Gold (XAUUSD) undergoes a moderate correction

XAUUSD prices declined to the 4,600 USD area during a downward correction following profit-taking by investors amid easing geopolitical tensions. Find out more in our analysis for 15 January 2026

XAUUSD forecast: key takeaways

- Market focus: US producer prices increased by 0.2% month-on-month in November

- Current trend: correcting downwards

- XAUUSD forecast for 15 January 2026: 4,642 or 4,550

Fundamental analysis

Gold prices entered a correction phase as investors locked in profits after a new all-time high in the previous session, while President Trump’s softer rhetoric reduced demand for safe-haven assets.

Trump said reports indicated that Iran was easing its crackdown on anti-government protesters and had no plans for mass executions, indicating a wait-and-see approach to the crisis.

He also noted that he does not plan to remove Federal Reserve Chairman Powell, despite a Department of Justice investigation, although he added that it is too early to say what he might ultimately decide.

Moderate growth in the PPI index confirmed expectations that the Federal Reserve has room for several interest rate cuts this year. However, some policymakers remain cautious, warning that inflationary pressures may prove more persistent than expected.

Technical outlook

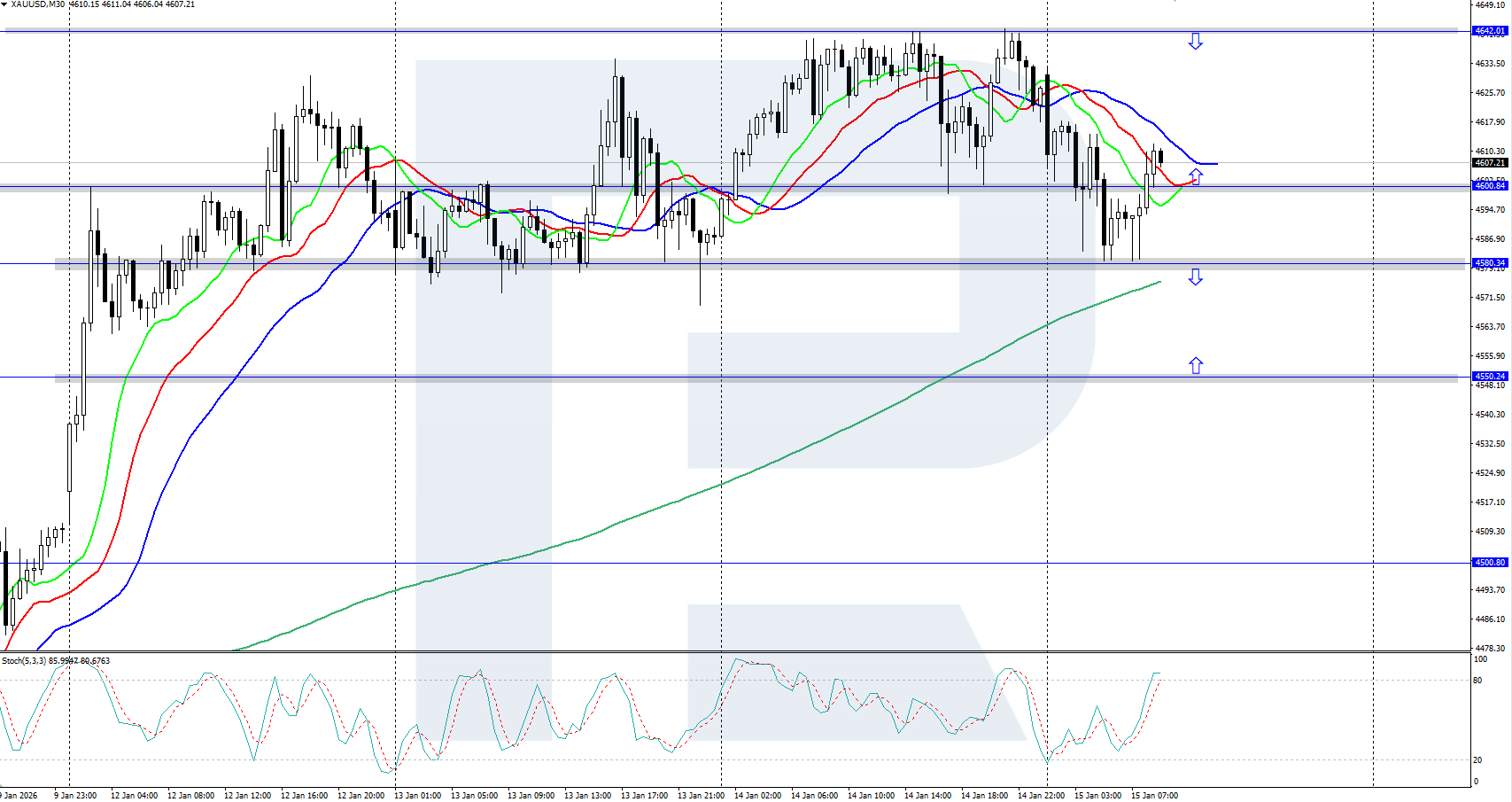

XAUUSD quotes corrected towards the 4,600 USD area amid easing geopolitical tensions related to Iran. The Alligator indicator is currently pointing downwards, so the corrective move may continue.

The short-term XAUUSD price forecast suggests further growth towards the 4,642 USD level and higher if bulls regain the initiative and hold above 4,600 USD. Conversely, if bears push prices lower and consolidate below 4,580 USD, a decline towards the 4,550 USD support level is possible.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: Bullish

- Key resistance levels: 4,600 and 4,642

- Key support levels: 4,580 and 4,550

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A rebound from the support level in the 4,600 USD area may indicate that conditions are forming for a long scenario.

The risk-to-reward ratio is approximately 1:2. Potential profit upon reaching the take-profit target amounts to 5,000 pips, while possible losses are limited to 2,500 pips.

- Take Profit: 4,650 USD

- Stop Loss: 4,575 USD

Alternative scenario (Sell Stop)

Short positions are possible if prices break and consolidate below the 4,580 USD support level.

- Take Profit: 4,550 USD

- Stop Loss: 4,590 USD

Risk factors

The main risks to the bullish scenario include easing geopolitical tensions around Iran and Venezuela, as well as profit-taking by investors.

Summary

Gold is undergoing a moderate correction, declining towards the 4,600 USD level, with the market closely monitoring developments around Iran.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.