XAUUSD under pressure after Fed signals

XAUUSD prices are declining amid a clash between the Fed’s hawkish rhetoric and signs of weakening in the US labour market. The current quote stands at 4,926 USD. Find more details in our analysis for 5 February 2026

XAUUSD forecast: key takeaways

- The Fed has strengthened its hawkish rhetoric on interest rates

- The US private sector added 22 thousand jobs in January, according to ADP

- The US labour market maintained weak hiring momentum at the start of 2026

- XAUUSD forecast for 5 February 2026: 5,115

Fundamental analysis

XAUUSD quotes are undergoing a correction after rising for two consecutive trading sessions. Buyers faced strong resistance near the 5,005 USD level, which triggered profit-taking and a local price decline.

Gold came under pressure following signals from the Federal Reserve about maintaining a restrictive monetary stance. The regulator reinforced its cautious rhetoric regarding interest rate cuts. Fed Governor Lisa Cook stated that she does not support further policy easing, prioritising the risks of persistent inflationary pressure over signs of labour market slowing. The market interpreted these signals as a factor supporting the US dollar, which increased pressure on gold prices.

However, macroeconomic data is forming an opposing fundamental backdrop. According to ADP, US private sector employment increased by only 22 thousand jobs in January. The figure came in well below the revised December reading of 37 thousand and below the consensus forecast of 45 thousand. The report confirmed persistently weak hiring dynamics, low labour market activity, and structural sluggishness in the employment sector at the start of 2026.

