Gold (XAUUSD) rebounds, but the outlook remains highly uncertain

Gold (XAUUSD) prices have partially recovered and returned to 4,850 USD. The market is focused on Fed-related news and overall risk sentiment. Discover more in our analysis for 3 February 2026.

XAUUSD forecast: key takeaways

- Gold (XAUUSD) is supported by a solid fundamental backdrop but shows technical sell signals

- The market still needs gold as a safe-haven asset

- XAUUSD forecast for 3 February 2026: 4,900

Fundamental analysis

Gold (XAUUSD) rose by more than 3% on Tuesday to 4,858 USD per ounce amid renewed buying activity after a sharp decline over the previous two days.

The precious metal fell by nearly 5% a day earlier, with Friday’s drop marking the largest single-day decline in more than a decade. The trigger was news that US President Donald Trump nominated Kevin Warsh as the next Federal Reserve chairman. The market perceived him as a more hawkish candidate compared to other contenders, increasing concerns about a potential tightening of monetary policy.

Despite elevated volatility, gold remains bolstered by central banks and the so-called asset value protection strategies. Against this backdrop, investors are reallocating funds from currencies and bonds into physical assets due to rising fiscal risks.

Global uncertainty and concerns over the Federal Reserve’s independence remain additional supportive factors, enhancing gold’s appeal as a safe-haven asset.

The outlook for gold (XAUUSD) is mixed.

Technical outlook

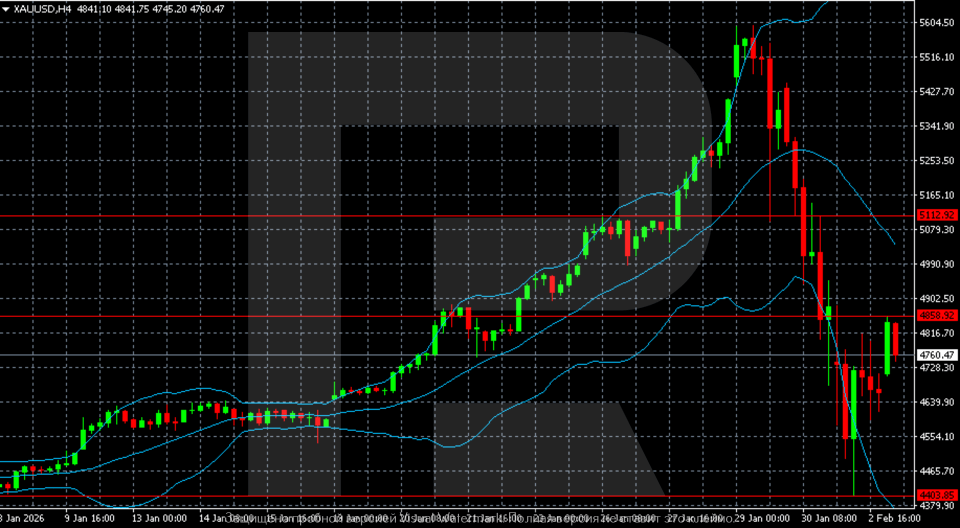

The XAUUSD H4 chart shows the completion of a strong uptrend and a transition into a sharp correction phase. In the first half of January, gold moved within a stable uptrend, with prices consistently hitting higher highs and holding above the middle Bollinger Band. The rally accelerated after breaking out of a consolidation range and shifted into a momentum phase in the second half of the month, accompanied by expanding volatility and movement along the upper Bollinger Band.

The peak was recorded near 5,600, after which the structure changed abruptly, with aggressive selling beginning in late January. The decline was accelerated and accompanied by band expansion, indicating a panic-driven sell-off phase.

Prices moved through several key support levels, including the 5,100 area and the 4,860 zone, without significant pauses. The low was formed around 4,440–4,450, where a long lower shadow appeared, and a technical rebound followed.

Currently, quotes are recovering from the lows but remain below the middle Bollinger Band. The rebound appears corrective. The structure of highs and lows remains descending, while the nearest resistance level has shifted to the 4,850–4,900 area. Overall, the picture points to a transition from a momentum rally into a phase of heightened volatility with prevailing bearish risks, despite short-term stabilisation.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: neutral-to-bearish (corrective rebound after the sell-off)

- Key resistance levels: 4,900 and 5,100

- Key support levels: 4,450 and 4,250

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

After forming a low in the 4,440–4,450 zone, gold has entered a phase of technical recovery. A consolidation above 4,900 will confirm a corrective rebound after panic selling and open the potential for movement towards 5,100.

The risk-to-reward ratio is around 1:2.5, with upside potential of about 200 pips and risk of around 80 pips.

- Buy Stop: 4,910 USD

- Take Profit: 5,100 USD

- Stop Loss: 4,830 USD

Alternative scenario (Sell Stop)

The rebound may remain corrective. Renewed selling pressure and a breakout below the 4,450 area would indicate the persistence of a downward structure and the risk of a retest of the lows.

- Sell Stop: 4,440 USD

- Take Profit: 4,250 USD

- Stop Loss: 4,520 USD

Risk factors

Fundamentally, gold is supported by central bank demand, fiscal risks, and overall uncertainty. However, the technical picture following the breakdown of the uptrend points to heightened volatility and the risk of renewed selling. A weaker US dollar and rising geopolitical tensions could strengthen the XAUUSD recovery. A return of hawkish monetary expectations would once again shift the balance towards a bearish scenario.

Summary

The situation in gold (XAUUSD) remains mixed: technical signals indicate the risk of renewed selling, while the fundamental backdrop remains supportive. The gold (XAUUSD) forecast for today, 3 February 2026, does not rule out a local recovery towards 4,900.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.