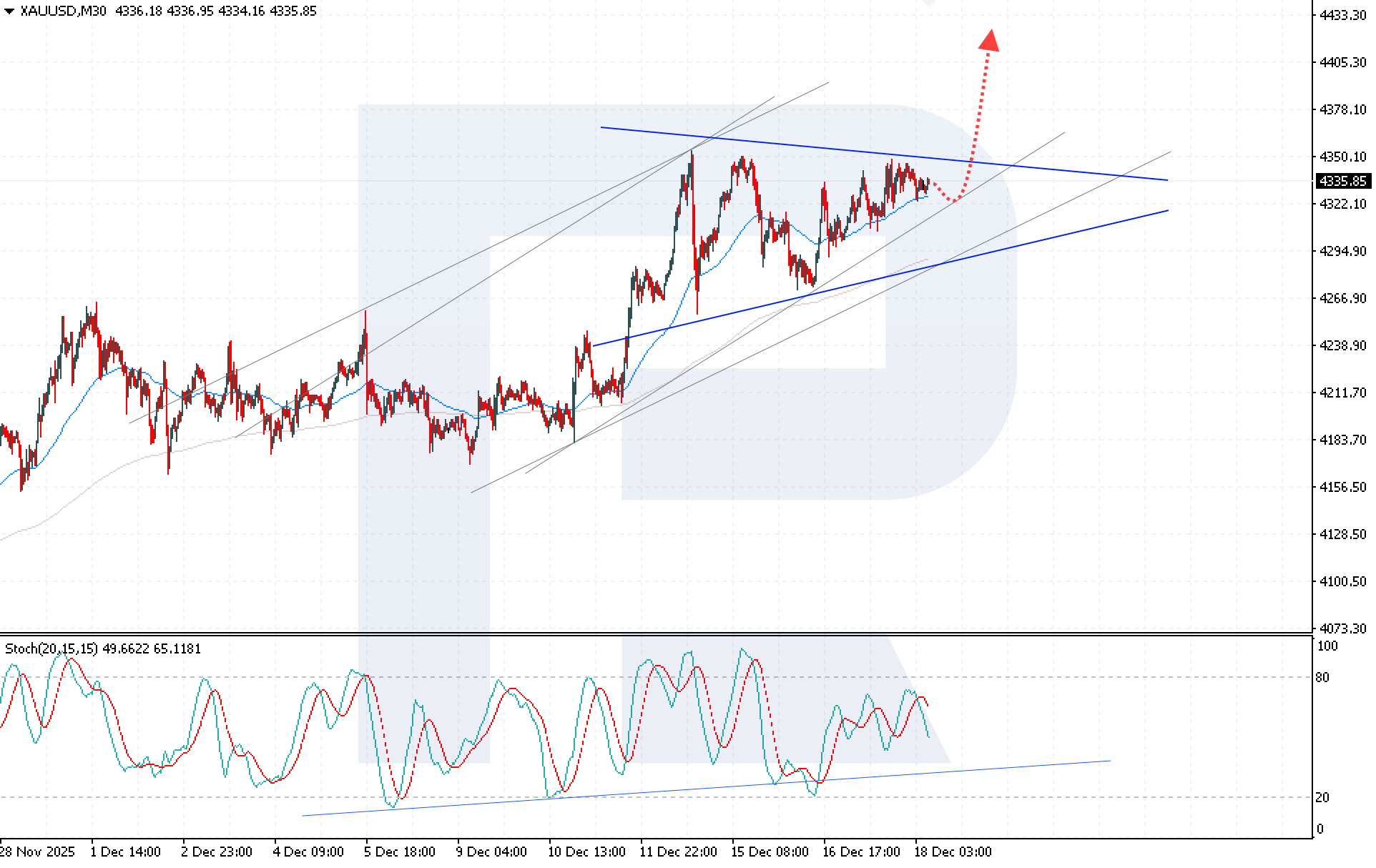

XAUUSD consolidates within a Triangle pattern

XAUUSD maintains its bullish momentum amid easing expectations regarding U.S. monetary policy. The current price stands at 4,335 USD. Details — in our analysis for 18 December 2025.

XAUUSD forecast: key trading points

- U.S. unemployment rate has risen to its highest level in four years

- Expectations of further easing in U.S. monetary policy continue to support demand for gold

- XAUUSD forecast for 18 December 2025: 4,445

Fundamental analysis

XAUUSD quotes have entered a corrective phase, with sellers holding the resistance area near 4,340 USD. Despite this, bullish pressure remains intact, and a breakout of this key level could trigger a price move toward 4,445 USD as part of the formation of a Triangle technical pattern.

Gold continues to receive support from expectations of further easing in U.S. monetary policy, as well as persistent geopolitical risks that sustain demand for safe-haven assets.

Meanwhile, Federal Reserve Governor Christopher Waller stated that the regulator is prepared to continue cutting interest rates, while emphasizing the need for a cautious approach. His comments followed weak U.S. labor market data: the unemployment rate rose to a four-year high, and job growth in November failed to offset the slowdown recorded in October.

XAUUSD technical analysis

XAUUSD continues to rebound from the EMA-65 despite the proximity of a key resistance level, indicating growing buying pressure. The XAUUSD forecast for today suggests a potential advance toward the 4,445 USD level.

An additional bullish signal is forming on the Stochastic Oscillator: the signal lines are rebounding from the support line and have not yet entered the overbought zone.

A firm break above the 4,355 USD level will confirm the bullish scenario and indicate a breakout above the upper boundary of the Triangle pattern.

Summary

A breakout above the 4,340 USD resistance level, supported by easing Fed rate expectations and persistent geopolitical risks, would strengthen the bullish momentum in XAUUSD and open the way for price growth toward the 4,445 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.