Rising uncertainty in global markets supports XAUUSD

XAUUSD prices continue to rise amid escalating geopolitical tensions around Greenland, currently standing at 4,840 USD. Find out more in our analysis for 21 January 2026.

XAUUSD forecast: key takeaways

- Demand for safe-haven assets strengthened amid the escalation of the situation around Greenland

- Investors fear the start of a large-scale trade confrontation between the US and Europe

- Geopolitical risks continue to intensify, worsening expectations for global economic growth

- XAUUSD forecast for 21 January 2026: 4,730

Fundamental analysis

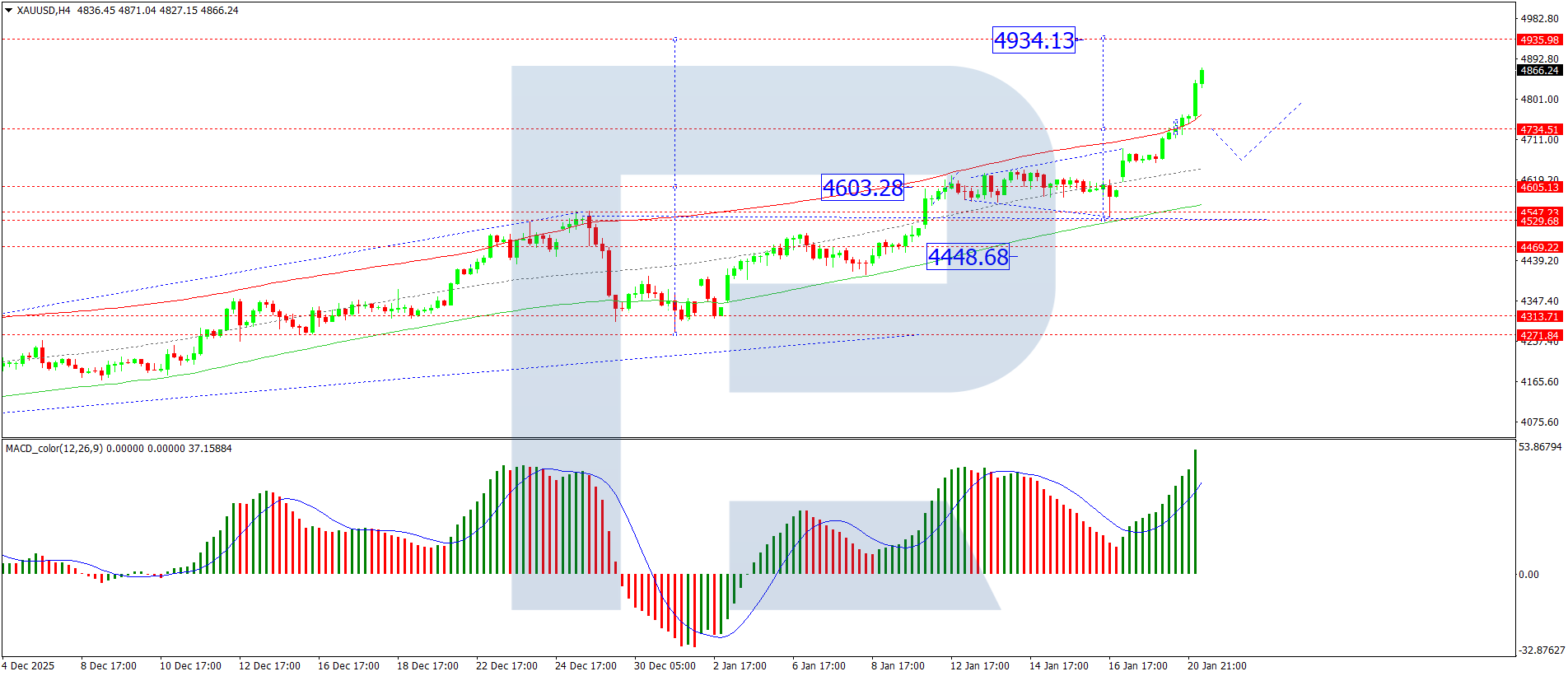

XAUUSD quotes are rising for the third consecutive trading session, indicating increased demand for safe-haven assets. Buyers confidently broke above the key resistance level at 4,635 USD, which previously limited the bullish momentum and acted as an important distribution zone. The breakout of this level triggered an acceleration of the upward move and confirmed a shift in the local balance of power in favour of buyers.

