Gold (XAUUSD) freezes before a breakout: new U.S. data may trigger an explosive move

The Federal Reserve’s rate cut did not trigger a rally in XAUUSD. Gold continues to move sideways, trading near 4,210 USD. More details in our analysis for 11 December 2025.

XAUUSD forecast: key trading points

- U.S. Initial Jobless Claims: previous – 191K, forecast – 220K

- Current trend: moving upwards

- XAUUSD forecast for 11 December 2025: 4175 or 4300

Fundamental analysis

Today’s XAUUSD outlook shows that gold remains within a sideways channel, trading around 4,210 USD per ounce.

U.S. Initial Jobless Claims reflect the number of people who filed for unemployment benefits for the first time over the previous week. This indicator assesses labor market conditions, and an increase suggests rising unemployment.

The previous value was 191K, while the forecast for today signals a jump to 220K. The change is substantial, and the publication of actual data will clarify the real state of the labor market. Figures matching or exceeding expectations may weaken the USD.

The Federal Reserve cut the interest rate to 3.75%, in line with market expectations, and gold barely reacted. XAUUSD only posted a minor gain, remaining within its previous range. A potential trigger for a larger move may come from next week’s U.S. economic data releases.

XAUUSD technical analysis

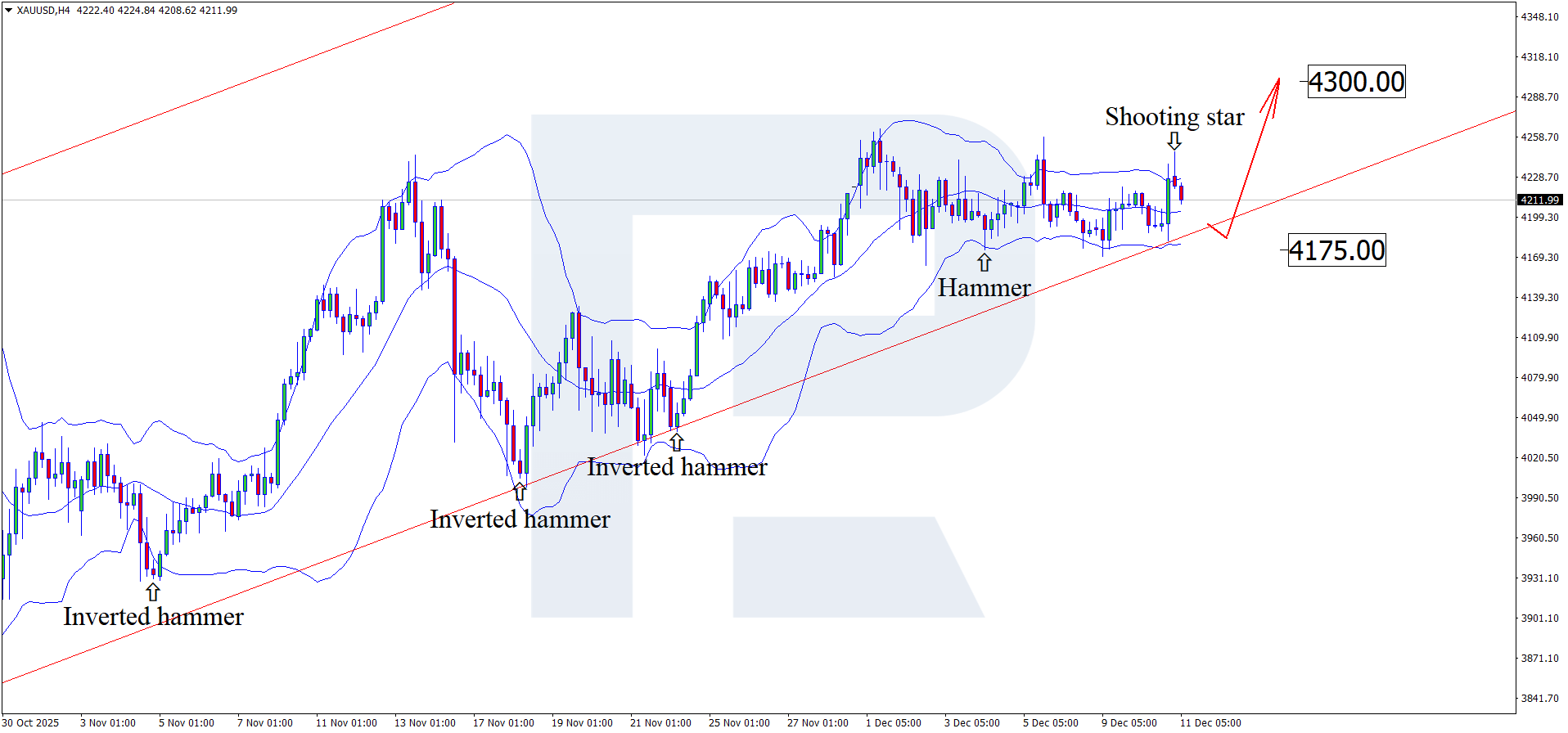

On the H4 chart, XAUUSD has formed a Shooting Star reversal pattern near the upper Bollinger Band. This may lead to a downward wave as the pattern is being worked out. Since the price remains within the broader ascending channel, the next downside target is 4,175 USD.

However, today's XAUUSD technical outlook also allows for an alternative scenario—an immediate rise toward 4,300 USD without testing support.

Summary

The XAUUSD forecast for 11 December 2025 is neutral. The pair continues to move inside a horizontal channel. Technical analysis suggests considering a correction toward 4,175 USD before the next upward wave.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.