Gold (XAUUSD) remains under pressure: markets focus on US data

Gold (XAUUSD) prices declined to 4,970 USD, with demand for the precious metal easing amid dollar strength and reduced activity during the Lunar New Year. Find more details in our analysis for 19 February 2026.

XAUUSD forecast: key takeaways

- Gold (XAUUSD) quotes are retreating amid a stronger US dollar and internal disagreements within the Federal Reserve

- Geopolitical risks remain a supporting factor

- XAUUSD forecast for 19 February 2026: 4,900 or 5,080

Fundamental analysis

Gold (XAUUSD) fell towards 4,970 USD per ounce on Thursday, remaining volatile after rebounding from late January’s record highs. The market continues to assess signals from the minutes of the January FOMC meeting.

The document revealed disagreements within the Federal Reserve. Some participants favour a pause in further rate cuts, while allowing for renewed easing later this year if inflation continues to improve. Others did not rule out the possibility of another rate hike and supported a two-sided description of policy outlook in official statements.

Against this backdrop, the market has reduced expectations for the number of rate cuts in 2026.

Attention is now shifting to the upcoming US GDP and PCE releases later this week.

Short-term demand for precious metals has also weakened due to the Lunar New Year celebrations in China, leading to lower liquidity and reduced investor activity.

An additional factor remains geopolitical risk surrounding Iran. According to media reports, in the event of a military scenario involving the US, the operation could evolve into a prolonged campaign following unsuccessful negotiations.

The outlook for gold (XAUUSD) is moderate.

Technical outlook

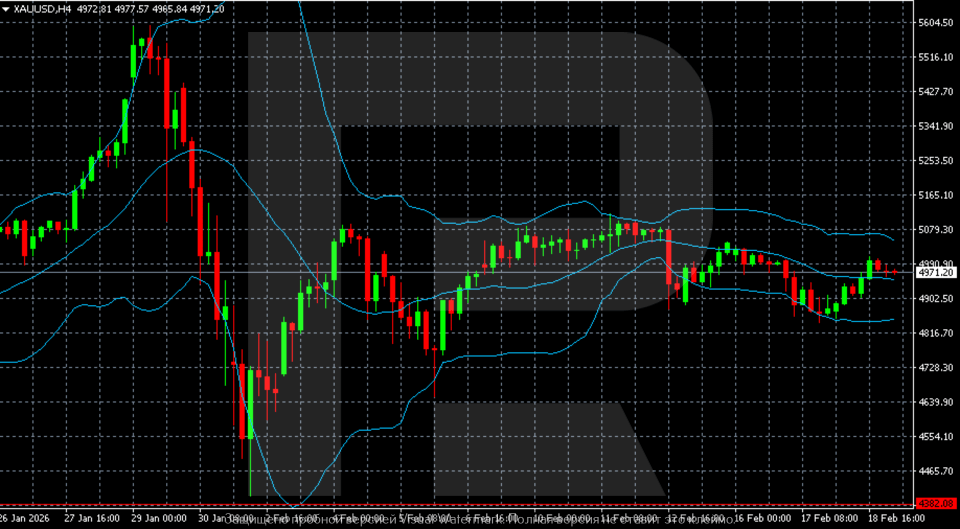

Gold (XAUUSD) is trading in the 4,970–4,980 range after a sharp decline from highs above 5,500. The downward momentum was strong, with the market later transitioning into a broad consolidation phase.

Prices are fluctuating between approximately 4,900 and 5,080 and are currently near the middle Bollinger Band. The bands are gradually narrowing, indicating declining volatility and a developing balance after the sharp sell-off. The nearest resistance level is located in the 5,080–5,100 zone, followed by 5,160, while support lies around 4,900, with the next level at 4,816.

The current structure is assessed as sideways with a moderately neutral bias. A breakout beyond the 4,900–5,080 range will likely determine the direction of the next impulse.

XAUUSD overview

- Asset: XAUUSD

- Timeframe: H4 (Intraday)

- Trend: range (after impulsive decline)

- Key resistance levels: 5,080 and 5,160

- Key support levels: 4,900 and 4,816

XAUUSD trading scenarios for today

Main scenario (Buy Stop)

A breakout and consolidation above 5,080 would confirm an exit from the current 4,900–5,080 consolidation range and create conditions for a corrective rise towards 5,160. The potential move is around 70–80 USD, with risk estimated at 30–35 USD, resulting in a risk-to-reward ratio close to 1:2.

- Buy Stop: 5,085 USD

- Take Profit: 5,160 USD

- Stop Loss: 5,050 USD

Alternative scenario (Sell Stop)

A move below 4,900 would increase downside pressure and open the way towards 4,816, with the risk of a further decline.

- Sell Stop: 4,895 USD

- Take Profit: 4,816 USD

- Stop Loss: 4,935 USD

Risk factors

Key risks to the bullish scenario include strong US macroeconomic data and a hawkish Fed tone, both of which could strengthen the dollar. Additional pressure may come from reduced short-term demand from Asia and any easing of geopolitical tensions, which would diminish interest in safe-haven assets.

Summary

XAUUSD prices are declining due to the strong US dollar and the Lunar New Year in China. The gold (XAUUSD) forecast for today, 19 February 2026, suggests continued trading within the 4,900–5,080 range.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisDive deep into the Gold (XAUUSD) price outlook for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.