Silver (XAGUSD) price rises, climbing above 31.00 USD

The XAGUSD price steadily rose after reversing from the support level near 30.00 USD. The trend is upward, and it is likely to continue. Our XAGUSD analysis for today, 17 October 2024, provides more details and insights.

XAGUSD forecast: key trading points

- Current trend: an uptrend is underway

- The market will focus on US retail sales data today

- XAGUSD forecast for 17 October 2024: 31.00 and 32.95

XAGUSD fundamental analysis

Industrial silver consumption is forecast to increase by 4% in 2024 to a record 690 million ounces, replicating last year’s performance. In line with the trend in recent years, the photoelectricity and automotive sectors remain the key growth drivers this year.

Following gold, silver also enjoys strong demand from investors. Its investment appeal is due to declining real yields on the US Treasuries and the gradually decreasing appeal of the US dollar amid the beginning of the US Fed’s monetary policy easing cycle.

XAGUSD technical analysis

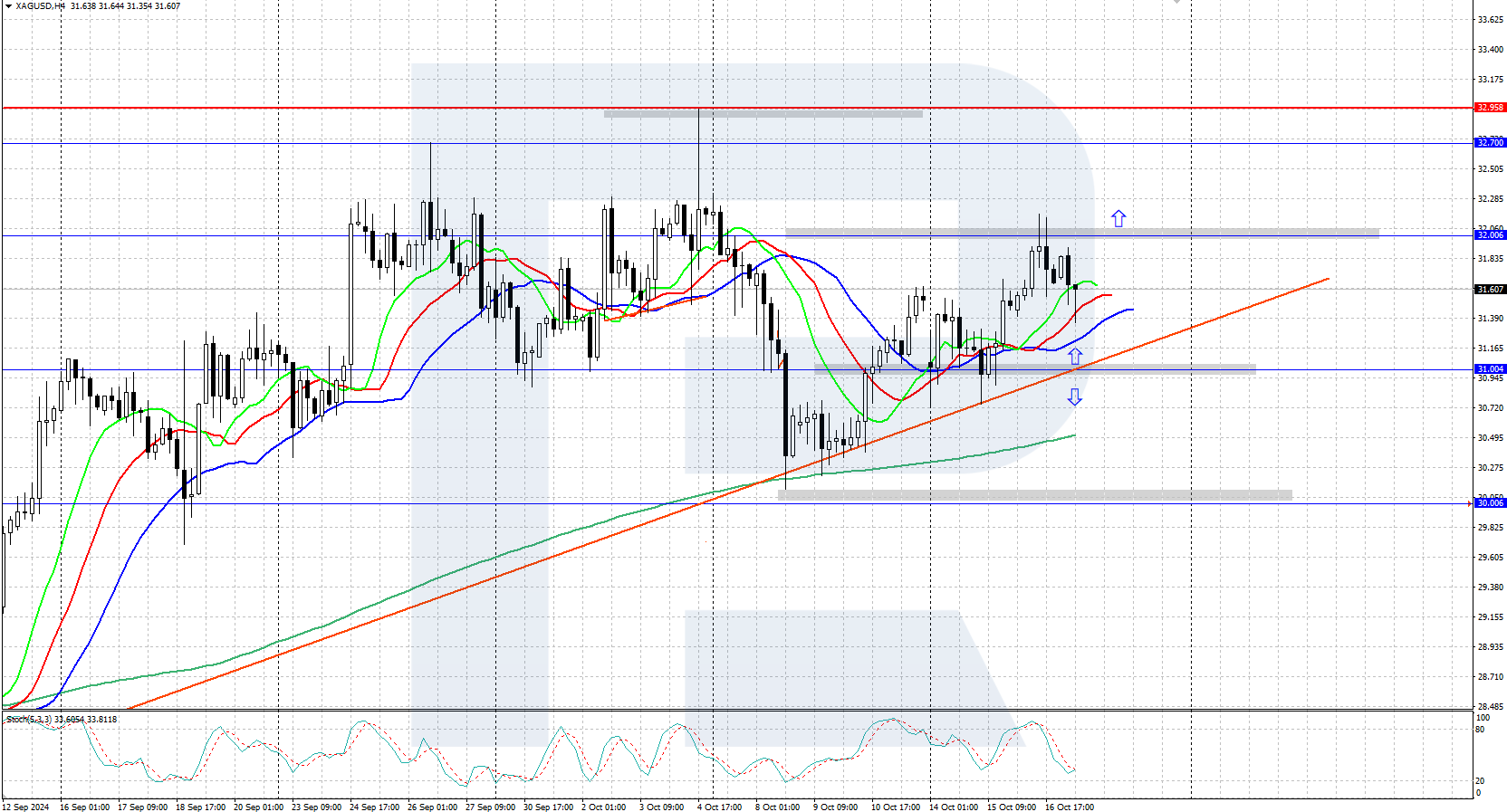

XAGUSD quotes continue to rise gradually after receiving strong support from buyers in the price area near 30.00 USD and reversing upwards. Market participants now focus on an annual high of 32.95 USD. If the price surpasses this level, there is potential for growth to 35.00 USD.

The short-term XAGUSD price forecast suggests that prices could rise further to the annual high of 32.95 USD if bulls hold the initiative and rise above 32.00 USD. If bears push the quotes below 31.00 USD, the decline could continue towards 30.00 USD.

Summary

Silver (XAGUSD) quotes continue ascending within the uptrend, potentially reaching an all-time high of 32.95 USD in the short term.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.