Gold (XAUUSD) weekly forecast: solid prospects backed by future Fed easing

Gold (XAUUSD) remains in a consolidation zone near a six-week high, supported by firm expectations of a Federal Reserve rate cut in December. The market estimates the likelihood of easing at nearly 90% following weak ADP data and dovish comments from Fed officials. Geopolitical uncertainty also increases demand for safe-haven assets.

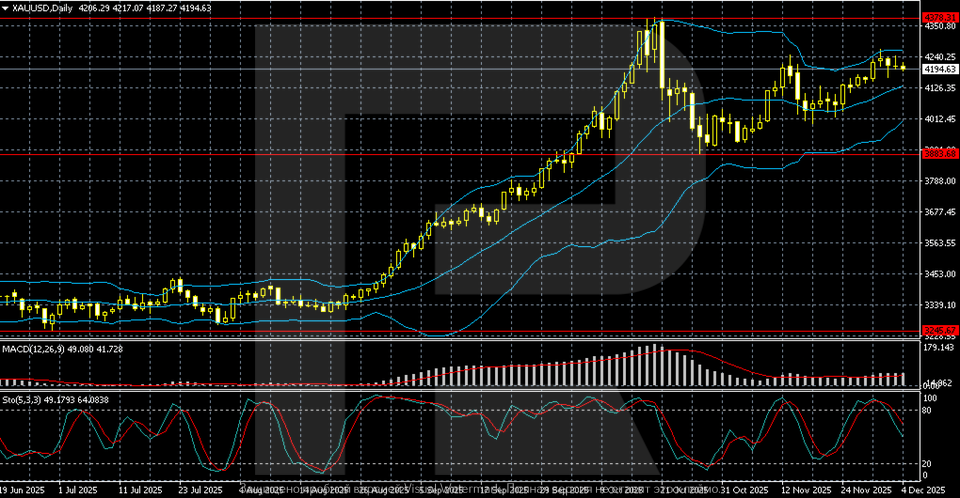

This review explores the key factors that will drive gold’s movement during 8–12 December 2025. The focus is on the delayed US macroeconomic data after the shutdown, expectations for the Fed’s December meeting, and the technical structure within the 4,050–4,240 range, where XAUUSD has settled following the September–October rally and subsequent consolidation.

XAUUSD forecast for this week: quick overview

- Weekly performance: gold (XAUUSD) is trading near a six-week high above 4,210 USD. The market is pricing in nearly a 90% likelihood of a December Fed rate cut. Weak ADP data added further pressure on the US dollar

- Support and resistance: gold is trading within an extended range between 3,883 and 4,378. The key support levels are located at 4,050 (middle Bollinger band) and 3,883 (key boundary). Resistance levels are at 4,240–4,250 (local supply zone) and 4,378 (all-time high)

- Fundamentals: the market is pricing in a cooling US labour market and dovish Fed commentary. The likelihood of December easing remains high. Sentiment was also affected by a lack of progress in US-Russia negotiations, which supported safe-haven demand. Gold maintains a steady uptrend

- Outlook: the base case is neutral consolidation within the 4,050–4,250 range amid fading momentum. A breakout above 4,240–4,250 would open the path to retest 4,378. A short-term pullback is possible if prices return to 4,050. The medium-term uptrend remains intact

Gold (XAUUSD) fundamental analysis

Gold (XAUUSD) is hovering above 4,210 USD per ounce, near its highest level in over a month and a half. Buying activity during the week was supported by growing expectations of a Fed rate cut at the upcoming meeting.

The key catalyst was the November ADP report. Instead of the forecasted 10 thousand increase, private employment declined by 32 thousand, marking the third drop in four months and the sharpest slowdown in hiring since 2023, raising concerns about a cooling US labour market. The data aligned with dovish comments from Fed officials, who increasingly emphasise the need to factor in employment weakness in future policy decisions.

Amid this backdrop, futures are pricing in a nearly 90% chance of a 25-basis-point rate cut in December. Soon, the market will factor in the delayed PCE data for September – the final key metric before the Fed’s meeting.

