of the range, confirming buyers’ control. The 61.60 mark now acts as a key support level, having previously capped gains and being broken on strong momentum.

At the same time, trading near the upper Bollinger Band increases the risk of a short-term pause or correction. In the event of a pullback, the baseline scenario remains consolidation above 61.60–62.00 while maintaining the bullish structure. A confident consolidation above 64.00 would open the way for further upside, with the first target at 64.20. A return below the breakout zone would signal weakening momentum.

Summary

Brent crude is rising amid market turmoil, supported by signs of supply instability. The Brent forecast for today, 13 January 2026, does not rule out a move towards 64.20 if prices hold above 64.00.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.