Gold (XAUUSD) failed to renew its all-time high

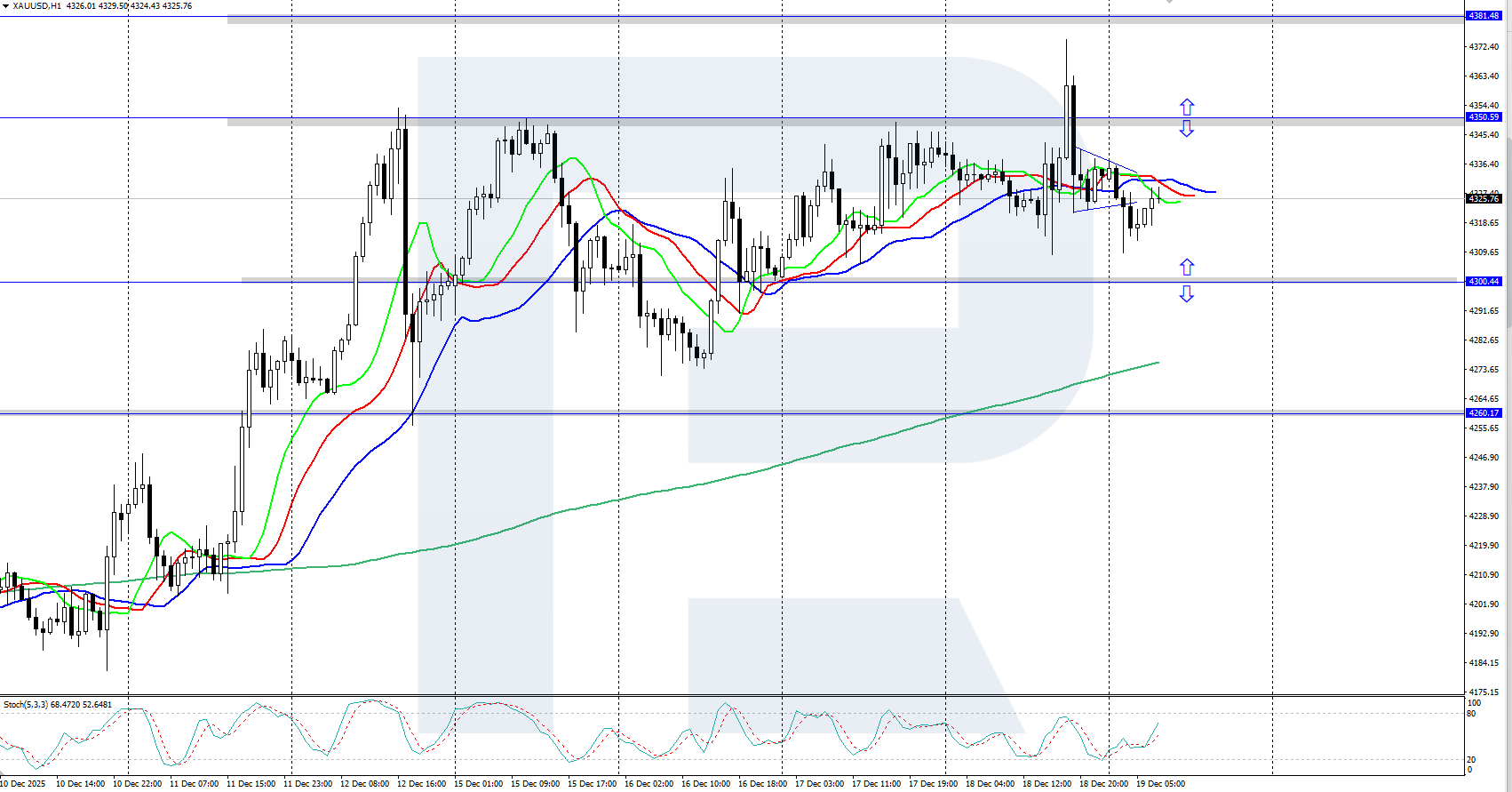

The price of XAUUSD declined toward the 4,300 USD area during a downward correction after an unsuccessful attempt to renew the all-time high, following the release of US inflation data. Details — in our analysis for 19 December 2025.

XAUUSD forecast: key takeaways

- Market focus: US inflation slowed to 2.7% in November, significantly below the forecast of 3.1%

- Current trend: range-bound trading

- XAUUSD forecast for 19 December 2025: 4,300 or 4,381

Fundamental analysis

Gold (XAUUSD) has returned to a consolidation range of 4,260–4,350 USD per ounce, remaining close to record highs. An attempt to renew the all-time high at 4,381 USD after weaker-than-expected US inflation data proved unsuccessful.

US inflation slowed to 2.7% in November, below the 3.1% forecast, while core CPI came in at 2.6% — the lowest reading since March 2021. This has strengthened expectations of a potential Federal Reserve rate cut in 2026.

Geopolitical tensions continue to support the precious metal. Confrontation between the US and Venezuela persists, military action in Ukraine continues, and there has been no clear progress in peace negotiations so far.

XAUUSD technical analysis

XAUUSD quotes corrected toward the 4,300 USD area. The daily trend, confirmed by the Alligator indicator, remains upward, indicating the possibility of a continuation of the bullish move once the current correction is complete.

Within the short-term price forecast for XAUUSD, if bulls manage to regain control, another attempt to break the all-time high at 4,381 USD may follow. If bears succeed in extending the decline and secure prices below 4,300 USD, a deeper correction toward support at 4,260 USD may develop.

Summary

Gold is undergoing a moderate correction after failing to renew the all-time high at 4,381 USD. Slowing US inflation and ongoing geopolitical tensions continue to support the precious metal. Once the correction phase is complete, the upward movement may resume.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.