Brent prices are heading higher: what comes next

Political and economic factors continue to push Brent prices higher, with quotes testing the 68.00 USD level. Discover more in our analysis for 5 February 2026.

Brent forecast: key takeaways

- Brent prices continue their upward trajectory

- The geopolitical environment supports further price growth

- Rising production in China could become an additional trigger for strengthening global oil prices

- Brent forecast for 5 February 2026: 70.20

Fundamental analysis

The Brent fundamental analysis for today, 5 February 2026, takes into account that Brent prices continue an upward wave, trading near 68.00 USD per barrel.

Key triggers that may influence Brent prices in the current environment include:

- Expected oil inventory data. The market will be focused on the weekly US crude oil inventory report, which may signal a supply deficit or surplus. A decline in inventories could support higher Brent prices

- OPEC+ decisions. The market is awaiting statements regarding potential changes to production quotas among OPEC+ member countries. If the cartel decides to extend or deepen production cuts, this could lead to another increase in prices

- Geopolitical risks continue to affect Brent quotes. Tensions in oil-exporting countries such as Libya or Iran could disrupt supplies, becoming an additional growth driver

- Economic data from China. China is one of the world’s largest oil consumers, and improving economic indicators or rising industrial output would boost demand and push Brent prices higher

- US dollar fluctuations. Since oil is priced in USD, changes in the dollar’s exchange rate can also impact Brent prices. A stronger dollar may pressure prices lower, and vice versa

Overall, the news backdrop remains positive for Brent crude, with global economic and geopolitical factors continuing to support upside potential for Brent prices.

Technical outlook

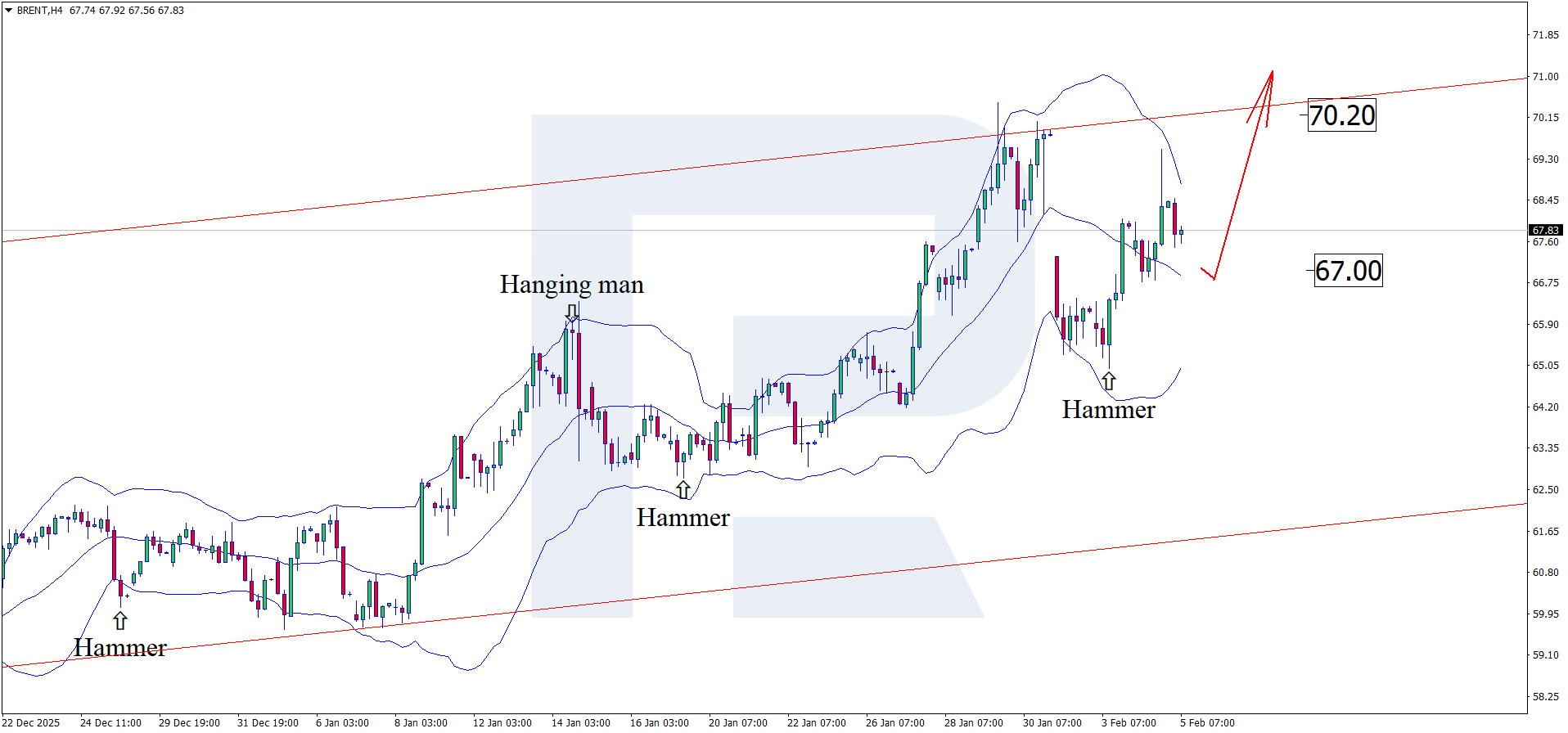

Having tested the lower Bollinger Band, the quotes formed a Hammer reversal pattern on the H4 chart. At this stage, they continue to follow this signal as an upward wave.

The Brent price forecast for 5 February 2026 suggests the 70.20 USD level as an upside target. A breakout above resistance would open the way for a more substantial upward movement.

At the same time, an alternative scenario is also possible, in which Brent quotes may form a corrective wave, with the downside target at 67.00 USD.

Brent overview

- Asset: Brent

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 68.50 and 70.20

- Key support levels: 65.50 and 64.40

Brent trading scenarios for today

Main scenario (Buy Stop)

Brent continues to develop a stable uptrend amid geopolitical risks and a weaker US dollar. After forming a correction, prices are attempting to regain ground.

A breakout and consolidation above the 68.40–68.50 zone will signal continued growth, with the next target at 70.20 USD. The absence of reversal signals on the H4 timeframe keeps buyers in control.

The risk-to-reward ratio exceeds 1:3. While the upside potential is limited by local resistance, momentum remains strong.

- Buy Stop: 68.50 USD

- Take Profit: 70.20 USD

- Stop Loss: 68.00 USD

Alternative scenario (Sell Limit)

Short-term profit-taking after a sharp rise could trigger a decline from the 65.30–65.20 area. If momentum weakens, a pullback towards the nearest support level at 64.40 and then 63.10 is possible.

This scenario is considered purely corrective and does not negate the dominant bullish trend.

- Sell Limit: 65.10 USD

- Take Profit: 63.10 USD

- Stop Loss: 65.60 USD

Risk factors

Geopolitics remains the main source of uncertainty. Any further escalation involving Iran, including threats to shipping through the Strait of Hormuz, could accelerate price growth and lead to a sharp breakout above resistance levels without corrections. Additional support for prices may come from further weakening of the US dollar.

Summary

Geopolitical risks remain the primary driver of Brent prices. Brent technical analysis for today suggests potential growth towards the 70.20 USD level after a correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.