Silver (XAGUSD) prices correct downwards from the area around 35.00 USD

XAGUSD prices are undergoing a downward correction after failing to break above the 35.00 USD level. The trend remains upward, with growth likely to continue. Find out more in our XAGUSD analysis for today, 24 October 2024.

XAGUSD forecast: key trading points

- Silver hit a new annual high of 34.86 USD

- Current trend: correcting as part of the uptrend

- The market will focus on US data today – the Composite Purchasing Managers’ Index (PMI)

- XAGUSD forecast for 24 October 2024: 33.50 and 34.86

XAGUSD fundamental analysis

XAGUSD continues to trade in an uptrend, reaching another annual high of 34.86 USD. According to the latest forecasts, industrial silver consumption will rise by 4% this year, reaching a record 690 million ounces, with the photoelectricity and automotive sectors as key demand drivers.

Silver prices are additionally supported by steady growth in gold prices, which remain in demand from central banks and investors amid geopolitical instability and escalating tensions in the Middle East.

The anticipated Federal Reserve rate cut also makes XAGUSD more appealing to investors. The Fed is expected to lower the interest rate twice this year (by 0.25% each time), bringing it down to 4.5%.

XAGUSD technical analysis

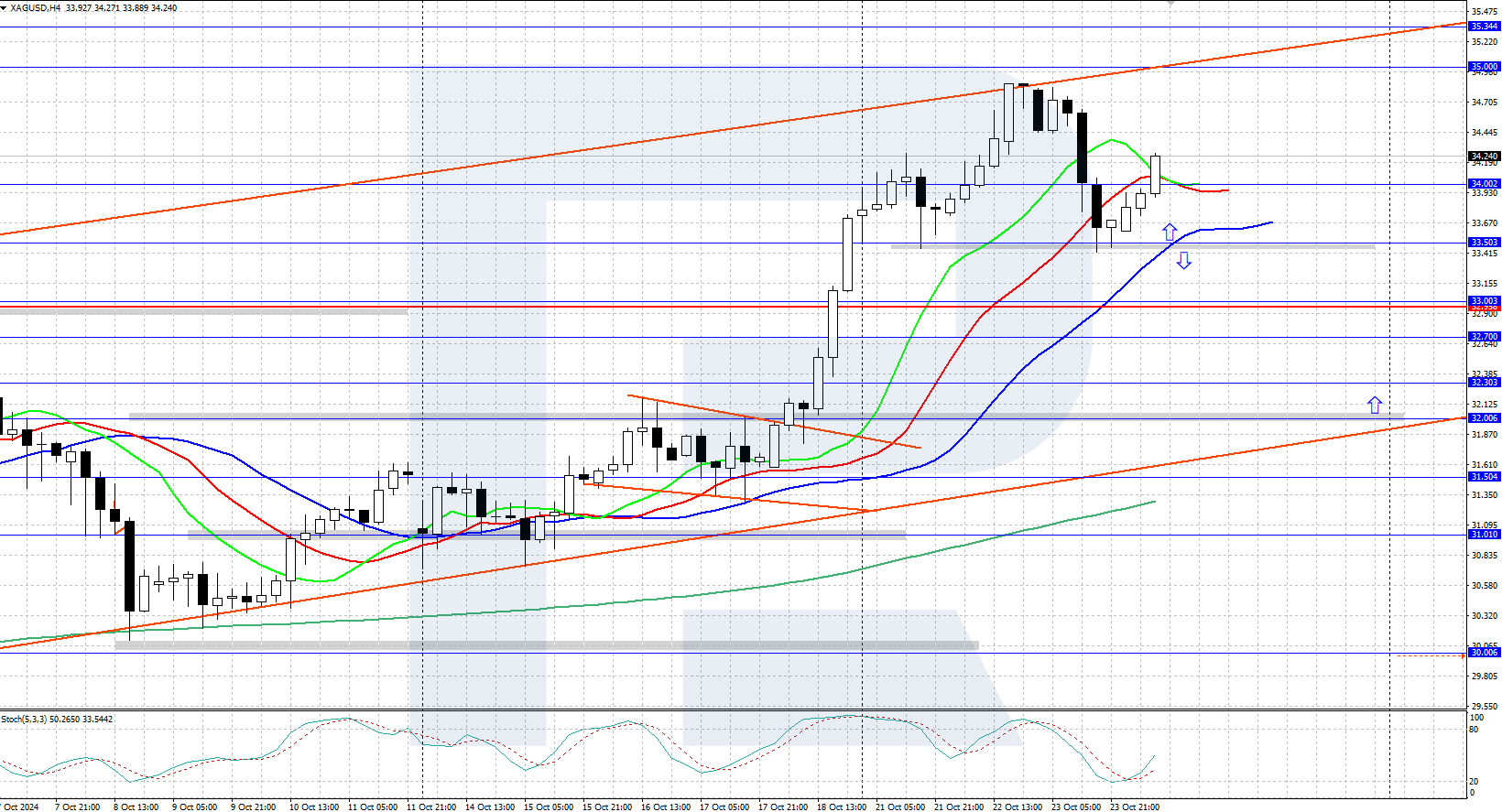

XAGUSD quotes are currently undergoing a downward correction on the H4 chart, rebounding from the upper boundary of the ascending price channel. The price hit a new annual high of 34.86 USD. Once the correction is complete, further growth to the area above 35.00 USD can be expected.

The short-term XAGUSD price forecast suggests that if bulls seize the initiative and gain a foothold above 34.00 USD, the price could rise further to the annual high of 34.86 USD. If bears push the quotes below the 33.50 USD support level, the decline could continue towards 32.00 USD.

Summary

Silver (XAGUSD) prices are correcting downwards after reaching another annual high of 34.86 USD. The pair may experience increased volatility today following the release of the US statistics, which will provide data on the S&P Global Composite Purchasing Managers’ Index (PMI).

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.