The main support for gold comes from rising geopolitical tensions. The market actively reacts to the escalation of the situation around Greenland and the increased pressure from US President Donald Trump, who has once again publicly asserted his claims to this region. Investors view such rhetoric as a potential catalyst for a large-scale trade and political confrontation between the US and Europe.

Analysts note that the current round of trade tensions differs in structure from last year’s tariff conflicts; however, the level of uncertainty for the global economy remains high. Risks of fragmentation in global trade chains are increasing, negatively affecting expectations for global economic growth.

An additional supportive factor for precious metals comes from declining confidence in the US dollar. Aggressive US foreign policy rhetoric and rising geopolitical risks intensify capital outflows from dollar-denominated assets into value-preserving instruments. Under these conditions, gold and silver once again fulfil the role of key safe-haven assets.

Thus, the combination of geopolitical instability, trade risks, and pressure on the US dollar forms a favourable fundamental environment for further growth in XAUUSD quotes. The short-term and medium-term fundamental backdrop remains clearly bullish.

Technical outlook

On the M30 chart, XAUUSD maintains its upward momentum within the established bullish channel. Prices are holding steady above the SMA-50, which has turned upwards and currently acts as dynamic support, confirming the persistence of the dominant buyer-driven trend.

After an impulsive breakout from the consolidation zone, the market moved into a phase of controlled correction, which ended with a rebound from the lower boundary of the bullish channel near 4,835 USD. This level confirmed its significance as a local demand zone and a point for forming a new upward wave.

Technical indicators support the scenario of continued upward movement. The Stochastic Oscillator rebounded from the upward trendline, with its signal lines turning upwards and exiting the mid-range zone, indicating the formation of another bullish impulse without signs of extreme overbought conditions.

The key technical condition for the continued bullish scenario remains price consolidation above 4,730 USD. A sustained breakout and hold above this level will indicate that quotes have moved beyond the upper boundary of the local bullish channel and will confirm the market’s readiness to accelerate.

The baseline scenario suggests continued growth towards the 5,000 USD level, where the immediate impulse target lies. If buying activity intensifies and a positive fundamental backdrop persists, the likelihood of continued growth towards 5,300 USD increases significantly. This area represents a local target and an important psychological level, around which profit-taking and the formation of a subsequent corrective phase are possible.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: M30 (Intraday)

- Trend: bullish

- Key resistance levels: 5,000 and 5,300

- Key support levels: 4,835 and 4,800

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

Holding above the 4,800 USD level signals market readiness to continue the upward move and creates favourable conditions for opening long positions.

The risk-to-reward ratio exceeds 1:3. Potential profit upon reaching the target amounts to approximately 13,000 pips, while possible losses are limited to 3,500 pips.

- Take Profit: 5,000 USD

- Stop Loss: 4,800 USD

Alternative scenario (Sell Stop)

A short scenario is possible if prices break and consolidate below the lower boundary of the bullish channel under the 4,750 USD level, increasing the probability of a bearish correction developing after the current upward impulse.

- Take Profit: 4,575 USD

- Stop Loss: 4,850 USD

Risk factors

The main risks to the bullish XAUUSD scenario remain easing geopolitical tensions around Greenland, an unexpected strengthening of the US dollar, and possible profit-taking after three consecutive sessions of gold gains.

Summary

Escalating geopolitical tensions, rising demand for safe-haven assets, and declining confidence in the US dollar create favourable conditions for further strengthening of gold. The XAUUSD forecast for today indicates a continued bullish scenario and a high probability of further growth towards the 5,000 USD level, provided prices consolidate firmly above 4,835 USD.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.