Brent declined to 80.00, with the market focusing on EIA data today

Brent crude oil prices are declining for the fifth consecutive trading session. Read about it in the analysis for 24 July 2024.

Brent trading key points

- The market awaits EIA data: inventories are expected to have increased by 0.70 million barrels

- Brent forecast for 24 July 2024: 82.80 and 76/80

Fundamental analysis

Brent continues to fall as part of a downward correction, reaching 80.00. Today, market participants await the release of US oil stock data from the Energy Information Administration (EIA) during the American session. Inventories are projected to have risen by 0.70 million barrels. A significant divergence between the actual data and the forecast may drive further movement of Brent quotes.

US oil stock data from the American Petroleum Institute (API) was released yesterday. According to the statistics, US hydrocarbon reserves decreased by 3.90 million barrels last week, while the forecast suggested a decline of only 2.47 million. As a result, Brent prices received support and, halting their decline, stabilised around 80.00-81.00.

Brent technical analysis

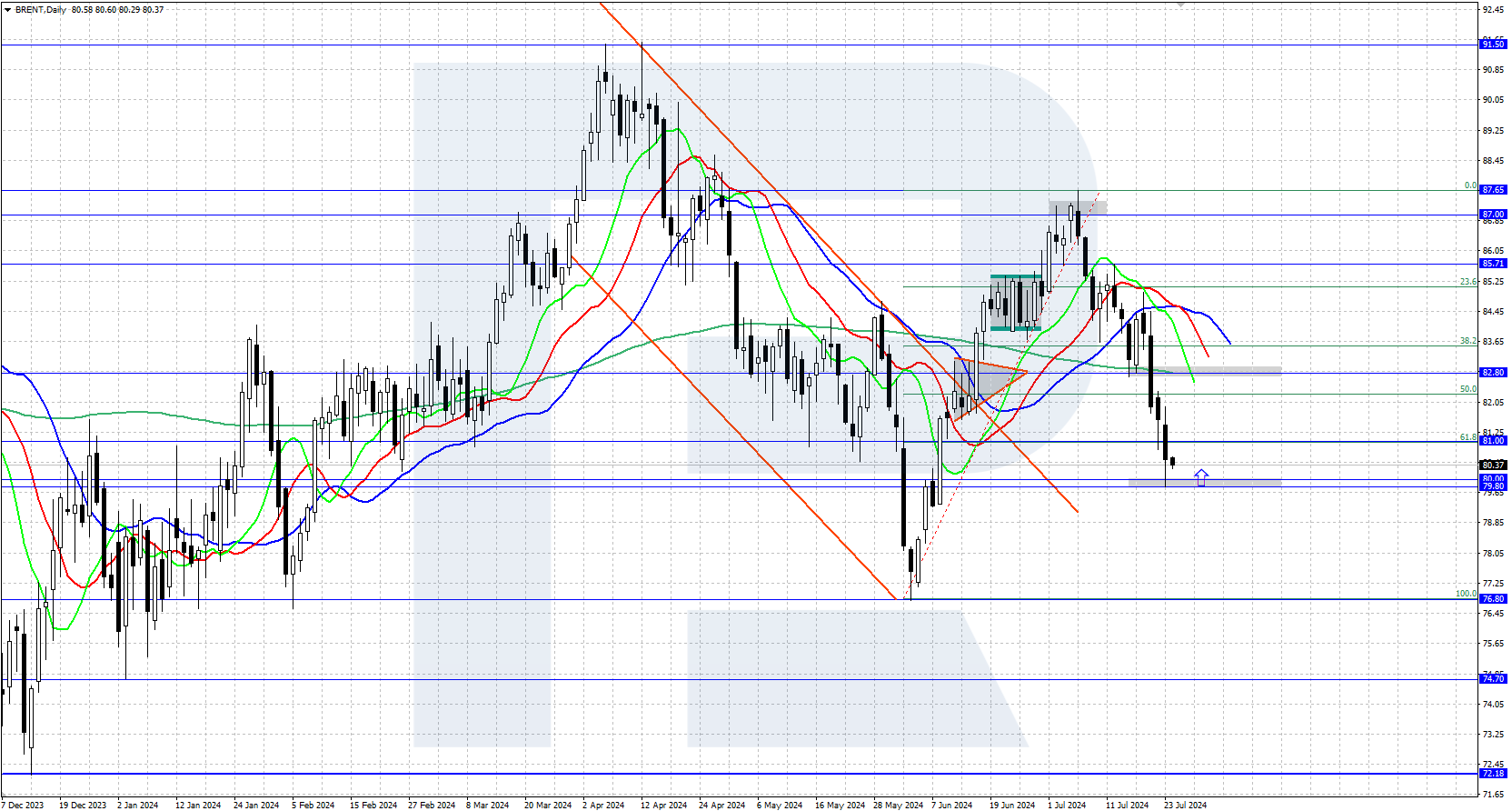

Brent is experiencing downward solid momentum on the daily chart. Bulls failed to seize the initiative near the 81.00 support level, which coincides with the 61.8% Fibonacci retracement level, resulting in the quotes falling to 80.00.

The 79.80-80.00 area currently serves as a crucial support level. If bears surpass this level and consolidate below it, this will open the way for a decline to a daily low of 76.80. If the bulls hold the 80.00 level and reverse the quotes upwards, the price could rise to the 82.80 resistance level.

Summary

Brent continues to decline within the current downward correction, reaching the 80.00 mark. Today, market participants will focus on US oil stock data from the EIA, which may drive further movement of oil prices.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.