Gold (XAUUSD): buyers retain control after the Triangle pattern breakout

XAUUSD maintains its upward momentum after breaking key resistance, supported by rising expectations of Fed policy easing. The current price stands at 4,277 USD. Details — in our analysis for 12 December 2025.

XAUUSD forecast: key trading points

- Gold received support amid expectations of further easing in Fed monetary policy

- US initial jobless claims increased by 44K

- New labor market data strengthened expectations of two Fed rate cuts in 2026

- XAUUSD forecast for 12 December 2025: 4,365

Fundamental analysis

XAUUSD prices are undergoing a mild correction today following yesterday’s aggressive rally. Buyers confidently broke through the key resistance level at 4,255 USD, signaling that bullish momentum remains intact. Gold continues to receive solid support amid expectations of further easing in US monetary policy.

Fresh signs of a slowdown in the US labor market have reinforced expectations that the Fed could implement two rate cuts in 2026. Initial jobless claims in the US rose to their highest level since 2020. The US Department of Labor reported that first-time claims increased by 44K to 236K, while the forecast had pointed to a rise only to 220K.

Fed Chair Jerome Powell emphasized that the likelihood of further rate hikes has effectively fallen to zero. These comments prompted market participants to price in expectations of two rate cuts in 2026, even though the Fed’s own projections currently imply only one cut.

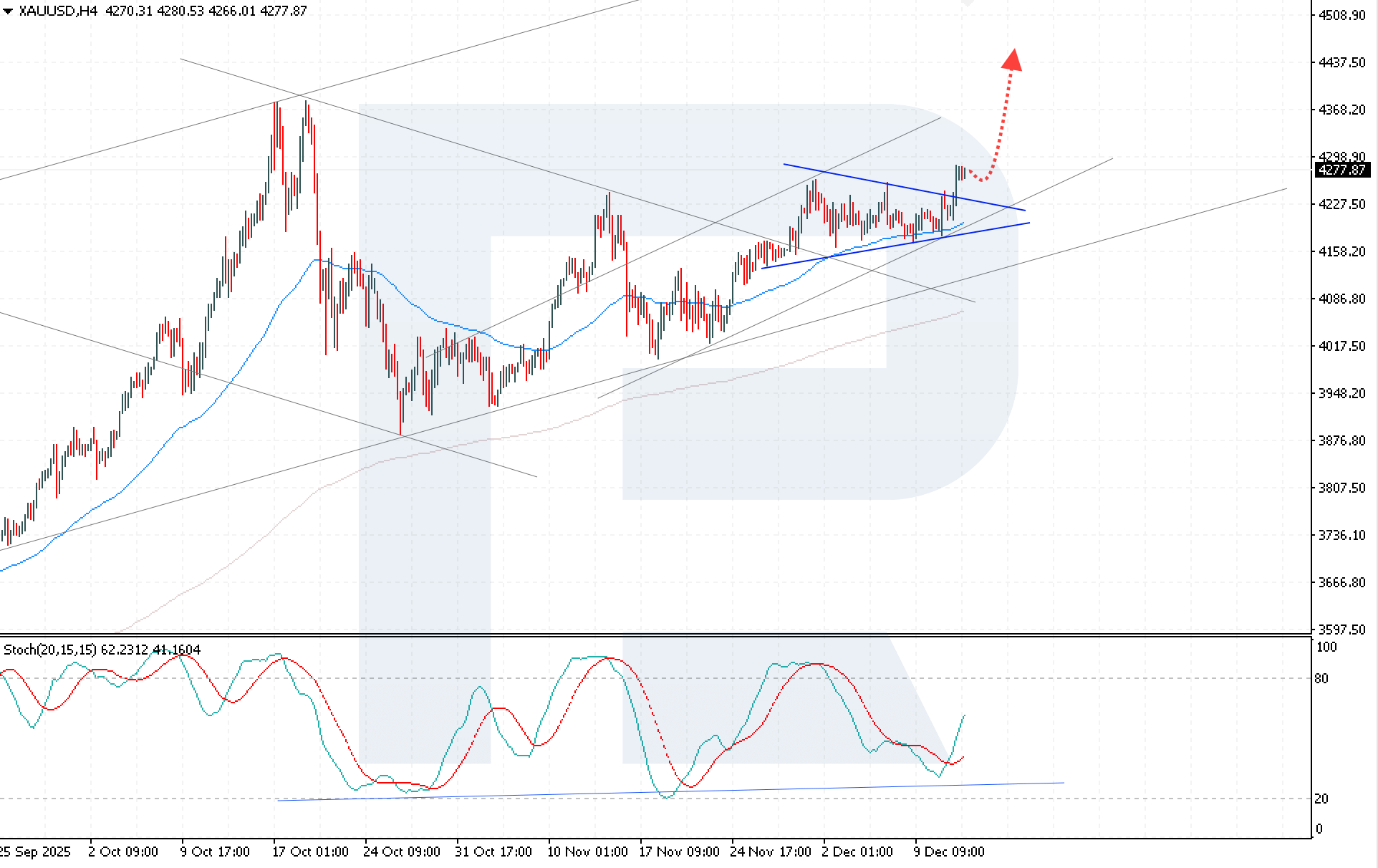

XAUUSD technical analysis

XAUUSD has consolidated above the upper boundary of the Triangle pattern, indicating a high probability of continued upside movement following the correction.

Today’s XAUUSD forecast suggests the development of a bullish impulse with potential growth toward the 4,365 USD level as part of the current chart pattern. Additional confirmation of the bullish scenario comes from the Stochastic Oscillator: the signal lines rebounded from the trendline area and formed a bullish crossover, strengthening the buy signal.

Holding above the key support level at 4,255 USD will confirm the end of the consolidation phase and the continuation of the upward scenario.

Summary

XAUUSD price action confirms the preservation of bullish momentum following the breakout above key resistance and stronger expectations of Fed policy easing amid weakness in the US labor market. The XAUUSD forecast for December 12, 2025, points to further upside potential toward 4,365 USD, provided support at 4,255 USD holds.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.