The Fed’s speech will decide gold’s fate, XAUUSD maintains an uptrend

Gold continues to rise toward price highs, with XAUUSD quotes testing the 4,340 USD level. Details — in our analysis for 17 December 2025.

XAUUSD forecast: key trading points

- Speech by FOMC member John Williams

- Current trend: moving upwards

- XAUUSD forecast for 17 December 2025: 4,290 or 4,400

Fundamental analysis

Today’s XAUUSD price forecast shows that gold continues its upward trend, with quotes currently trading near the 4,340 USD per ounce level.

The XAUUSD forecast for December 17, 2025 takes into account the scheduled speech by FOMC member John Williams.

What to expect from the speech:

- In his remarks, he may emphasize the importance of balancing the fight against inflation with support for the labor market, especially following the recent cycle of rate cuts

- He may hint at whether the regulator is ready for further rate reductions or, conversely, for a pause in monetary easing

- Any comments signaling a bias toward further easing are likely to increase pressure on the US dollar and support gold

- Williams’ speech comes amid this year’s Fed rate cuts and ongoing uncertainty in inflation and employment forecasts due to delays in data releases. His remarks may further clarify how the Fed assesses these risks

XAUUSD technical analysis

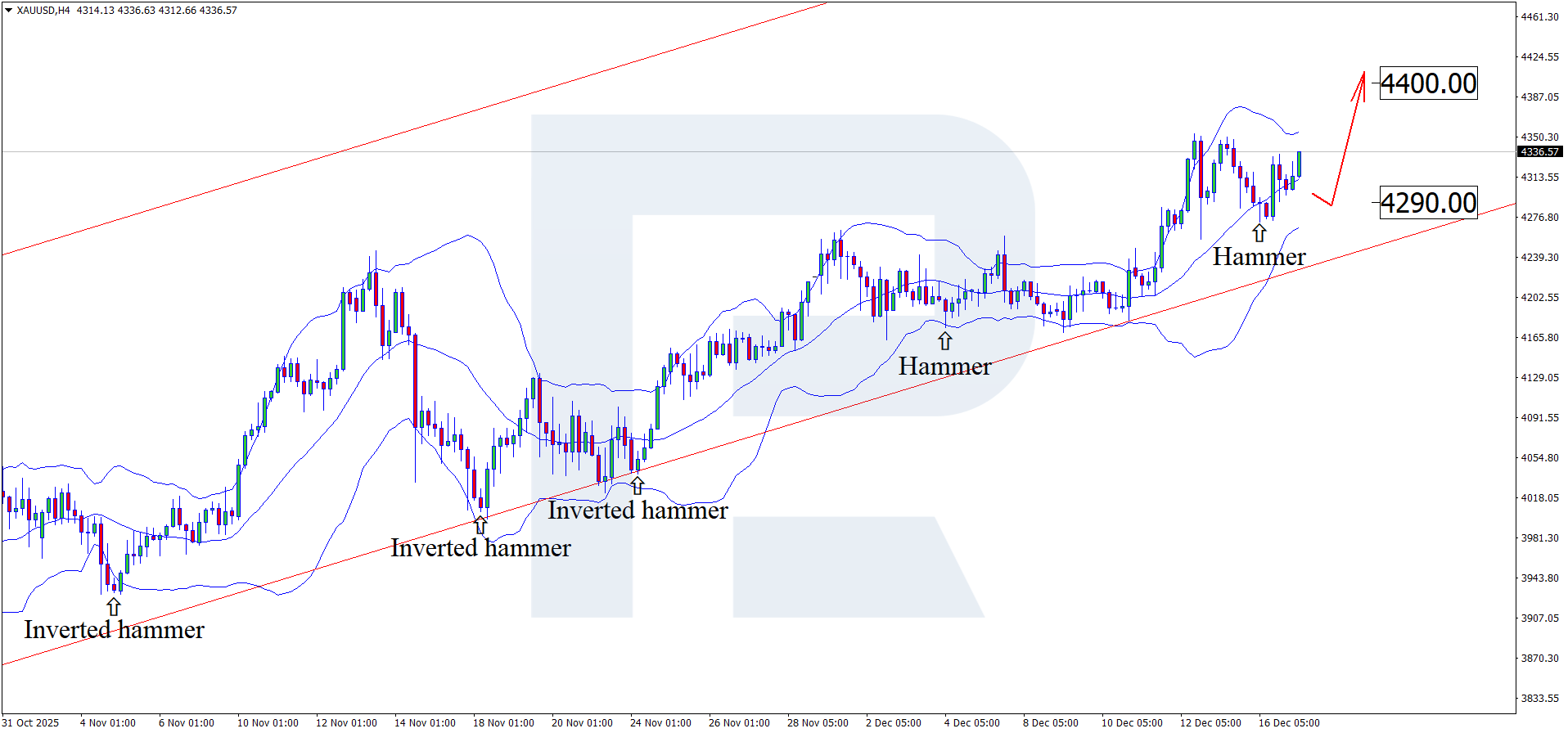

On the H4 chart, XAUUSD has formed a Hammer reversal pattern near the middle Bollinger Band. At this stage, price may continue its upward wave as the pattern plays out. Given that XAUUSD quotes remain within an ascending channel, the upside target is the 4,400 USD level.

At the same time, today’s XAUUSD technical analysis also allows for an alternative scenario, involving a corrective pullback toward the 4,290 USD level before further growth.

The potential for continuation of the uptrend remains intact, and in the near term XAUUSD prices may move toward the next psychological level at 4,500 USD.

Summary

Against the backdrop of the FOMC representative John Williams’ speech, gold continues to strengthen. XAUUSD technical analysis suggests a rise toward the 4,400 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.