Brent oil under pressure as Double Top forms

Brent crude prices are declining due to a combination of technical signals and weakening fundamental support factors. The current price is 64.48 USD. Find more details in our analysis for 27 January 2026.

Brent forecast: key takeaways

- Easing supply shortage risks have added pressure on Brent prices

- Weather conditions in the US led to temporary shutdowns of oil and gas production in several regions

- US oil production losses due to weather amounted to around 250 thousand barrels per day

- Brent forecast for 27 January 2026: 61.55

Fundamental analysis

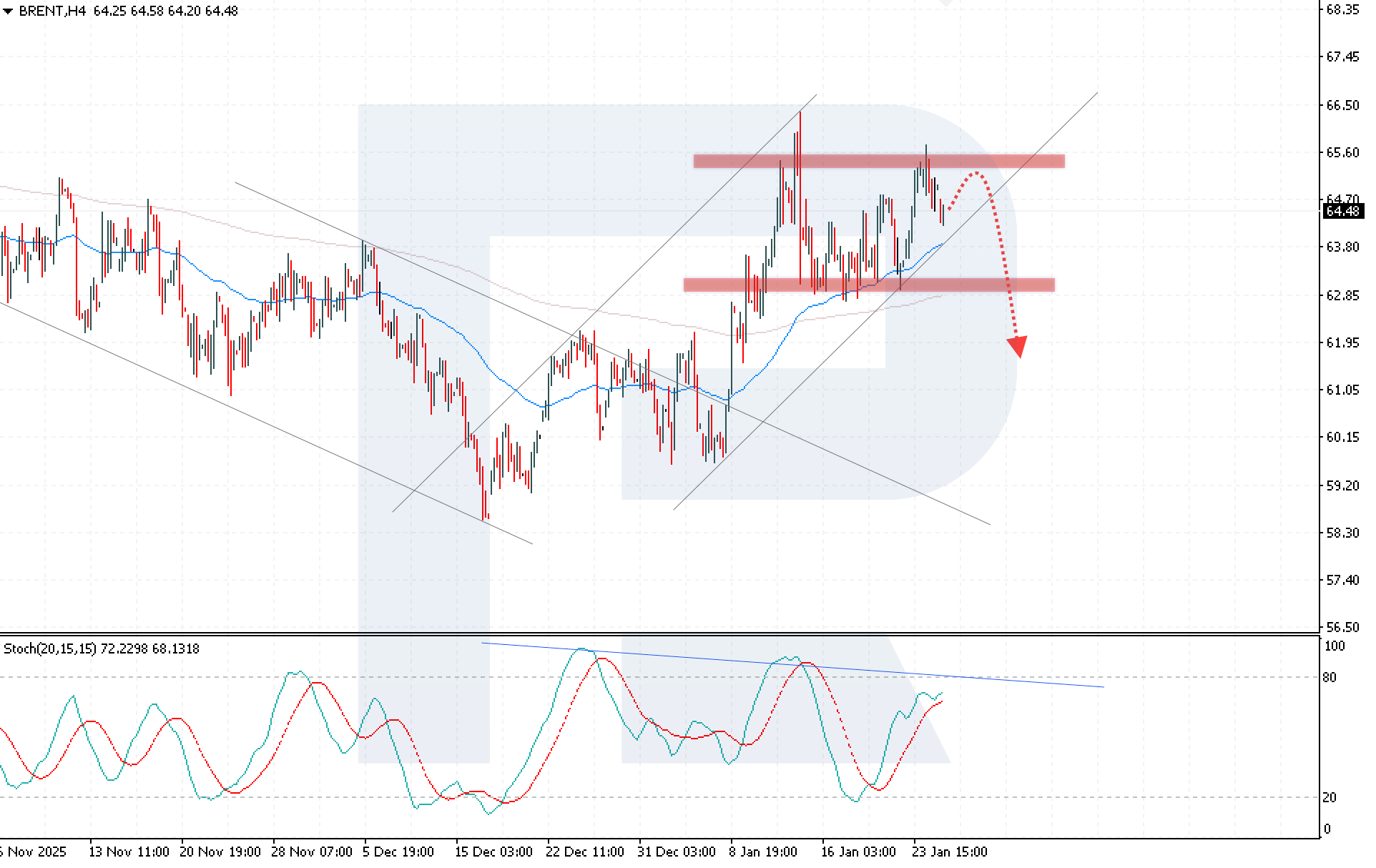

Brent crude prices are falling for the second consecutive trading session after a confident rebound from the key resistance level at 65.35 USD. Selling pressure remains in place, while the market continues to form conditions for completing a Double Top reversal pattern, increasing the risks of a deeper correction.

An additional negative factor for prices was the easing of supply disruptions from Kazakhstan. The resumption of operations at a key export terminal on the Black Sea reduced concerns about supply shortages and weakened support for prices.

The situation in the US remains in focus. Weather conditions have disrupted oil and gas production in several regions and caused outages at several refineries along the Gulf Coast. According to analysts, production losses due to the snowstorm reached around 250 thousand barrels per day. However, the impact of the weather factor is short-term and is unlikely to provide lasting support to the market.

Technical outlook

Brent prices are undergoing a correction after rebounding from the upper boundary of the Double Top reversal pattern. At the same time, prices remain above the EMA-65, indicating the continued presence of buyers and holding back a sharp decline.

The Brent forecast for today suggests another rebound from the resistance level and a decline towards the 61.55 USD level as the reversal pattern begins to play out. The Stochastic Oscillator further confirms the bearish scenario. Its signal lines are approaching a downward resistance line and may soon form a bearish crossover, increasing the likelihood of a deeper correction.

The key condition for a sustained bearish momentum will be consolidation below the 63.50 USD level. Such a signal would indicate a breakout below the lower boundary of the ascending channel and increase the likelihood of reaching the target level of 61.55 USD.

Brent overview

- Asset: Brent

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 65.35 and 66.50

- Key support levels: 63.80 and 62.85

Brent trading scenarios for today

Main scenario (Sell Limit)

A rebound of Brent prices from the resistance level near the upper boundary of the Double Top reversal pattern will indicate the completion of the upward correction and the start of the bearish scenario. Bearish signals from the Stochastic Oscillator increase the probability of a decline.

The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the take-profit level is around 355 pips, while potential losses are limited to 95 pips.

- Sell Limit: 65.10 USD

- Take Profit: 61.55 USD

- Stop Loss: 66.05 USD

Alternative scenario (Buy Stop)

Opening long positions should be considered if prices break above the 66.15 USD resistance level, as this would cancel the Double Top reversal pattern and signal continued bullish momentum.

- Take Profit: 68.05 USD

- Stop Loss: 64.50 USD

Risk factors

Risks to the downside scenario for Brent prices are associated with a possible intensification of the weather factor in the US, which could lead to more prolonged disruptions in oil production and refining and provide support to prices. A renewed escalation of logistical risks in the Black Sea region could further limit the decline.

Summary

Brent remains under pressure after failing to consolidate above 65.35 USD, while the recovery of supplies and the temporary nature of weather-related risks in the US increase the likelihood of a continued downward correction. Brent technical analysis indicates a high probability of a bearish correction towards 61.55, provided prices consolidate below the 63.50 level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.