XAUUSD under pressure: what to expect from an FOMC member’s speech

XAUUSD continues a correction amid expectations of fundamental news from the US, with prices testing the 4,520 USD level. Discover more in our analysis for 2 February 2026.

XAUUSD forecast: key takeaways

- US manufacturing Purchasing Managers’ Index (PMI): previously at 51.8, projected at 51.9

- Speech by Federal Open Market Committee (FOMC) member Raphael W. Bostic

- XAUUSD forecast for 2 February 2026: 4,400 and 4,800

Fundamental analysis

The XAUUSD price forecast for today indicates that gold continues its corrective wave, with prices currently trading around 4,520 USD per ounce.

The XAUUSD outlook for 2 February 2026 takes into account that the US manufacturing PMI may increase to 51.9 points from the previous 51.8. The projected rise is modest, but it signals some positive sentiment in the US manufacturing sector.

Today, FOMC member Raphael W. Bostic is scheduled to deliver a speech.

Key aspects to watch include:

- Tone of the speech: if Bostic confirms the possibility of further monetary tightening, this may strengthen the US dollar, putting pressure on gold and other risk assets

- Economic outlook: his views on the US economy, inflation, and labour markets will be particularly important, as they may indicate future Fed policy steps on interest rates

- Rate stance: FOMC members’ speeches typically contain hints about potential future interest rate changes, which have a strong impact on liquidity conditions and the bond market

Technical outlook

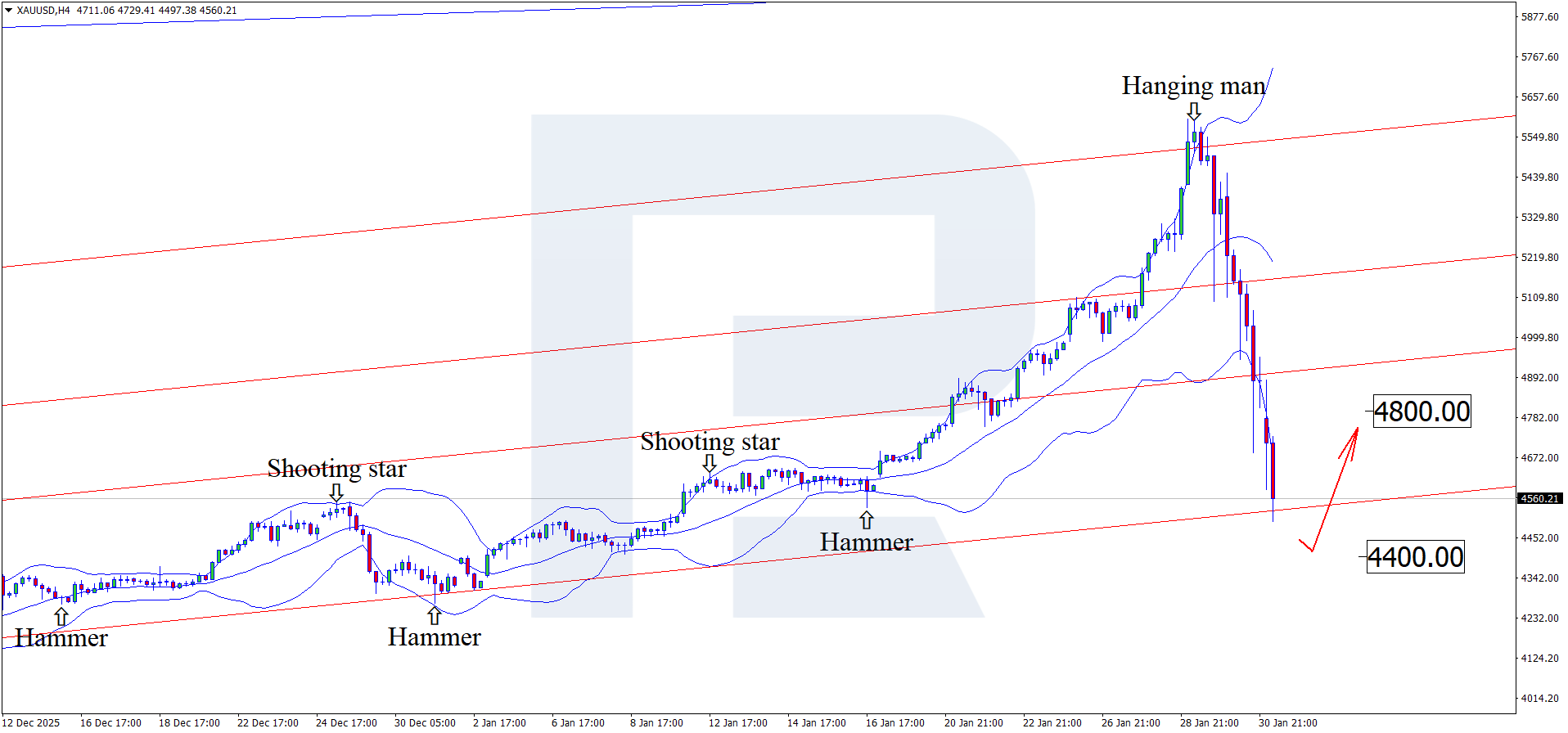

On the H4 chart, XAUUSD prices have formed a Hanging Man reversal pattern near the upper Bollinger Band. At this stage, prices continue to develop a corrective wave as the pattern signal plays out. Since XAUUSD quotes have retraced within the ascending channel, the target for the pullback may be the 4,400 USD support level.

At the same time, today’s technical analysis of XAUUSD also considers an alternative scenario, involving a rise towards the 4,800 USD level without testing the support level.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: bullish

- Key resistance levels: 4,800 and 5,550

- Key support levels: 4,400 and 4,250

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A return of quotes to the previously broken 4,800 level would signal continued upward momentum.

The risk-to-reward ratio exceeds 1:4. Potential profit upon reaching the target is around 300 pips, while possible losses are limited to 50 pips.

- Take Profit: 5,100 USD

- Stop Loss: 4,750 USD

Alternative scenario (Sell Stop)

A breakout and consolidation below the key 4,250 USD support level would open the way for a deeper correction.

- Take Profit: 4,000 USD

- Stop Loss: 4,500 USD

Risk factors

US dollar weakness and geopolitical risks may once again undermine the USD, which in turn could push XAUUSD prices higher.

Summary

Gold continues to lose ground against the USD. Technical analysis suggests a potential decline in XAUUSD quotes towards the 4,400 USD level.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.