Gold (XAUUSD) is trading above 4,210 on expectations of a Fed rate cut

Gold (XAUUSD) prices are stable near 4,210, as investors show increased interest in the metal amid upcoming Fed rate decisions. Find more details in our analysis for 4 December 2025.

XAUUSD forecast: key trading points

- Market focus: gold (XAUUSD) remains firm on expectations of an imminent Federal Reserve rate cut

- Current trend: the market is concerned about slowing US employment

- XAUUSD forecast for 4 December 2025: 4,230

Fundamental analysis

Gold (XAUUSD) prices consolidated above 4,210 USD per troy ounce, staying close to a six-week high. Investors continue to increase bets on a Fed rate cut next week following weak ADP data for November.

Private-sector employment unexpectedly fell by 32 thousand, while markets expected a 10 thousand increase. This marks the third decline in four months and the sharpest slowdown in hiring since 2023. Investors have effectively received a clear signal of a cooling labour market.

The report aligned with dovish remarks from several Fed officials stressing the need to respond to weakening employment. Futures now price in nearly a 90% likelihood of a 25-basis-point rate cut. The market is also focused on delayed PCE data for September, scheduled for release on Friday. It may further refine expectations regarding Fed policy.

Additional support for gold came from geopolitics, as US-Russia talks ended without breakthroughs.

The gold (XAUUSD) forecast is positive.

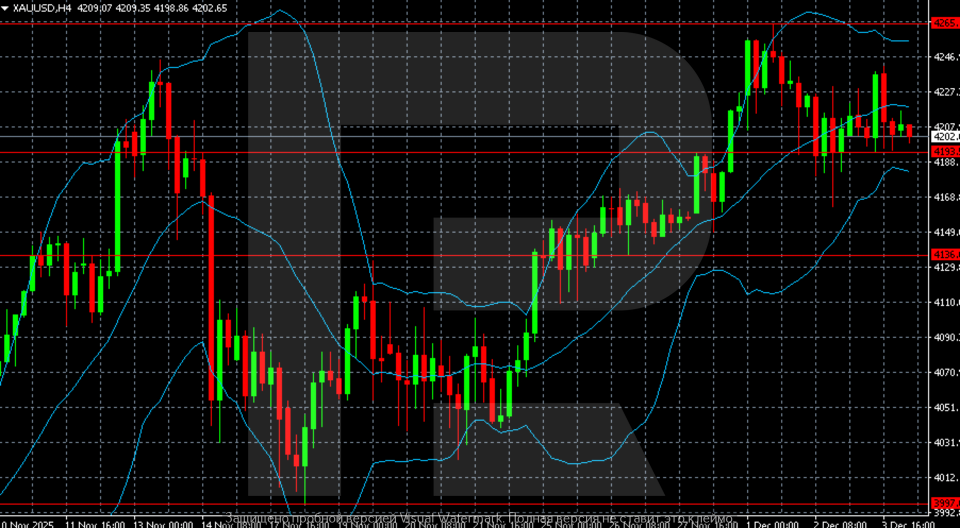

XAUUSD technical analysis

The gold (XAUUSD) H4 chart shows a continuation of a local corrective phase after the recent rise towards the 4,265 resistance level. Prices are hovering above key support at 4,193, forming a sideways range within Bollinger Bands. The middle band acts as the nearest dynamic resistance, limiting buyers’ attempts to regain bullish momentum.

The current structure indicates lower volatility and preparation for a directional move. A breakout below 4,193 would open the way towards the next support level at 4,136, where the lower Bollinger Band is located. Conversely, if quotes consolidate above 4,220–4,230, a recovery towards the highs near 4,265 becomes more likely.

Summary

Gold (XAUUSD) remains stable and is preparing for a directional move. The gold (XAUUSD) forecast for today, 4 December 2025, suggests potential upside towards 4,230 as the first target.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.