Brent rally peaks as markets fear supply disruptions

Brent prices have approached 68.36 USD. There are too many risks in the news flow. Discover more in our analysis for 29 January 2026.

Brent forecast: key takeaways

- Oil prices are rising rapidly amid growing supply risks

- The market is closely watching the news, as the trend may change quickly

- Brent forecast for 29 January 2026: 69.00

Fundamental analysis

Brent crude oil surged to 68.36 USD per barrel on Thursday. The rally has continued for the third consecutive session, with prices reaching their highest levels since late September last year. The market received strong support from US statements regarding possible military action if nuclear negotiations with Iran fail. This has significantly increased concerns over potential supply disruptions.

US President Donald Trump stated that a large US naval task force in the region is ready to act quickly and decisively if necessary. These comments heightened fears of disruptions to oil exports from the Middle East, a region that accounts for roughly one-third of global oil supply.

An additional source of concern is Iran’s potential response, including threats to shipping through the Strait of Hormuz, a critical route for oil and LNG deliveries. Tehran has declared its willingness to engage in dialogue but warned of an unprecedented response in the event of provocations, while simultaneously stepping up diplomatic efforts across the region.

Oil prices are also supported by the weakening US dollar, which has fallen to its lowest levels in nearly four years, increasing the attractiveness of commodities denominated in the USD.

The outlook for Brent is mixed.

Technical outlook

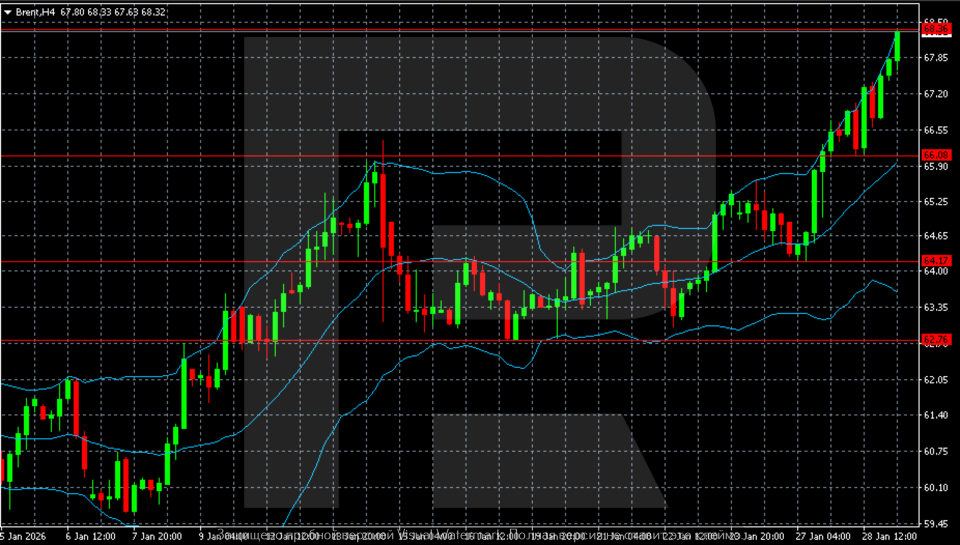

On the H4 timeframe, Brent remains in a stable uptrend. Prices continue to form higher lows and higher highs, indicating clear buyer dominance.

In early January, quotes reversed higher from the 60.00–60.50 area and, following a momentum-driven rally, consolidated above 62.75, which shifted from resistance to support. In the middle of the month, a correction unfolded towards the 64.00–64.20 zone, where the market again found demand and resumed its advance.

In the second half of the period, the bullish momentum intensified significantly, with Brent confidently breaking above the 66.08 level and continuing higher without a deep correction. Currently, prices are trading near 68.30–68.40, close to local highs.

Quotes remain above the middle Bollinger Band and, in recent sessions, have been moving along the upper band, confirming the strength of the trend and rising volatility.

The nearest resistance level is located in the 68.30–68.40 zone, while the support level lies at 66.10, followed by 64.15 and the key support area at 62.75. As long as prices remain above 66.10, the baseline scenario remains bullish.

Overall, the current dynamics resemble a trend-driven rally. A short-term pause or moderate correction is possible after the sharp advance, but there are no signs of a structural reversal on the H4 chart.

Brent overview

- Asset: Brent

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 68.40 and 69.00

- Key support levels: 66.10 and 64.15

Brent trading scenarios for today

Main scenario (Buy Stop)

Brent maintains strong upward momentum amid geopolitical risks and a weakening US dollar. Prices are holding above the key support level at 66.10 and moving along the upper Bollinger Band, indicating sustained bullish momentum.

A breakout and consolidation above the 68.30–68.40 zone would signal a continuation of the trend-driven rally, with the next target near 69.00. The lack of reversal signals on the H4 chart keeps the focus on buying opportunities.

The risk-to-reward ratio exceeds 1:2. Upside potential is limited by nearby resistance, but momentum remains strong.

- Buy Stop: 68.50 USD

- Take Profit: 69.00 USD

- Stop Loss: 66.90 USD

Alternative scenario (Sell Limit)

Short-term profit-taking after the sharp rally may trigger a moderate correction from the 68.30–68.40 area. If signs of weakening momentum appear, a pullback towards the nearest support level at 66.10 is possible, where demand was previously observed.

This scenario is considered purely corrective and does not invalidate the dominant bullish trend.

- Sell Limit: 68.35 USD

- Take Profit: 66.10 USD

- Stop Loss: 69.20 USD

Risk factors

The main source of uncertainty remains geopolitics. Any further escalation involving Iran, including threats to shipping through the Strait of Hormuz, could accelerate price growth and lead to a sharp breakout above resistance levels without corrections. Additional support may come from continued weakness in the US dollar.

Summary

Brent crude oil continues its rally amid rising geopolitical risks. The Brent forecast for today, 29 January 2026, suggests further growth towards 69.00.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.