Gold (XAUUSD) in a correction phase: a logical move after an explosive rally

Gold (XAUUSD) prices have declined to 4,780 USD as markets reduce the risk premium and lower demand for safe-haven assets. Discover more in our analysis for 22 January 2026.

XAUUSD forecast: key takeaways

- Gold (XAUUSD) is undergoing a correction after extreme price movements

- The market is reducing demand for safe-haven assets due to a decline in the risk premium

- XAUUSD forecast for 22 January 2026: 4,760

Fundamental analysis

Gold (XAUUSD) fell by more than 1% on Thursday to 4,780 USD per troy ounce. The precious metal corrected after setting a new all-time high in the previous session.

The trigger was a softening of geopolitical rhetoric: US President Donald Trump abandoned threats of imposing tariffs against Europe over Greenland, stated that an agreement was approaching, and ruled out the use of force. This reduced the geopolitical premium and demand for safe-haven assets.

At the same time, uncertainty persists. European lawmakers suspended the ratification of the EU–US trade agreement reached in July. An additional supportive factor for gold came from a sell-off in Japanese government bonds amid pre-election promises of tax relief, which increased concerns about Japan’s fiscal sustainability.

The market is focused on the delayed release of the US PCE price index, scheduled for today. It may provide new signals regarding the trajectory of Federal Reserve interest rates.

The forecast for gold (XAUUSD) is moderate.

Technical outlook

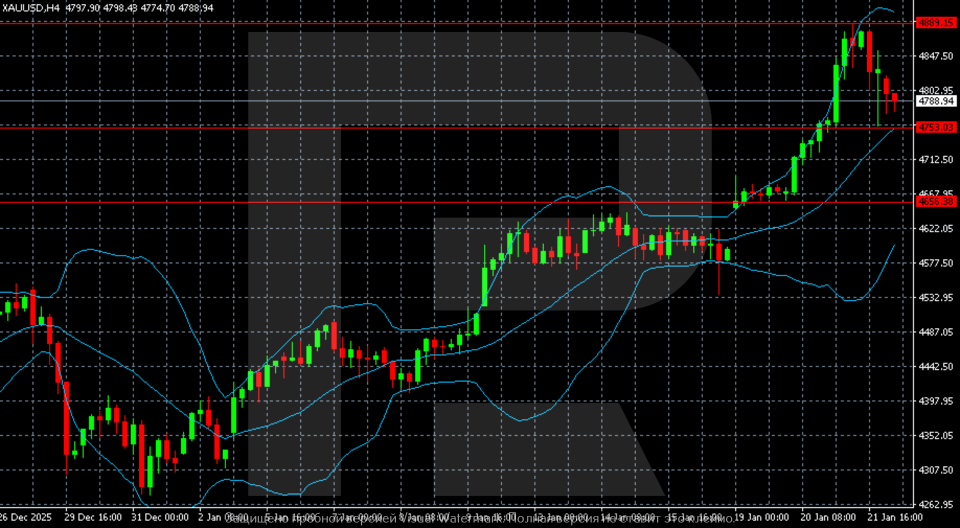

The gold (XAUUSD) H4 chart shows a pronounced uptrend continuing after a strong upward momentum in mid-January. Prices reached a new all-time high in the 4,885–4,890 area and moved into a corrective downward phase.

The upward momentum was rapid, with quotes moving into overbought territory. The current pullback appears technical. Prices have returned to the range and are stabilising in the 4,780–4,800 area, without signs of a breakdown in the primary structure.

Volatility remains elevated, which is typical after extreme movements. The market is unwinding overbought conditions. The nearest support zone is located in the 4,750–4,760 area, and holding this zone is critical for maintaining the bullish scenario. Below this, a stronger support zone lies at 4,655–4,680, where a consolidation phase previously developed.

As long as quotes hold above these levels, the baseline scenario remains moderately bullish with the potential for a renewed test of all-time highs after the correction ends. A loss of the 4,750–4,680 area will increase the risk of a deeper downward phase.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: bullish (correction within an upward impulse)

- Key resistance levels: 4,885–4,900 and 5,000

- Key support levels: 4,760 and 4,680

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

Prices holding above the 4,750–4,760 USD zone confirm the preservation of the upward structure after the correction from all-time highs. The decline is technical in nature amid a reduction in the geopolitical premium, without a trend breakdown.

Risk-to-reward ratio is around 1:3.

- Buy Stop: 4,800 USD

- Take Profit: 4,980–5,000 USD

- Stop Loss: 4,750 USD

Alternative scenario (Sell Stop)

A breakout and consolidation below the 4,750–4,680 USD area will indicate a deeper correction after extreme growth and increased profit-taking.

- Sell Stop: 4,745 USD

- Take Profit: 4,655 USD

- Stop Loss: 4,820 USD

Risk factors

A reduction in geopolitical tensions around Greenland, strengthening of the US dollar following the PCE price index release, and further profit-taking after new all-time highs may limit gold’s upside potential in the short term.

Summary

Gold (XAUUSD) is correcting following a reduction in the risk premium. The gold (XAUUSD) forecast for today, 22 January 2026, does not rule out a move towards 4,760 to complete the correction phase.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.