XAUUSD in correction phase after profit-taking near record highs

XAUUSD quotes are hitting new all-time highs as demand for safe-haven assets surges amid rising trade and geopolitical risks. Prices are currently at 5,059 USD. Find out more in our analysis for 26 January 2026.

XAUUSD forecast: key takeaways

- Increased demand for gold is driven by growing trade and geopolitical uncertainty

- Washington has intensified its tough trade rhetoric towards its partners

- Markets interpreted US statements as a signal of possible escalation in trade conflicts

- XAUUSD forecast for 26 January 2026: 5,145

Fundamental analysis

XAUUSD quotes are rising for the sixth consecutive trading session, approaching the 5,100 USD level as demand for safe-haven assets rises amid mounting trade and geopolitical uncertainty. The current moderate decline is a bearish correction and likely reflects profit-taking after new record highs.

Gold’s rally accelerated after Donald Trump’s statements about the US intention to seek sovereignty over certain territories of Greenland. These comments heightened market concerns and triggered capital inflows into safe-haven assets.

Additional support for buyers came from Washington’s aggressive trade rhetoric. Trump warned Canada that all of its exports to the US could face 100% tariffs if it finalises a trade agreement with China. Markets interpreted this as a signal of a potential escalation of trade conflicts.

Technical outlook

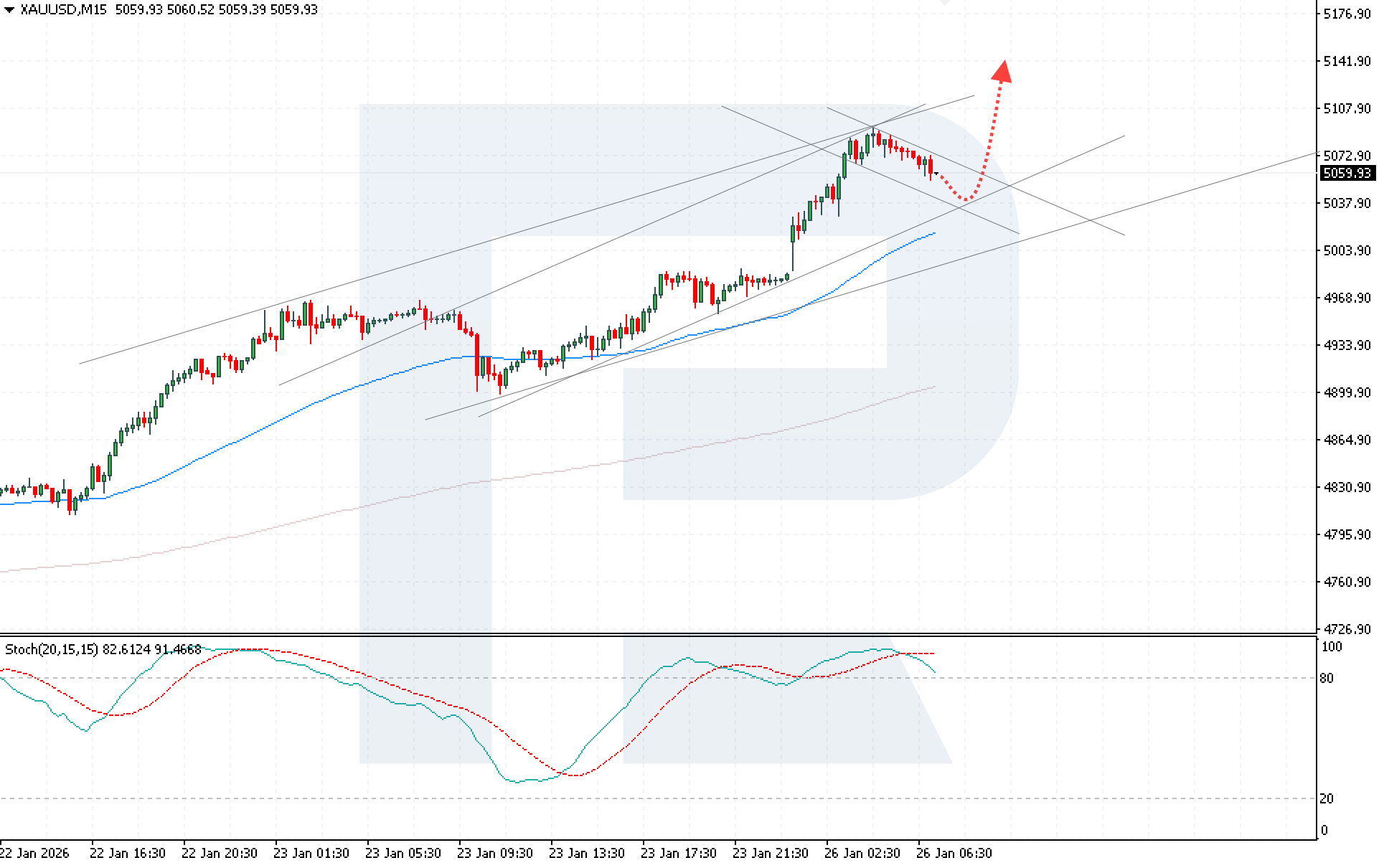

XAUUSD quotes are undergoing a correction after rebounding from the upper boundary of the bullish channel. At the same time, prices remain above the EMA-65, indicating persistent buying pressure.

The XAUUSD price forecast suggests resumed upward momentum with a target of 5,145 USD after a rebound from the lower boundary of the bullish channel. The signal lines of the Stochastic Oscillator remain in overbought territory, which may indicate the likelihood of a continued moderate bearish correction before the next stage of growth.

A key condition for the bullish scenario will be a consolidation of XAUUSD quotes above the 5,080 USD level. Such a signal would indicate a breakout above the upper boundary of the descending corrective channel and significantly increase the probability of reaching the target level.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: M15 (Intraday)

- Trend: bullish

- Key resistance levels: 5,075–5,100

- Key support levels: 5,040 and 4,965

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

XAUUSD prices holding above the EMA-65 line and forming a rebound from the lower boundary of the bullish channel indicate a sustained bullish structure after the correction. Consolidation above the 5,080 USD level would confirm a breakout of the upper boundary of the descending corrective channel and create conditions for a long scenario. Potential profit upon reaching the take-profit level is about 6,500 pips, with possible losses capped at 1,500 pips. The risk-to-reward ratio exceeds 1:3.

- Take Profit: 5,145 USD

- Stop Loss: 5,060 USD

Alternative scenario (Sell Stop)

A consolidation of XAUUSD quotes below the 5,030 USD level would indicate a breakout below the lower boundary of the bullish channel and a deeper bearish correction.

- Take Profit: 4,685 USD

- Stop Loss: 5,055 USD

Risk factors

A softening of US trade and geopolitical rhetoric, including reduced tensions around Greenland and a refusal to escalate trade threats against Canada, as well as continued profit-taking after hitting new record highs, may restrain further XAUUSD growth in the short term.

Summary

Ongoing trade and geopolitical tensions continue to support steady demand for gold, while the current XAUUSD correction is limited in nature and does not change the overall bullish market sentiment. Today’s XAUUSD forecast suggests the upward scenario will continue with potential for growth towards 5,145 USD, provided prices consolidate above the 5,080 USD level, despite the possibility of a continued short-term correction.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.