Profit-taking in XAUUSD after reaching record highs

XAUUSD prices remain highly volatile amid a corrective decline, currently trading at 5,165 USD. Discover more in our analysis for 30 January 2026.

XAUUSD forecast: key takeaways

- Traders are locking in profits after prices hit record levels

- Geopolitical tensions remain elevated

- Economic uncertainty supports demand for gold

- XAUUSD forecast for 30 January 2026: 5,585

Fundamental analysis

XAUUSD quotes are falling for the second consecutive day after rebounding from a local high. A reversal candlestick pattern is adding to pressure on prices, indicating the risk of a deeper correction. The key support level for buyers remains near the 5,150 USD level; however, profit-taking after record highs continues to be a relevant factor.

The previous rally was driven by persistent weakness in the US dollar and rising economic and geopolitical uncertainty. The geopolitical backdrop remains tense. Donald Trump called on Iran to return to nuclear negotiations. Tehran responded by stating its readiness for countermeasures and promised an unprecedented response, which provides fundamental support for gold and creates conditions for a renewed rise after the current correction is completed.

Technical outlook

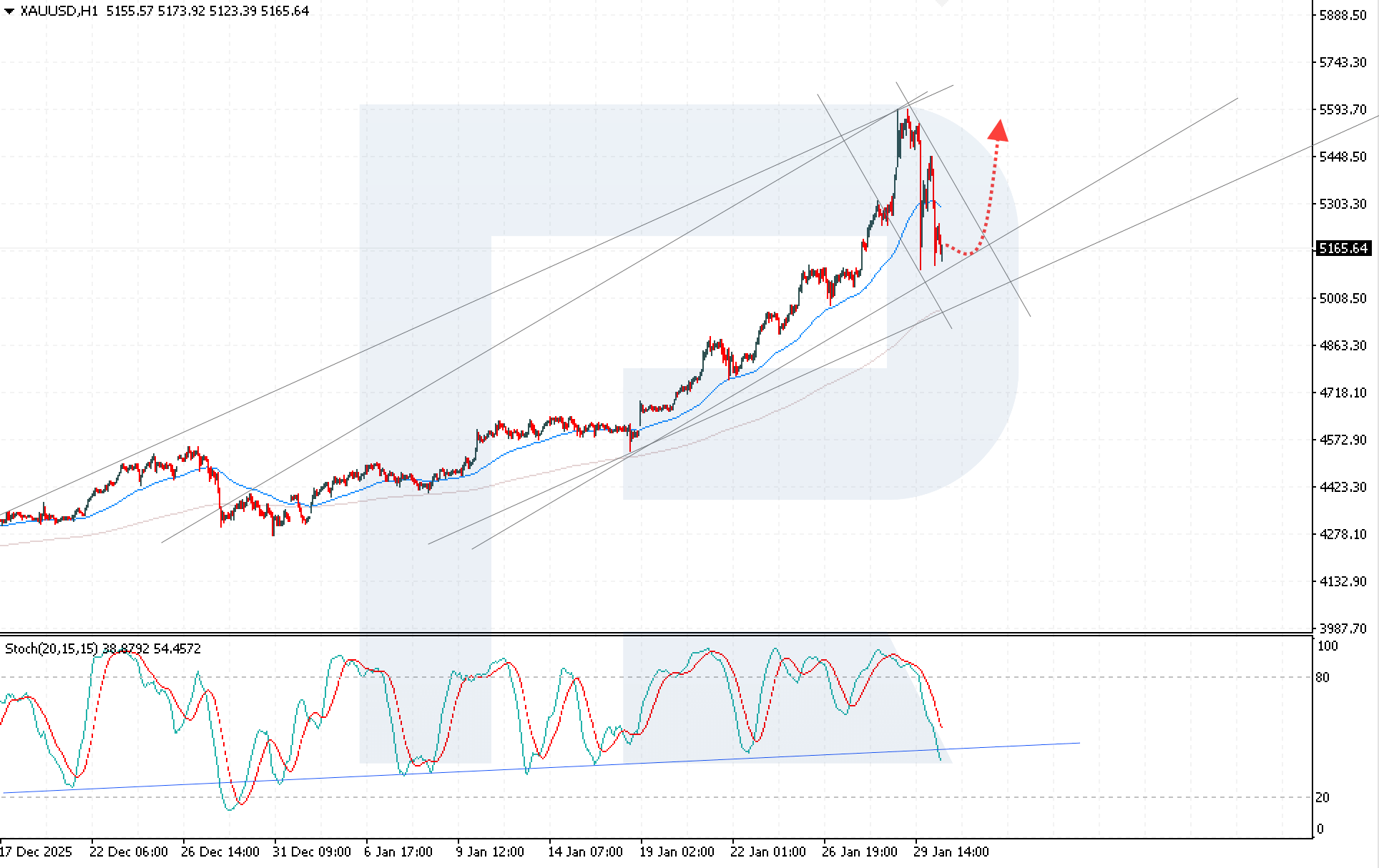

XAUUSD quotes continue their corrective move, but the market is holding above the key support levelat 5,105 USD. This area coincides with the lower boundary of the ascending channel, indicating sustained buying pressure and solid underlying demand.

The XAUUSD forecast for today suggests the completion of the current correction and an attempt to form a new bullish impulse with potential movement towards 5,585 USD. Additional confirmation of the bullish scenario comes from the Stochastic Oscillator. Its signal lines have exited overbought territory and reached the ascending support line, strengthening buying pressure and increasing the probability of an upward reversal.

The key technical condition for the bullish scenario remains a firm consolidation above 5,305 USD. This signal would confirm a breakout of the corrective channel and significantly increase the likelihood of reaching the 5,585 USD target.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H1 (Intraday)

- Trend: bullish

- Key resistance levels: 5,205 and 5,445

- Key support levels: 5,105 and 5,005

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout above the nearest resistance level at 5,245 USD would indicate the start of a Double Bottom reversal pattern on lower timeframes and create conditions for opening long positions.

The risk-to-reward ratio exceeds 1:4. Potential profit upon reaching the target is about 34,000 pips, while possible losses are limited to around 8,000 pips.

- Take Profit: 5,585 USD

- Stop Loss: 5,165 USD

Alternative scenario (Sell Stop)

A breakout below the key support level at 5,105 USD and consolidation below the lower boundary of the bullish channel would increase selling pressure and open the way for a deeper correction.

- Take Profit: 4,845 USD

- Stop Loss: 5,205 USD

Risk factors

The formation of a reversal candlestick pattern and the development of a corrective phase after record highs increase the risk of a decline in XAUUSD, especially amid active profit-taking and a potential breakout below the 5,150 USD support level. Additional pressure on gold prices could come from stabilising geopolitical conditions, reduced demand for safe-haven assets, and a potential strengthening of the US dollar.

Summary

The current decline in XAUUSD is corrective. As long as geopolitical tensions persist and the US dollar remains weak, the market retains the potential to return to an upward trajectory after stabilising above the 5,150 USD support level. The overall structure remains bullish. Holding above 5,105 USD and a consolidation above 5,305 USD would create conditions for renewed growth and the development of bullish momentum in XAUUSD.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.