Technical outlook

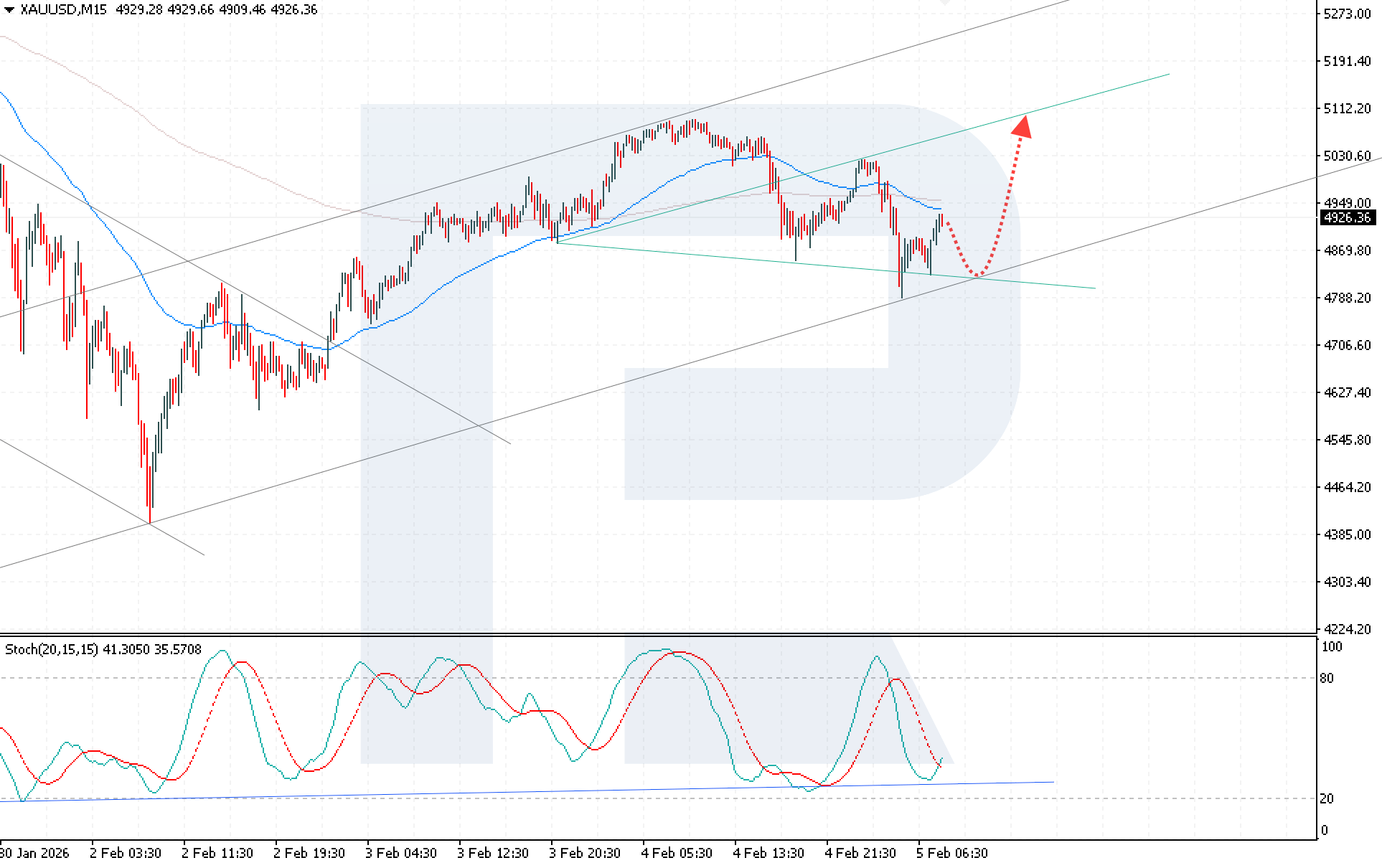

XAUUSD quotes are rising after rebounding confidently from the lower boundary of the bullish Wolfe Wave pattern. The current pattern structure indicates that directional upward momentum is forming, aiming for the pattern’s upper boundary. The XAUUSD forecast for today suggests the completion of the correction phase and continued growth towards the target of 5,115.

The Stochastic Oscillator further confirms the bullish scenario. Its signal lines have reached the support zone and are forming a new bullish crossover, increasing buying pressure and confirming the recovery of the upward momentum.

The key technical condition for the upside scenario remains a firm consolidation of XAUUSD quotes above the 4,955 level. This factor will confirm a breakout above the upper boundary of the Wolfe Wave pattern and significantly increase the probability of reaching the target zone of 5,115.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: M15 (Intraday)

- Trend: bullish

- Key resistance levels: 4,955 and 5,030

- Key support levels: 4,805 and 4,625

XAUUSD trading scenarios for today

Main scenario (Buy Limit)

A test of the lower boundary of the bullish Wolfe Wave pattern at the 4,805 level creates conditions for renewed upward momentum. A rebound from this area will confirm the preservation of the bullish structure and the market’s transition to a phase of directional growth. A consolidation of XAUUSD quotes above the 4,955 level will serve as technical confirmation of a breakout above the pattern’s upper boundary and will open the potential for movement towards the target of 5,115.

The risk-to-reward ratio exceeds 1:5. Potential profit upon reaching the take-profit level amounts to 31,000 pips, with possible losses capped at 6,000 pips.

- Take Profit: 5,115 USD

- Stop Loss: 4,745 USD

Alternative scenario (Sell Stop)

A breakout below the 4,745 support level will indicate the invalidation of the bullish Wolfe Wave structure and the market’s transition to a phase of continued downward movement. A violation of the pattern geometry will confirm sustained selling pressure and increase the likelihood of a deeper correction.

- Take Profit: 4,620 USD

- Stop Loss: 4,885 USD

Risk factors

The XAUUSD upward movement may be limited by a further strengthening of the Fed’s hawkish rhetoric and continued appreciation of the US dollar, which would maintain pressure on gold prices. An additional risk remains the inability of XAUUSD to consolidate above the 4,955 level, which would keep the price in a correction phase and increase the likelihood of a renewed decline.

Summary

Technical analysis of XAUUSD indicates the formation of upward momentum after a rebound from the lower boundary of the bullish Wolfe Wave pattern. A consolidation above the 4,955 level will confirm a breakout of the pattern’s upper boundary and open up growth potential towards the target of 5,115.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.