New XAUUSD high: U.S. macro data weighs on the dollar

The U.S. dollar continues to lose ground against gold, with XAUUSD setting another record after testing the 4,497 USD level. Details — in our analysis for 23 December 2025.

XAUUSD forecast: key takeaways

- U.S. GDP Q3: previous value — 3.8%, forecast — 3.2%

- U.S. CB Consumer Confidence Index: previous value — 88.7, forecast — 83.4

- Current trend: moving upwards

- XAUUSD forecast for 23 December 2025: 4,550 or 4,440

Fundamental analysis

Today’s XAUUSD price outlook shows that gold continues its upward trend. At this stage, prices have updated another all-time high and are trading around the 4,480 USD per ounce level.

Gross Domestic Product (GDP) represents the total value of all goods and services produced in a country, calculated based on final output without including the cost of raw materials.

The XAUUSD forecast for 23 December 2025 takes into account that U.S. GDP for Q3 may decline to 3.2%, down from the previous reading of 3.8%. A confirmed slowdown in GDP would put additional pressure on the U.S. dollar, which is already losing ground against major global currencies and precious metals.

The U.S. Consumer Confidence Index published by the Conference Board reflects consumers’ confidence in current economic conditions. It is a leading indicator that helps predict consumer spending, which accounts for a significant share of overall economic activity. Higher readings indicate greater consumer optimism.

The forecast for 23 December 2025 suggests the index may fall to 83.4 points, signaling deteriorating consumer sentiment.

Thus, a decline in GDP combined with other weakening economic indicators could act as a trigger for further appreciation in XAUUSD.

XAUUSD technical analysis

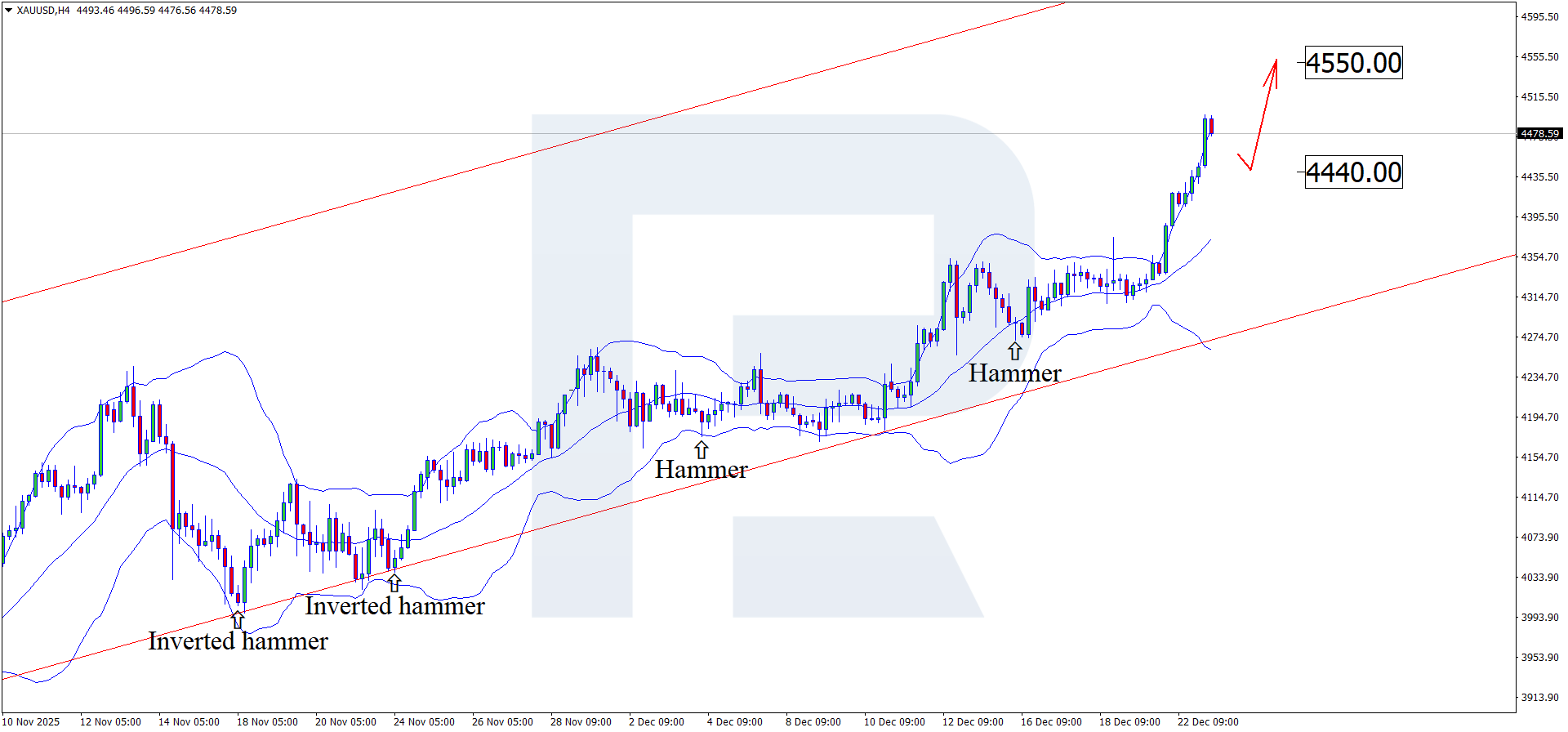

On the H4 chart, XAUUSD has formed a Hammer reversal pattern near the middle Bollinger Band. At this stage, price continues its upward wave as the pattern signal plays out. Given that XAUUSD remains within an ascending channel, the next upside target may be the 4,550 USD level.

At the same time, today’s technical outlook for XAUUSD also considers an alternative scenario involving a corrective move toward the 4,440 USD level before further growth.

The potential for continuation of the uptrend remains intact, with XAUUSD possibly heading toward the next psychological milestone at 4,700 USD in the near term.

Summary

A potential slowdown in U.S. GDP would further weaken the U.S. dollar. Technical analysis of XAUUSD points to continued upside toward the 4,550 USD level following a corrective phase.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.