Gold (XAUUSD) remains under pressure after a failed growth attempt

XAUUSD prices are declining amid increasing pressure from sellers and shifting expectations regarding US monetary policy. The current quote is 4,907 USD. Discover more in our analysis for 17 February 2026.

XAUUSD forecast: key takeaways

- XAUUSD quotes are declining for the second consecutive trading session

- Easing geopolitical tensions reduced demand for gold as a safe-haven asset

- Weak inflation strengthened expectations of Fed policy easing

- XAUUSD forecast for 17 February 2026: 5,265

Fundamental analysis

XAUUSD quotes are falling for the second consecutive trading session. Buyers failed to gain a foothold above the key 5,105 resistance level, with the initiative shifting to sellers. Bears have intensified pressure and are actively testing the nearest support level at 4,875. Gold came under pressure as easing geopolitical tensions reduced demand for safe-haven assets.

Weaker-than-expected US inflation data fuelled expectations of Federal Reserve monetary easing this year, leading the market to increase bets on interest rate cuts.

Investors are focusing on the January Federal Reserve meeting minutes, which will be released on Wednesday, 18 February. The document may provide additional signals regarding the regulator’s next steps. According to the CME FedWatch Tool, market participants are currently pricing in the first rate cut as early as June.

Technical outlook

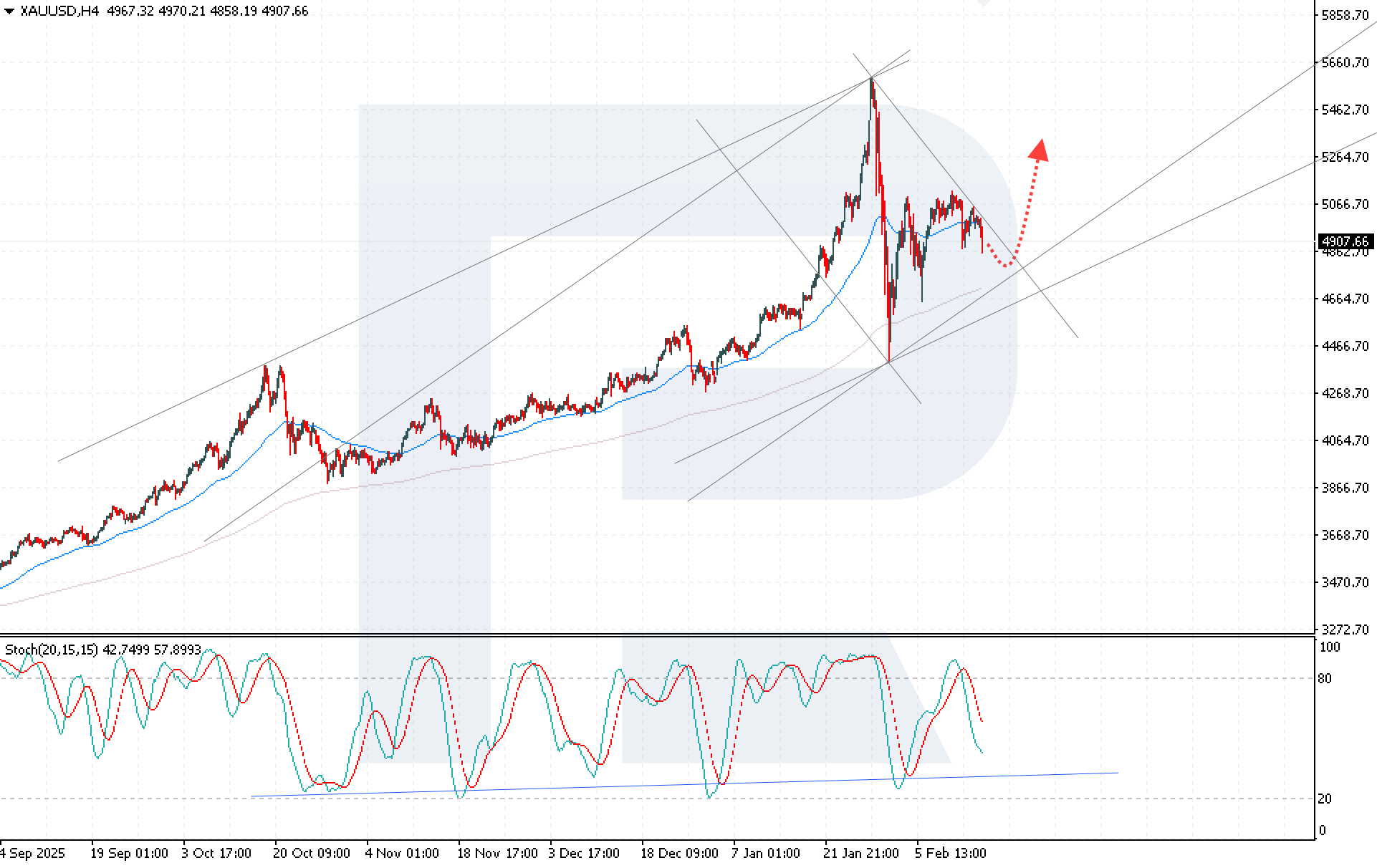

XAUUSD quotes are rebounding from the support level and continue to trade within a long-term ascending channel. Despite increasing pressure, buyers retain control of the market and hold prices above the EMA-285, confirming a continued overall bullish trend.

The XAUUSD forecast for today suggests renewed growth towards 5,265 if prices rebound from the lower boundary of the bullish channel. The technical picture indicates potential for an upward scenario. The Stochastic Oscillator strengthens growth signals. The signal lines have exited oversold territory and are approaching the ascending support line, from which upward reversals previously occurred.

The key condition for further growth remains consolidation above 5,045. A confident breakout above this level would indicate that prices have moved beyond the upper boundary of the corrective downward channel.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: uptrend, consolidation phase

- Key resistance levels: 5,105 and 5,265

- Key support levels: 4,875 and 4,665

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout of the descending resistance line and consolidation of XAUUSD quotes above 5,025 would indicate the completion of the consolidation phase and create conditions for opening long positions. The risk-to-reward ratio exceeds 1:3. The potential profit amounts to around 24,000 pips, while possible losses are limited to 7,000 pips.

- Take Profit: 5,265 USD

- Stop Loss: 4,955 USD

Alternative scenario (Sell Stop)

Consolidation below the key 4,875 support level would strengthen bearish pressure and signal continued downward movement towards the next support at 4,755.

- Take Profit: 4,760 USD

- Stop Loss: 4,935 USD

Risk factors

The main risk factors for the upside XAUUSD scenario remain persistent selling pressure and the possibility of the US dollar strengthening amid unexpectedly hawkish US macroeconomic data. Additionally, increased geopolitical stability may affect gold performance by reducing demand for safe-haven assets.

Summary

Federal Reserve signals and expectations of policy easing continue to support gold; however, selling pressure limits growth. Today’s XAUUSD technical analysis indicates persistent upward potential if prices consolidate above 5,045, with a possible move towards 5,265.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.