XAUUSD on the way to new highs: what is driving gold higher today?

XAUUSD quotes set another price record, testing the 4,957 USD level, with further growth above the 5,000 USD mark possible amid weak US economic indicators. Find more details in our analysis for 23 January 2026.

XAUUSD forecast: key takeaways

- US services PMI: previously at 52.5, projected at 52.9

- US manufacturing PMI: previously at 51.8, projected at 51.9

- Current trend: moving upwards

- XAUUSD forecast for 23 January 2026: 5,050

Fundamental analysis

The XAUUSD forecast for today indicates that gold prices continue their upward momentum, having once again set a new price record and testing the 4,967 USD level. At this stage, XAUUSD prices are trading around 4,957 USD per ounce.

Today’s XAUUSD analysis takes into account that the US services Purchasing Managers’ Index (PMI) for the previous reporting period may rise to 52.9 from the previous 52.5.

The manufacturing PMI measures the activity of purchasing managers in the industrial sector and indicates the condition of manufacturing and production dynamics in the economy. Purchasing managers are among the first to receive information about company operations, making the PMI an important indicator of overall economic health. Readings above 50.0 indicate expansion, while values below 50.0 signal contraction.

The XAUUSD forecast for 23 January 2026 takes into account that the US manufacturing PMI may increase to 51.9 points from the previous 51.8. While the projected increase is modest, it reflects slightly improved sentiment in the US manufacturing sector.

US economic data forecasts for today indicate limited growth potential. If actual figures come in below expectations, this could exert significant pressure on the USD and trigger a new wave of growth in XAUUSD prices.

Technical outlook

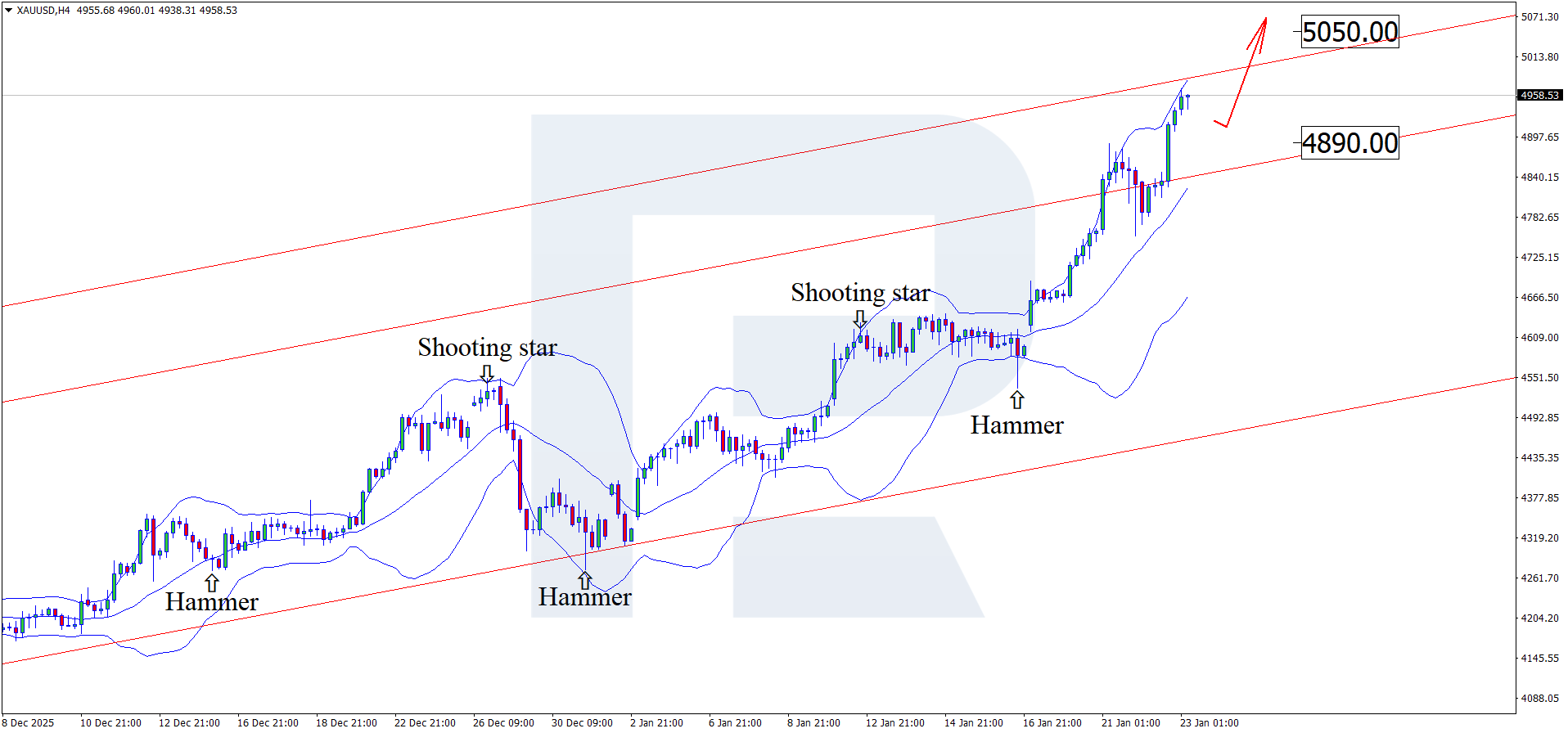

On the H4 chart, XAUUSD formed a Hammer reversal pattern near the lower Bollinger Band. At this stage, prices continue to develop an upward wave following the pattern’s signal. Since XAUUSD quotes remain within an ascending channel, the next psychological upside target may be 5,050 USD.

At the same time, today’s technical analysis also considers an alternative scenario involving a corrective move towards the 4,890 USD level before growth resumes.

The possibility of continuing the uptrend remains, and in the near term, XAUUSD prices may move towards the next psychological level at 5,500 USD.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: bullish (correction within an upward impulse)

- Key resistance levels: 5,000-5,050

- Key support levels: 4,860 and 4,790

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

Prices holding above the 4,950–4,960 USD zone confirm the continuation of the upward structure after the correction from all-time highs. The decline remains technical, driven by a reduction in the geopolitical premium without a trend reversal.

The risk-to-reward ratio is around 1:3.

- Buy Stop: 5,000 USD

- Take Profit: 5,150–5,250 USD

- Stop Loss: 4,950 USD

Alternative scenario (Sell Stop)

A breakout and consolidation below the 4,750–4,680 USD area would indicate a deepening correction after the extreme rally and increased profit-taking.

- Sell Stop: 4,745 USD

- Take Profit: 4,655 USD

- Stop Loss: 4,820 USD

Risk factors

A reduction in geopolitical tensions around Greenland, strengthening of the US dollar following the PCE price index release, and further profit-taking after new all-time highs may limit gold’s upside potential in the short term.

Summary

Lack of growth in US economic indicators may trigger further increases in gold prices. XAUUSD technical analysis suggests potential growth towards the 5,050 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.