Gold also found support from geopolitical risk: US-Russia talks ended without progress, sustaining demand for safe-haven assets.

At week’s end, gold remains within a strong upward channel. The trajectory in the coming days will depend on inflation data and Fed rhetoric ahead of the December decision.

XAUUSD technical analysis

On the daily chart, gold (XAUUSD) is trading within a broad ascending channel following the sharp rally in September–October, which saw prices hit a record high near 4,378. After peaking, the market entered a prolonged consolidation phase between the 3,883 support level and local resistance at 4,240.

Bollinger Bands are gradually narrowing, signalling lower volatility and preparation for a new directional move. Prices remain above the middle band, keeping the bias tilted towards buyers. However, the lack of new highs makes the structure neutral.

MACD is moving horizontally, indicating a fading trend impulse. The Stochastic Oscillator has exited overbought territory and is pointing downwards, suggesting a possible short-term correction. A consolidation above 4,240 would open the door for a retest of the all-time high at 4,378. A breakout below 3,883 would signal a deeper correction within the long-term uptrend.

XAUUSD trading scenarios

The fundamental backdrop for gold remains firmly positive. Gold (XAUUSD) ended the week near a six-week high amid rising expectations of a December Fed rate cut. Weak ADP data strengthened the dovish case, prompting the market to price in nearly a 90% probability of easing. Geopolitical risks also supported gold demand. The market continues to consolidate within a medium-term ascending channel, with key reference points at 4,050–4,240.

- Buy scenario

Long positions are justified if prices hold above 4,050, where the Bollinger middle band and nearest dynamic support are located. A breakout above the 4,240–4,250 resistance zone would open the path to retest the all-time high at 4,378. A consolidation above this zone would allow expansion towards 4,400+. Bullish catalysts include dovish Fed statements, the high probability of a December interest rate cut, and weak macroeconomic data reinforcing easing expectations.

- Sell scenario

Short positions are relevant if prices break below 4,050. In this case, immediate targets shift towards the 3,883–3,900 area, which marks the next demand zone. Additional pressure on XAUUSD may come from dollar strength, rising Treasury yields, and renewed risk appetite following new macroeconomic releases.

Conclusion

Gold remains in the 4,050–4,240 range, reflecting a stable consolidation phase following the September–October rally. The baseline scenario suggests range-bound movement, with potential to return to 4,240–4,250 if easing expectations persist. A breakout below 4,050 would signal a deeper correction towards 3,883. The medium-term trend remains bullish.

Summary

Gold (XAUUSD) ended the week near a six-week high but remains in a prolonged consolidation phase. The market is pricing in nearly a 90% likelihood of a December Fed rate cut after weak ADP data and dovish comments from Fed officials. Geopolitical factors also supported gold demand, as US-Russia talks ended without progress, sparking interest in safe-haven assets.

The technical picture remains neutral, with XAUUSD trading within a broad 4,050–4,240 range, above key support at 3,883. The nearest resistance level lies in the 4,240–4,250 zone: a breakout here would open the path to a retest of the record high at 4,378. A drop below 4,050 would increase the risk of a deeper correction. The medium-term trend remains bullish.

Editors’ picks

EURUSD 2026-2027 forecast: key market trends and future predictions

EURUSD 2026-2027 forecast: key market trends and future predictionsThis article provides the EURUSD forecast for 2026 and 2027 and highlights the main factors determining the direction of the pair’s movements. We will apply technical analysis, take into account the opinions of leading experts, large banks, and financial institutions, and study AI-based forecasts. This comprehensive insight into EURUSD predictions should help investors and traders make informed decisions.

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysis

Gold (XAUUSD) forecast 2026 and beyond: expert insights, price predictions, and analysisThis article offers a Gold (XAUUSD) price forecast for 2026 and beyond, combining technical analysis, expert forecasts, and key macroeconomic factors. It explains the drivers behind gold’s recent surge, explores potential scenarios including a move toward 4,500 to 5,000 USD per ounce, and highlights why the metal remains a strong hedge during global uncertainty.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.